- United States

- /

- Machinery

- /

- NYSE:XYL

Xylem (XYL): Evaluating Valuation as Shares Climb and Analyst Targets Shift

Reviewed by Simply Wall St

Xylem (XYL) shares have delivered a steady climb over the past year, as the company continues to capitalize on strong demand in the water technology sector. Investors are paying close attention to recent financial results and market moves.

See our latest analysis for Xylem.

Xylem’s share price has steadily trended higher this year, recently closing at $148.25 and delivering a strong year-to-date share price return of nearly 28%. With a 1-year total shareholder return of 15% and an impressive 5-year total return of 80%, momentum for the stock continues to build as market confidence grows around the company’s growth prospects and resilience.

If you’re interested in finding more companies with fast-rising potential and strong insider conviction, you’ll want to broaden your search with our fast growing stocks with high insider ownership

Yet with shares already near analyst price targets, investors face a critical question: is Xylem undervalued in light of its solid fundamentals, or has the market already priced in the company’s future growth trajectory?

Most Popular Narrative: 6.6% Undervalued

The most followed narrative now values Xylem at $158.67 per share, a notable premium to its last close of $148.25. This difference reflects analyst optimism about future growth and profitability, raising important questions about what is fueling this bullish stance.

Rapid adoption of smart metering and advanced monitoring solutions is driving double-digit growth in Xylem's Measurement and Control Solutions segment, reflecting resilient end-market demand for digital infrastructure upgrades. This is likely to drive revenue and expand higher-margin recurring earnings.

Want the real story behind this elevated price target? Unpack the bold assumptions about earnings, revenue growth, and margin expansion that could set new benchmarks for the sector. The full narrative reveals the numbers and the dynamic market shifts analysts are betting on.

Result: Fair Value of $158.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty in government infrastructure funding cycles and ongoing volatility in global markets could quickly undermine some of the assumptions supporting Xylem’s current valuation.

Find out about the key risks to this Xylem narrative.

Another View: Multiples Signal Potential Overvaluation

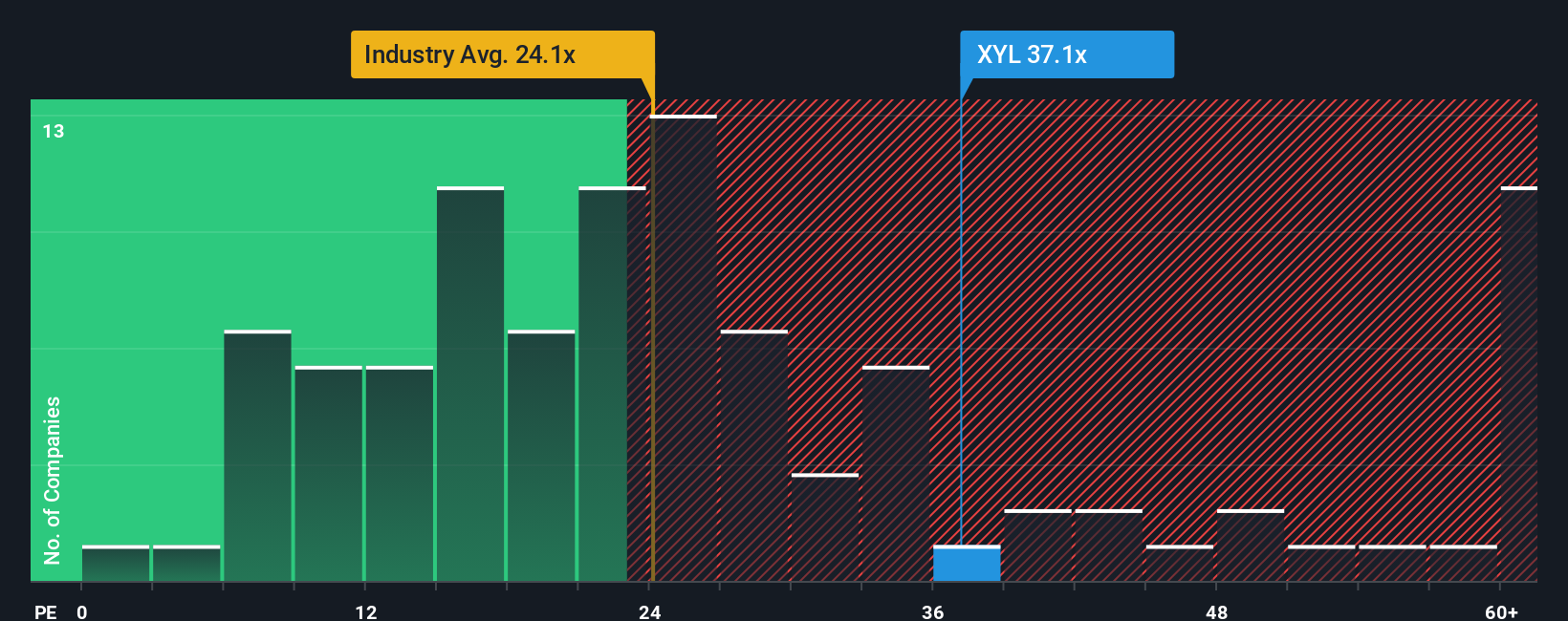

While analysts see Xylem as undervalued, a fresh look at its price-to-earnings ratio reveals a different story. The stock trades at 38.5x earnings, which is much higher than both the US Machinery industry average of 24.7x and the peer average of 31.3x. The fair ratio sits at just 26.8x, implying investors may be paying a premium based more on high expectations than on fundamentals. Does this signal opportunity or risk as momentum builds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xylem Narrative

If you want to dig even deeper or prefer building your own analysis, you can quickly assemble your perspective from the available data. Do it your way

A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your watchlist and get ahead of the market by tapping into proven strategies and breakthrough sectors. Top-performing investors are already tracking these trends, so you don’t want to miss out on what’s next.

- Capture passive income with reliable yields as you browse these 17 dividend stocks with yields > 3%, which offers consistently strong dividends above 3%.

- Tap into the potential of healthcare innovation by reviewing these 33 healthcare AI stocks, focused on AI-driven medical breakthroughs.

- Ride the momentum in undervalued opportunities by checking out these 877 undervalued stocks based on cash flows, currently priced below their fair value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives