- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Automatic Data Processing (NasdaqGS:ADP) Expands CPR Education With American Heart Association Partnership

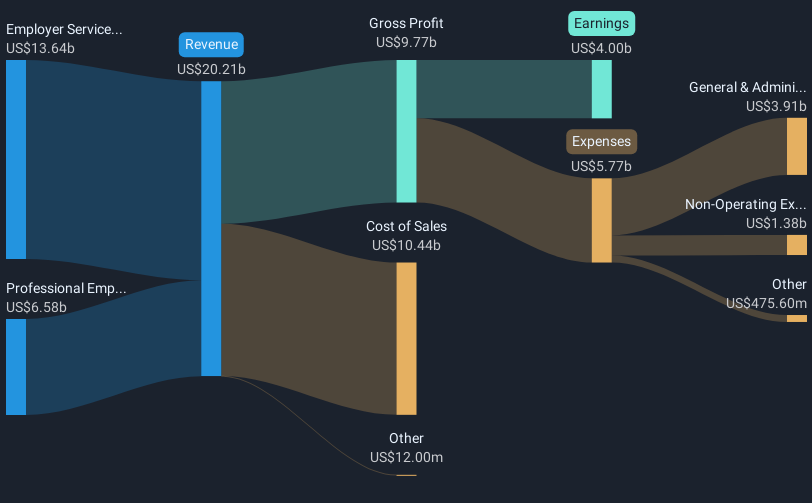

Automatic Data Processing (NasdaqGS:ADP) recently announced a partnership with the American Heart Association to integrate CPR training into its mobile app, aiming to boost health readiness among its workforce. This initiative aligns with the company's broader commitment to health and safety, reinforcing its corporate responsibility ethos. Over the past month, ADP's stock price moved up by 10%, amidst a generally positive market trend with major indexes like the S&P 500 experiencing growth. ADP's recent earnings report, showcasing a rise in sales and revenue, may have contributed positively, aligning well with the broader market’s upward momentum.

The recent partnership between Automatic Data Processing (ADP) and the American Heart Association, targeting enhanced health readiness through CPR training integration, aligns well with ADP's ongoing commitment to corporate responsibility. This initiative could potentially influence ADP's long-term narrative positively by strengthening workforce engagement and satisfaction, possibly leading to higher productivity and operational efficiency. Such efforts might indirectly support revenue growth by sustaining a motivated workforce and possibly reducing turnover.

Over the past five years, ADP has delivered a total shareholder return of 165.98%, indicative of substantial capital appreciation and consistent dividend payments. In comparison, over the past year, ADP's return surpassed the US Professional Services industry average of 12%, reflecting relative strength in performance. This reflects the company's robust execution of its growth strategy and ability to maintain momentum despite market fluctuations.

With respect to revenue and earnings, the introduction of new health initiatives could enhance employee loyalty and efficiency, indirectly contributing to more stable revenue streams. While short-term earnings forecasts remain reliant on current product expansions and strategic partnerships, sustaining employee-focused programs might bolster long-term financial performance. The current share price of $308.19 is closely aligned with the consensus price target of $309.08, signaling that the stock is deemed fairly valued by analysts. This alignment suggests limited immediate upside but highlights confidence in the company's revenue and earnings projections, assuming continued execution of strategic initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Increasing revenue at high costs relies on membership to convert to spend

Google - The world's first "Full Stack AI Sovereign"

Substantial founder ownership speaks to the strength of its business

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks