- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Automatic Data Processing, Inc. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

Automatic Data Processing, Inc. (NASDAQ:ADP) came out with its first-quarter results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. The result was positive overall - although revenues of US$4.8b were in line with what the analysts predicted, Automatic Data Processing surprised by delivering a statutory profit of US$2.34 per share, modestly greater than expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Automatic Data Processing

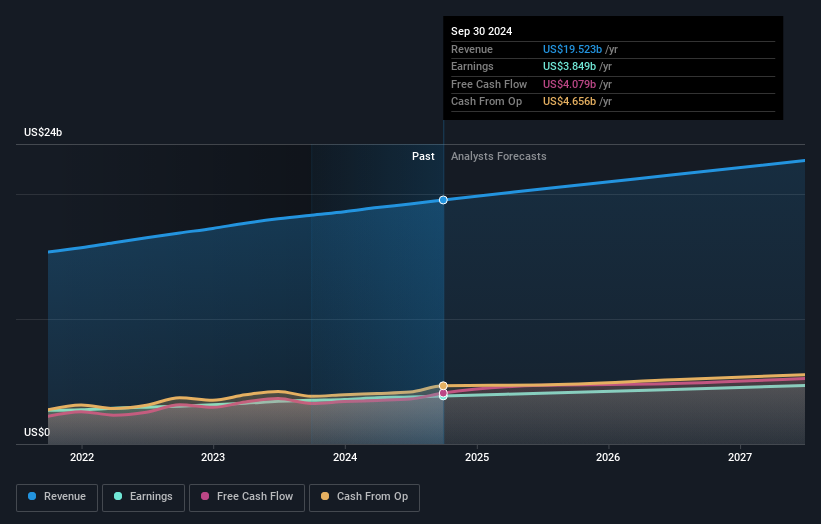

Taking into account the latest results, the current consensus from Automatic Data Processing's 14 analysts is for revenues of US$20.4b in 2025. This would reflect an okay 4.5% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to increase 5.3% to US$9.94. In the lead-up to this report, the analysts had been modelling revenues of US$20.2b and earnings per share (EPS) of US$10.04 in 2025. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

With the analysts reconfirming their revenue and earnings forecasts, it's surprising to see that the price target rose 6.2% to US$298. It looks as though they previously had some doubts over whether the business would live up to their expectations. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Automatic Data Processing, with the most bullish analyst valuing it at US$325 and the most bearish at US$280 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 6.0% growth on an annualised basis. That is in line with its 6.9% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 5.7% annually. It's clear that while Automatic Data Processing's revenue growth is expected to continue on its current trajectory, it's only expected to grow in line with the industry itself.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Automatic Data Processing going out to 2027, and you can see them free on our platform here..

It is also worth noting that we have found 1 warning sign for Automatic Data Processing that you need to take into consideration.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion