- United States

- /

- Building

- /

- NYSE:ZWS

Zurn Elkay Water Solutions (ZWS): Evaluating Valuation as Growth Trails Industry Benchmarks and Competitive Pressure Rises

Reviewed by Kshitija Bhandaru

Zurn Elkay Water Solutions (ZWS) recently reported that its organic revenue growth trails industry benchmarks. Earnings per share and free cash flow margin are also slipping. Competition is intensifying, which is shaping investor concerns and the stock's latest move.

See our latest analysis for Zurn Elkay Water Solutions.

Zurn Elkay’s share price momentum has cooled a bit in the past month, but over the longer term, its direction is tougher to ignore. The 90-day share price return is an impressive 21.81%, and the total shareholder return over the past year is 23.43%. Despite mounting competitive pressures and lagging organic growth, the stock’s multi-year performance, with a 203.83% total return over five years, reminds investors why it’s still on many watchlists.

If you’re keen to see what other names are outperforming, now’s your chance to discover fast growing stocks with high insider ownership.

With Zurn Elkay’s robust long-term returns and recent growth challenges, investors are weighing whether these concerns are already baked into the stock price, or if the current dip could signal an attractive entry point.

Most Popular Narrative: Fairly Valued

With Zurn Elkay’s fair value calculated at $47.43 and a last close of $45.74, the gap is less than 2%. The popular narrative suggests the current price captures analyst expectations and the business outlook almost perfectly.

Government funding and rising legislative requirements for water quality in schools, such as filter first mandates, are expected to drive broader adoption of advanced filtration and water safety products. This expands Zurn Elkay's addressable market and could boost long-term revenue growth. The rollout and market adoption of the new Elkay Pro Filtration platform, featuring drop-in replacements, longer filter life, proprietary filters, and IoT/connectivity, positions the company to accelerate replacement cycles and potentially sustain double-digit growth in high-margin filtration revenue. This would support higher earnings and margin expansion.

Curious how rapidly expanding regulation, innovative filtration products, and optimistic profit forecasts combine to set this high bar? Find out which numbers turn cautious optimism into a price nearly locked to fair value. The path from legislative catalyst to ambitious earnings targets could surprise you: see how each growth lever fits inside this narrative’s precise calculation.

Result: Fair Value of $47.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if legislative momentum slows or if demand in non-residential construction weakens, which could challenge growth expectations for Zurn Elkay.

Find out about the key risks to this Zurn Elkay Water Solutions narrative.

Another View: What Do Valuation Ratios Tell Us?

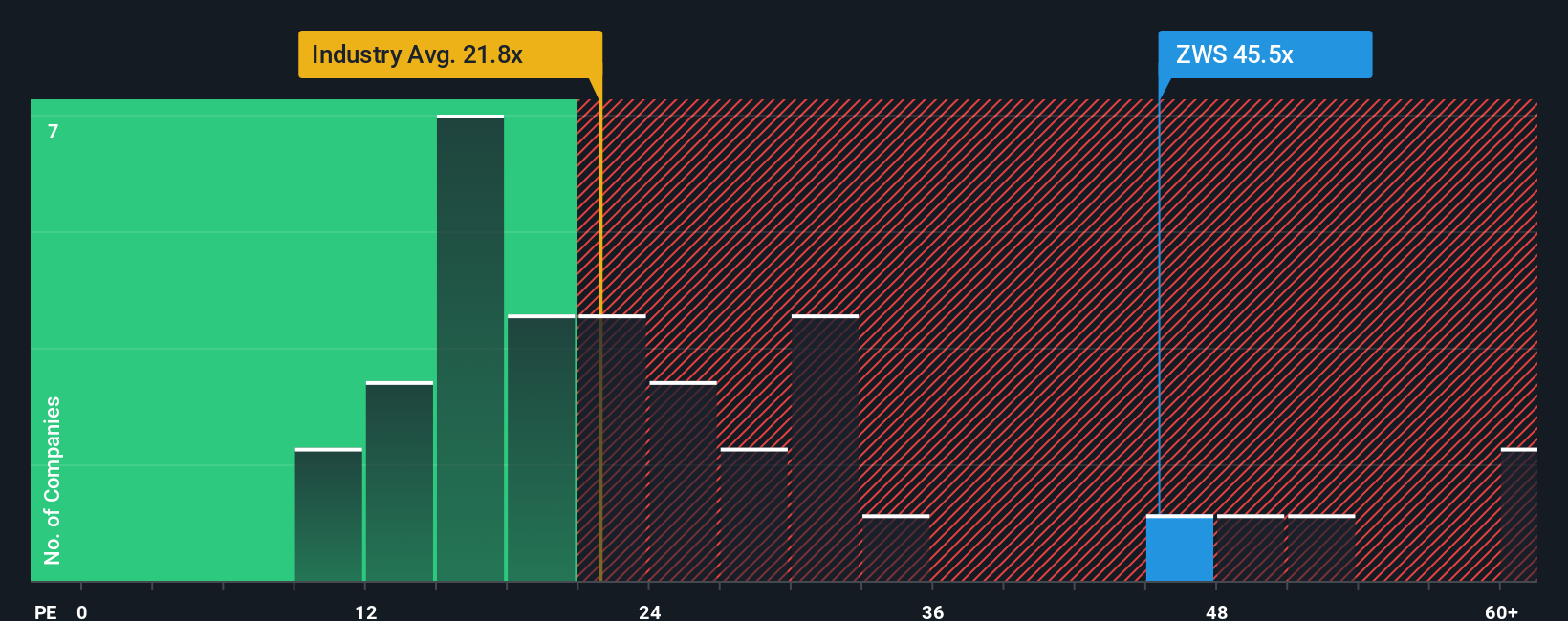

While the fair value model pins Zurn Elkay’s share price as about right, valuation scores using price-to-earnings paint a different story. The company trades at 44.9 times earnings, meaning investors are paying a significant premium compared to peers at 32.8 times and the US Building industry average of just 20.4 times. The so-called fair ratio, at 23.5 times, suggests the market could reassess this premium at any time. Does this steep multiple mean risk is lurking beneath the surface, or does the growth justify the cost?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zurn Elkay Water Solutions Narrative

If the consensus doesn’t match your view, or you’d rather crunch the numbers on your own terms, you can shape a narrative yourself in under three minutes with Do it your way.

A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Opportunities?

Don't miss your next breakthrough by sticking to the same watchlist. The smartest investors consistently seek out new trends and ideas others overlook.

- Capture higher monthly income potential by checking out these 18 dividend stocks with yields > 3% yielding over 3%, packed with companies rewarding their shareholders.

- Power up your portfolio with industry-shaping tech by uncovering leaders among these 24 AI penny stocks driving artificial intelligence forward.

- Find tomorrow’s undervalued growth stories early by starting with these 3592 penny stocks with strong financials that combine strong financials and strategic momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives