- United States

- /

- Machinery

- /

- NYSE:WTS

Watts Water Technologies (WTS): Assessing Valuation Following Bullish Analyst Upgrades and Strong Market Performance

Reviewed by Kshitija Bhandaru

If you've been tracking Watts Water Technologies (WTS), you might've noticed a surge in investor attention lately. The buzz comes off the back of bullish analyst ratings, including a top Zacks Rank and upbeat earnings estimate revisions. This flurry of favorable professional coverage has thrown a spotlight on the company’s solid fundamentals such as strong returns on equity and a knack for disciplined capital management, qualities that investors seem to be valuing more seriously in the current market.

Looking at performance, Watts Water Technologies' stock is up 37% over the past year, and it surged 13% in the past three months. This upward movement pairs with reports of the company capturing additional market share and benefiting from recurring demand driven by regulatory requirements. While shares have cooled slightly this month, momentum overall has been strong, raising fresh questions about what’s truly baked into the current price.

After such a run, is Watts Water Technologies trading at an attractive entry point, or are investors already factoring in the next phase of growth?

Most Popular Narrative: Fairly Valued

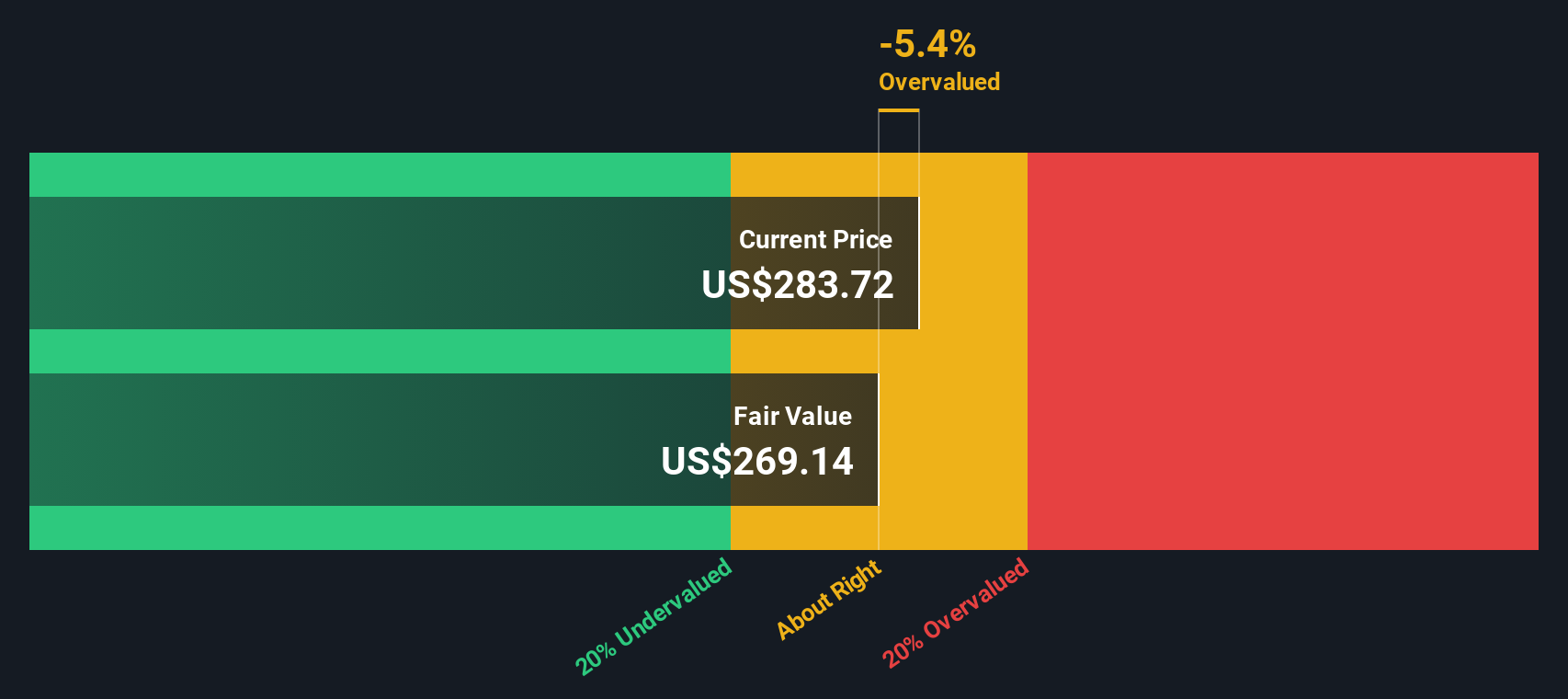

According to the most widely followed analysis, Watts Water Technologies is considered to be trading near its estimated fair value, with analysts mostly aligned on the stock’s worth based on robust future earnings expectations.

The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data-driven water conservation, efficiency, and regulatory compliance solutions. This is expected to drive higher-margin, recurring revenue and support long-term earnings and margin expansion.

Ready to dig into what’s fueling this price target? Bold growth assumptions are baked into the narrative, including higher-than-normal profit multiples, ambitious earnings expansion, and strategic market catalysts. Find out exactly what’s underpinning the current fair value and just how optimistic the street is on Watts’ future.

Result: Fair Value of $277.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued weakness in Europe and uncertainty around tariff impacts could challenge Watts' growth outlook and put pressure on future earnings assumptions.

Find out about the key risks to this Watts Water Technologies narrative.Another View: What Does the SWS DCF Model Say?

Taking a step back from analyst price targets, our DCF model tells a different story and suggests Watts Water Technologies may be priced a bit optimistically at the moment. Could the underlying assumptions be too confident?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Watts Water Technologies Narrative

If you want to challenge these assumptions or simply see how the numbers stack up for yourself, building your own view is quick and straightforward. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Watts Water Technologies.

Looking for more investment ideas?

Smart investors always keep an eye out for their next big opportunity. Don't let this moment pass you by when so many untapped themes await your attention.

- Spot overlooked value by tapping into undervalued stocks based on cash flows to find companies whose cash flows signal true bargain potential before the market catches on.

- Amplify your search for income with dividend stocks with yields > 3%, which showcases stocks with yields above 3 percent for those seeking both growth and reliable payouts.

- Catch the next AI breakthrough in healthcare and see how technology is transforming the sector with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watts Water Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTS

Watts Water Technologies

Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives