- United States

- /

- Building

- /

- NYSE:ZWS

Why We're Not Concerned About Zurn Elkay Water Solutions Corporation's (NYSE:ZWS) Share Price

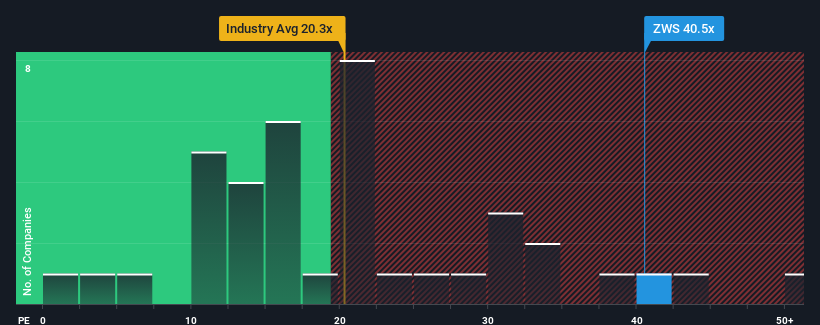

Zurn Elkay Water Solutions Corporation's (NYSE:ZWS) price-to-earnings (or "P/E") ratio of 40.5x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Zurn Elkay Water Solutions as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Zurn Elkay Water Solutions

What Are Growth Metrics Telling Us About The High P/E?

Zurn Elkay Water Solutions' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered an exceptional 179% gain to the company's bottom line. Pleasingly, EPS has also lifted 200% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we can see why Zurn Elkay Water Solutions is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Zurn Elkay Water Solutions' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Zurn Elkay Water Solutions with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Zurn Elkay Water Solutions. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives