- United States

- /

- Electrical

- /

- NYSEAM:SVT

Did Servotronics's (NYSEMKT:SVT) Share Price Deserve to Gain 36%?

Servotronics, Inc. (NYSEMKT:SVT) shareholders might be concerned after seeing the share price drop 11% in the last quarter. But at least the stock is up over the last five years. Unfortunately its return of 36% is below the market return of 51%.

View our latest analysis for Servotronics

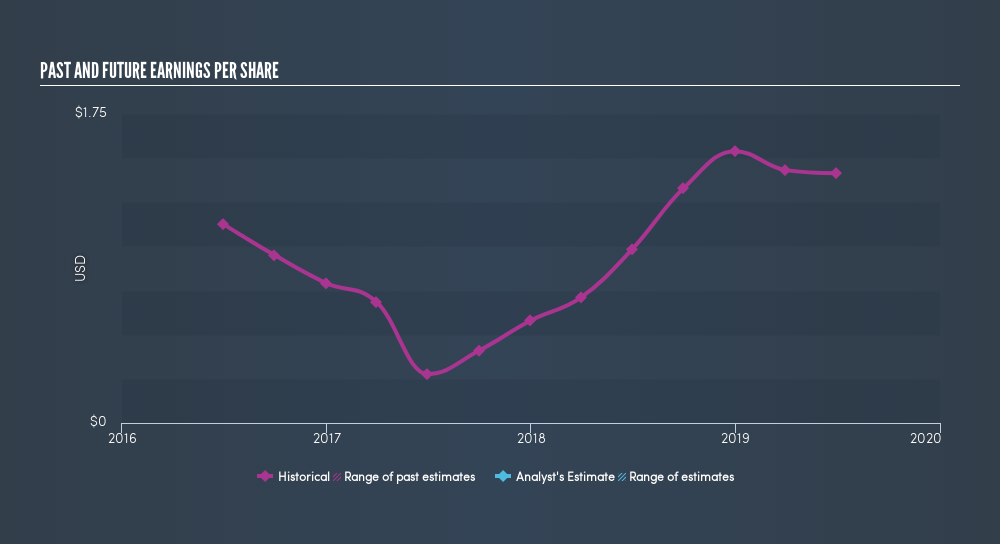

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Servotronics managed to grow its earnings per share at 39% a year. This EPS growth is higher than the 6.4% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.98.

Dive deeper into Servotronics's key metrics by checking this interactive graph of Servotronics's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Servotronics, it has a TSR of 50% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Servotronics shareholders are down 9.5% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 8.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on Servotronics you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:SVT

Servotronics

Designs, manufactures, and markets servo-control components and other technology products for aerospace, military, and medical applications in the United States and internationally.

Mediocre balance sheet very low.

Similar Companies

Market Insights

Community Narratives