- United States

- /

- Professional Services

- /

- NasdaqCM:ASUR

Subdued Growth No Barrier To Asure Software, Inc. (NASDAQ:ASUR) With Shares Advancing 26%

Asure Software, Inc. (NASDAQ:ASUR) shares have continued their recent momentum with a 26% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.7% over the last year.

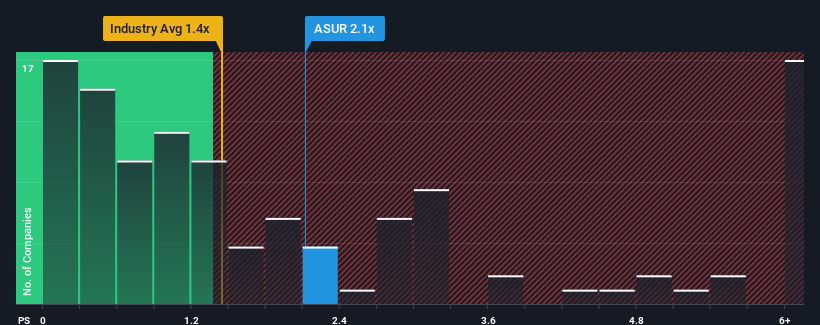

Following the firm bounce in price, given close to half the companies operating in the United States' Professional Services industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Asure Software as a stock to potentially avoid with its 2.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Asure Software

What Does Asure Software's P/S Mean For Shareholders?

Recent times have been advantageous for Asure Software as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Asure Software's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Asure Software?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Asure Software's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. The latest three year period has also seen an excellent 83% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.8% as estimated by the eight analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.7%, which paints a poor picture.

With this information, we find it concerning that Asure Software is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What We Can Learn From Asure Software's P/S?

Asure Software shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Asure Software currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Asure Software is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ASUR

Asure Software

Engages in the provision of cloud-based Human Capital Management (HCM) software solutions in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives