- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Is Automatic Data Processing (ADP) Attractive After Recent Share Price Softness?

- If you are wondering whether Automatic Data Processing's current share price lines up with its underlying worth, you are not alone. This article is built to help you frame that question clearly.

- The stock last closed at US$261.12, with returns of 0.6% over 7 days, a 0.2% decline over 30 days, a 3.3% gain year to date, and a 7.5% decline over the past year, while the 3 year and 5 year returns sit at 15.9% and 71.3% respectively.

- These mixed returns have kept interest in ADP alive, as investors weigh shorter term share price softness against longer term gains. Recent coverage has focused on how a mature payroll and HR services provider like ADP fits into portfolios that prioritize stability and income rather than high growth themes. This helps explain why the share price can move differently to high growth names.

- On our checklist-based valuation framework, Automatic Data Processing scores 3 out of 6 on undervaluation checks. Next we will walk through what that means across different valuation methods, before finishing with a more rounded way to think about what a fair price could look like.

Approach 1: Automatic Data Processing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business could be worth by projecting its future cash flows and then discounting those back to today using a required rate of return. It is essentially asking what all those future dollars are worth in present terms.

For Automatic Data Processing, the model uses a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $4.16b. Analysts provide explicit forecasts out to 2028, where free cash flow is projected at $5.58b, and Simply Wall St then extrapolates cash flows out to 2035 using modest annual growth assumptions to complete a 10 year view.

When all these projected cash flows are discounted back and combined, the DCF model arrives at an estimated intrinsic value of about $316.17 per share. Compared with the recent share price of $261.12, this points to an implied discount of 17.4%. This indicates that the shares are currently priced below this DCF estimate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Automatic Data Processing is undervalued by 17.4%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

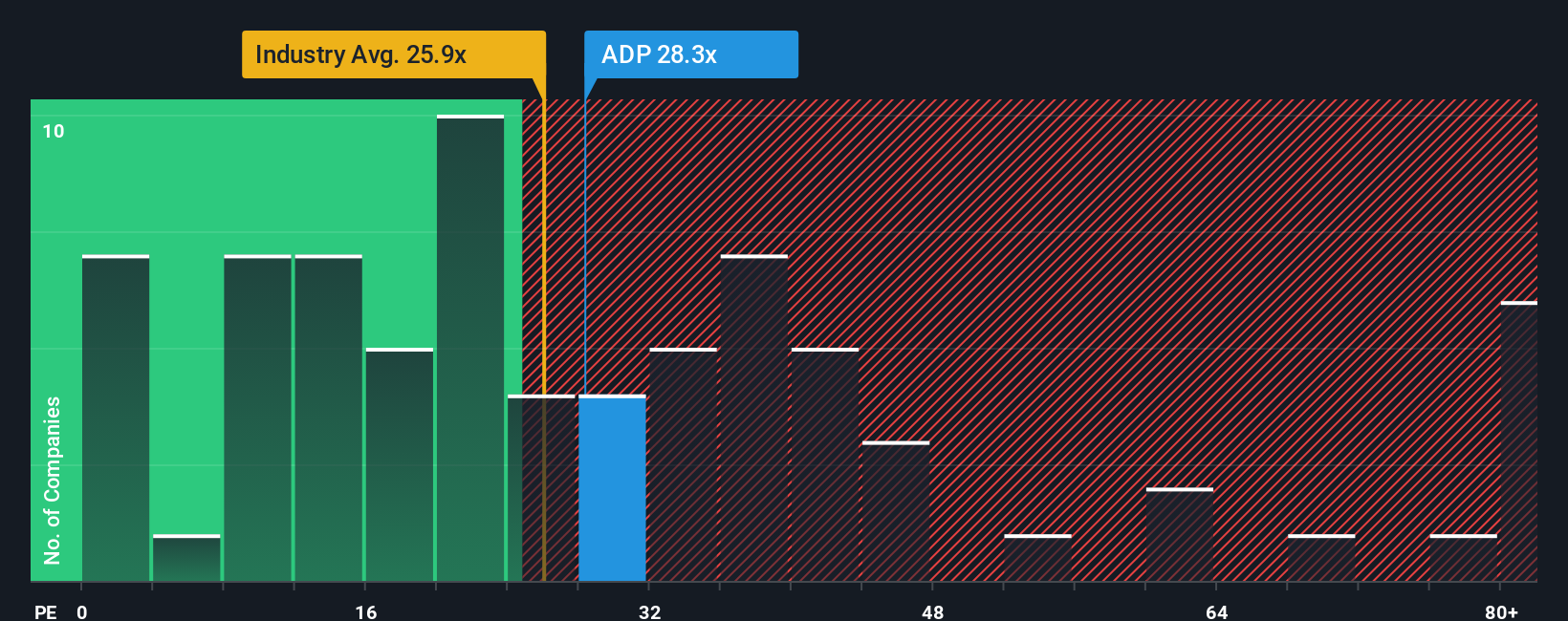

Approach 2: Automatic Data Processing Price vs Earnings

For a profitable company like Automatic Data Processing, the P/E ratio is a useful way to relate what you pay for each share to the earnings that share currently generates. Investors usually accept a higher P/E when they expect stronger growth or see the business as lower risk, and look for a lower P/E when growth is more modest or risks are higher.

ADP currently trades on a P/E of 25.53x. That sits close to the Professional Services industry average P/E of 25.00x and below the peer group average of 26.71x, so on simple comparisons the stock looks broadly in line with the sector, with a small discount to peers.

Simply Wall St also calculates a proprietary “Fair Ratio” for ADP of 30.26x. This is the P/E that would be expected given factors such as the company’s earnings growth profile, industry, profit margins, market capitalization and risk characteristics. Because it blends all of these into one figure, the Fair Ratio can be more informative than a basic comparison with peers or the industry alone.

Comparing ADP’s current P/E of 25.53x with the Fair Ratio of 30.26x suggests the shares trade below this modeled level.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

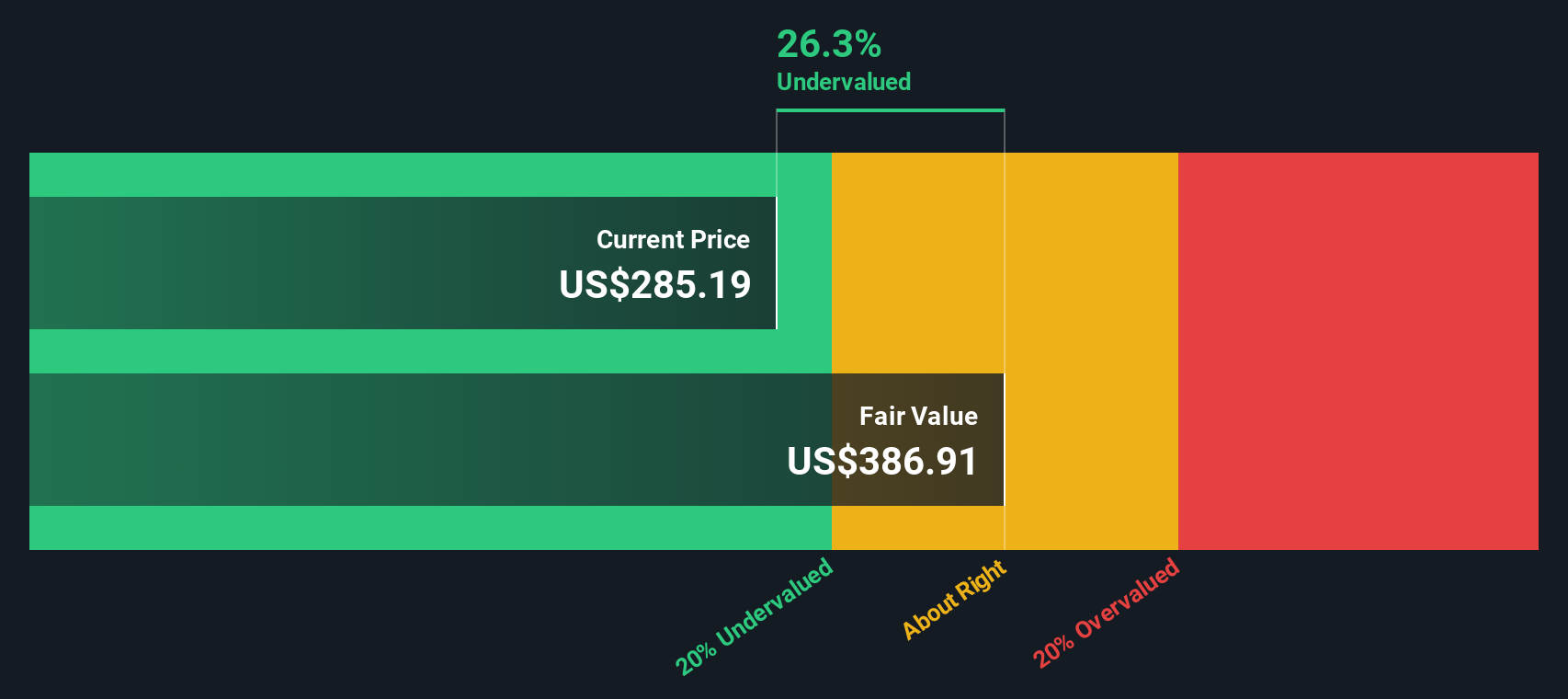

Upgrade Your Decision Making: Choose your Automatic Data Processing Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives, where you connect your view of Automatic Data Processing’s story to specific forecasts for revenue, earnings and margins, link those to a Fair Value, then compare that Fair Value to today’s share price on the Community page. Because Narratives update automatically when new news or earnings are added, you can see, for example, one investor framing ADP as a durable payroll utility with a Fair Value near US$387.77, while another focuses on dividend and buyback support with a Fair Value closer to US$289.54. This gives you a clear way to see how different perspectives translate into different numbers and timing decisions.

Do you think there's more to the story for Automatic Data Processing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market