- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Assessing ADP's (ADP) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Automatic Data Processing (ADP) shares have come under pressure recently, retreating over the past month as investors reassess valuations across business services stocks. The company’s performance trends open up some interesting questions about future growth and competitive resilience.

See our latest analysis for Automatic Data Processing.

ADP’s share price has slipped about 11% over the past month, with the year-to-date decline now topping 10%. That marks a meaningful shift in sentiment from its strong multi-year run. Its five-year total shareholder return still stands at an impressive 74%, which is evidence that longer-term holders have seen substantial gains even as momentum fades lately.

If you’re on the lookout for new opportunities during this industry pullback, now is a great moment to broaden your perspective and discover fast growing stocks with high insider ownership

With ADP’s stock losing ground despite steady growth and notable long-term returns, investors may wonder if the recent weakness is a sign of undervaluation or if the market is already reflecting all future gains in the price.

Most Popular Narrative: 16.5% Undervalued

With Automatic Data Processing’s fair value now set at $311.62 and shares last closing at $260.30, there is a significant gap that has market-watchers buzzing. This latest narrative offers detailed reasoning behind a higher fair value, pointing to strategic developments within the business.

Adoption of Next Gen products (like Lyric HCM and Workforce Now Next Gen) and integration of acquisitions (e.g., WorkForce Software) are accelerating demand for advanced, cloud-based, and AI-driven HR solutions. These factors are directly locking in higher average revenue per user and supporting earnings growth through margin expansion.

Want to know the catalyst behind this valuation jump? The narrative hinges on a potent mix of product innovation, margin expansion, and financial projections that stand out in today’s market. Curious what growth assumptions are priced in? See what’s fueling analyst optimism and whether you agree with the numbers that drive this fair value target.

Result: Fair Value of $311.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and longer sales cycles could still derail ADP’s growth outlook. This could put future earnings and profit margin expansion at risk.

Find out about the key risks to this Automatic Data Processing narrative.

Another View: What Do Multiples Say?

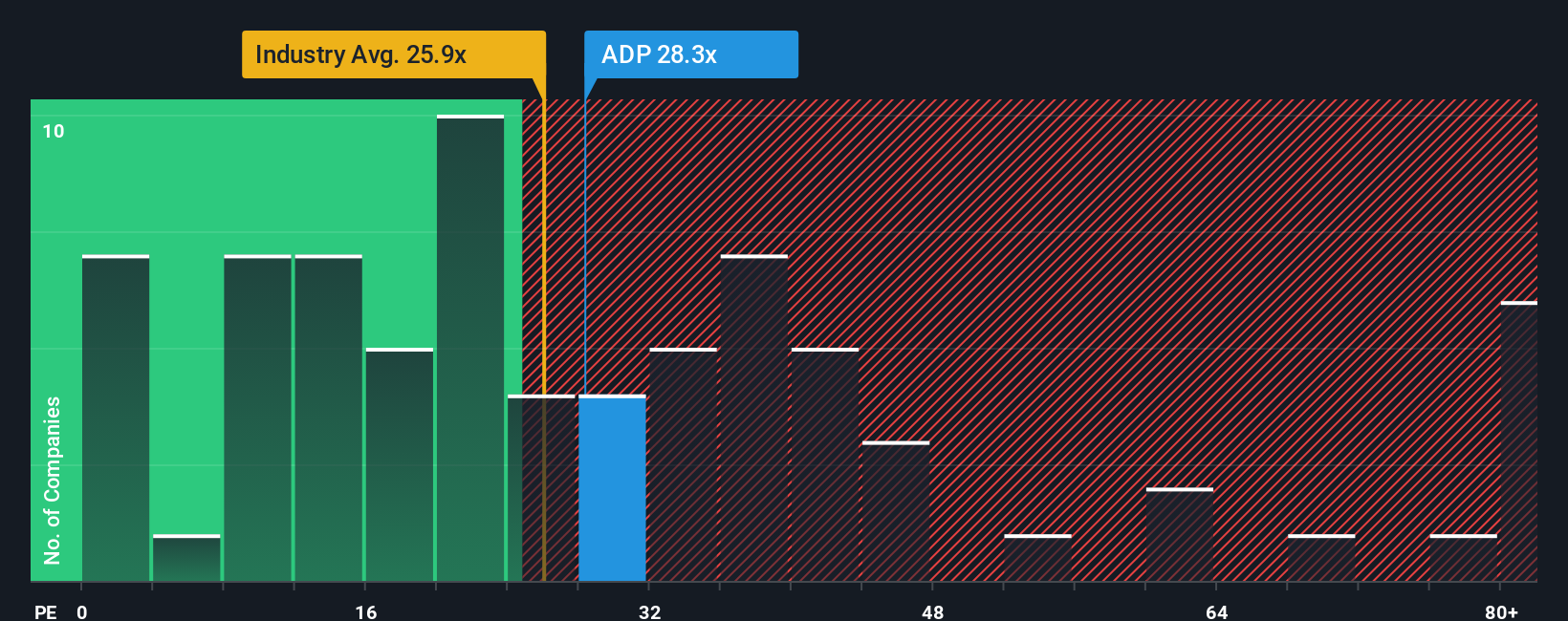

Looking at ADP’s valuation through its price-to-earnings ratio, the stock trades at 25.5x, very close to the US Professional Services industry average of 25.4x, but lower than the peer average of 29.9x. Compared to our fair ratio of 32.5x, there is a case the market leaves some headroom. Does this pricing suggest opportunity or is caution still warranted as multiples could shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Automatic Data Processing Narrative

If you’d rather dig into the numbers firsthand or shape the story yourself, building your own perspective with our tools takes just a few minutes. Give it a try and Do it your way

A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave potential gains on the table when you could be tracking top opportunities backed by solid research and powerful screeners, from proven dividend payers to future-defining tech.

- Capitalize on stable income by tapping into these 22 dividend stocks with yields > 3%, offering yields over 3% for consistent returns.

- Catalyze your portfolio with innovation by targeting these 26 AI penny stocks, at the forefront of artificial intelligence advancements.

- Strengthen your edge in the market with these 831 undervalued stocks based on cash flows, poised for growth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives