- United States

- /

- Building

- /

- NYSE:ZWS

How Investors Are Reacting To Zurn Elkay Water Solutions (ZWS) Launching Liv EZ for the Home Market

Reviewed by Sasha Jovanovic

- Earlier this week, Zurn Elkay Water Solutions introduced Liv EZ, a sleek built-in filtered water dispenser designed for residential use, expanding the company's commercial water filtration expertise into the home market with advanced filtration and sustainable design features.

- This move signals the company's intent to capture growing consumer demand for convenient and eco-friendly in-home hydration products, leveraging its strong reputation in commercial water solutions.

- We'll explore how this expansion into the residential market with Liv EZ could influence Zurn Elkay's growth outlook and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Zurn Elkay Water Solutions Investment Narrative Recap

To own shares of Zurn Elkay Water Solutions, investors need to believe the company can successfully expand beyond its core non-residential market, capturing new growth from rising demand for sustainable, at-home water solutions while managing ongoing risks tied to margin pressures and sector concentration. The introduction of Liv EZ marks a meaningful broadening of product reach, but it is not likely to significantly impact the most important short term catalyst, which remains the continued adoption of advanced filtration systems in institutional and commercial end-markets. However, the biggest risk continues to be potential demand slowdowns in the non-residential sector, especially given reliance on government and education budgets.

Among recent announcements, the launch of the Elkay Pro Filtration platform stands out as especially relevant. Like Liv EZ, it demonstrates Zurn Elkay's push for innovation in filtration technology with a focus on longer filter life, proprietary integration, and higher-margin replacement cycles, factors closely linked to near-term sales drivers and earnings expansion opportunities.

By contrast, what investors may not fully appreciate is that if project activity slows in key non-residential end-markets, revenue growth could ...

Read the full narrative on Zurn Elkay Water Solutions (it's free!)

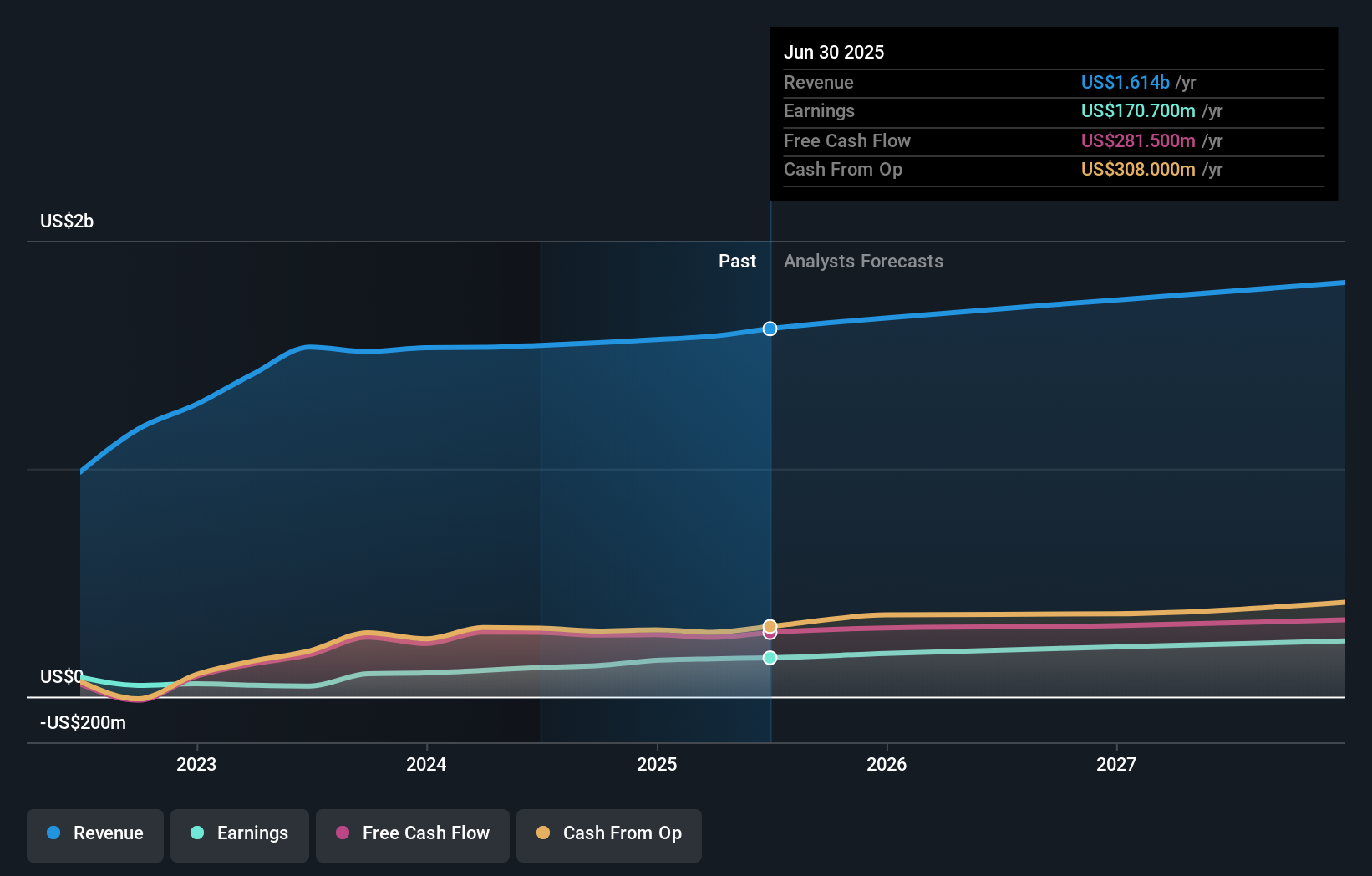

Zurn Elkay Water Solutions' narrative projects $1.9 billion revenue and $266.9 million earnings by 2028. This requires 5.1% yearly revenue growth and a $96 million earnings increase from $170.7 million today.

Uncover how Zurn Elkay Water Solutions' forecasts yield a $47.43 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members offered just one fair value estimate for Zurn Elkay, at US$45.25 per share. While product innovation remains a key catalyst, continued growth still depends on broader adoption across new and existing markets.

Explore another fair value estimate on Zurn Elkay Water Solutions - why the stock might be worth as much as $45.25!

Build Your Own Zurn Elkay Water Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zurn Elkay Water Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zurn Elkay Water Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives