- United States

- /

- Professional Services

- /

- NasdaqGS:BBSI

Is BBSI’s Surging Revenue and $100M Buyback Shifting the Growth Narrative for Barrett Business Services?

Reviewed by Simply Wall St

- Earlier this week, Barrett Business Services reported a 10% revenue increase for Q2 2025, record growth in worksite employees, and announced a new US$100 million stock repurchase program, shortly after CEO Gary Kramer sold 102,344 shares.

- This combination of operational gains and direct return of capital to shareholders highlights management's confidence in the company's outlook and proactive support for shareholder value.

- We'll explore how the launch of Barrett Business Services' US$100 million buyback may reshape the company's investment outlook and growth narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Barrett Business Services Investment Narrative Recap

If you own Barrett Business Services, you're likely focused on its expansion in outsourced HR and payroll, as well as the company's ability to deliver recurring revenue growth amid shifting client hiring trends. The strong Q2 2025 earnings and launch of a US$100 million buyback do bolster short-term sentiment and reinforce management's constructive stance, but they don't materially change the main catalyst: realizing sustainable worksite employee growth despite lingering hiring softness. The biggest immediate risk, persistent client reluctance to hire, remains unchanged by these results.

Among recent announcements, Barrett's raised outlook for gross billings and average worksite employees stands out. This is important because it signals management's confidence that geographic expansion, like the new Chicago and Dallas branches, can help offset macroeconomic and industry headwinds to client hiring, directly supporting the core catalyst at stake for shareholders.

Yet, while expansion brings opportunities, ongoing weakness in client hiring is still something investors should watch carefully, as...

Read the full narrative on Barrett Business Services (it's free!)

Barrett Business Services' narrative projects $1.5 billion in revenue and $75.8 million in earnings by 2028. This requires 7.4% yearly revenue growth and a $21.9 million earnings increase from $53.9 million today.

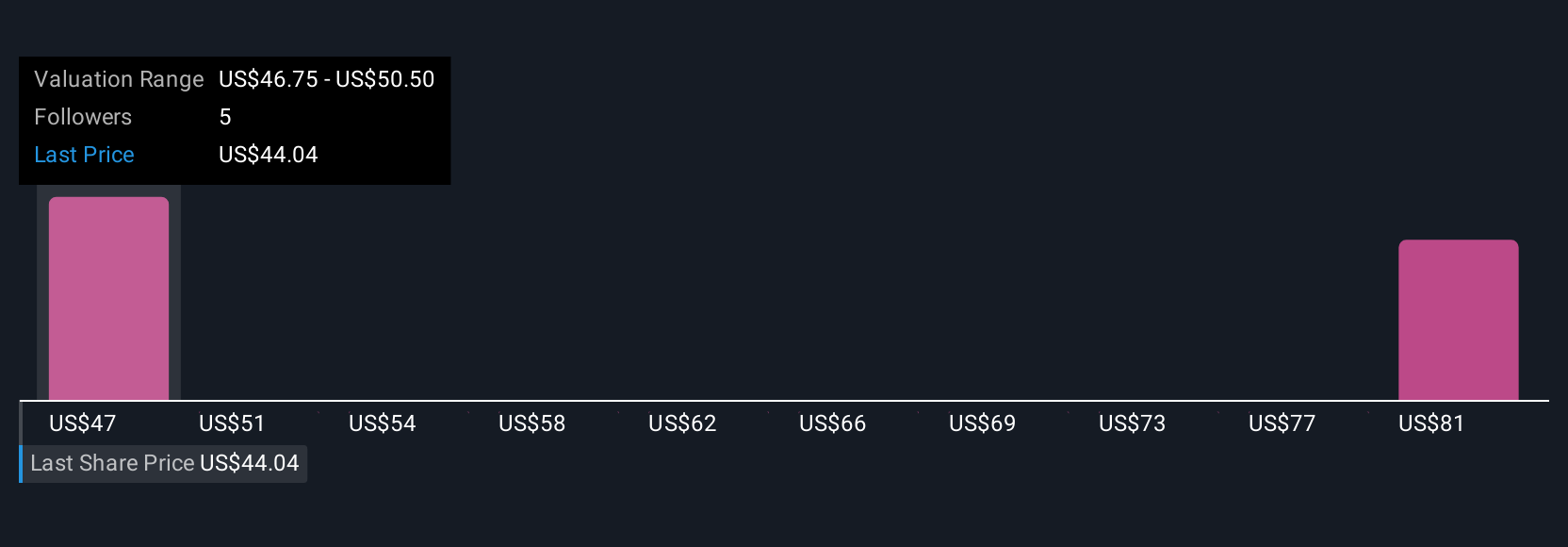

Uncover how Barrett Business Services' forecasts yield a $51.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for BBSI ranging from US$51.50 to US$134.73. As you compare these diverging views, consider that expectations for geographic growth are front and center in shaping the company's future performance.

Explore 2 other fair value estimates on Barrett Business Services - why the stock might be worth just $51.50!

Build Your Own Barrett Business Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrett Business Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Barrett Business Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrett Business Services' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrett Business Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBSI

Barrett Business Services

Provides business management solutions for small and mid-sized companies in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives