- United States

- /

- Trade Distributors

- /

- NYSE:WSO

If You Like EPS Growth Then Check Out Watsco (NYSE:WSO) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Watsco (NYSE:WSO), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Watsco

How Quickly Is Watsco Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Watsco has grown EPS by 9.5% per year. That growth rate is fairly good, assuming the company can keep it up.

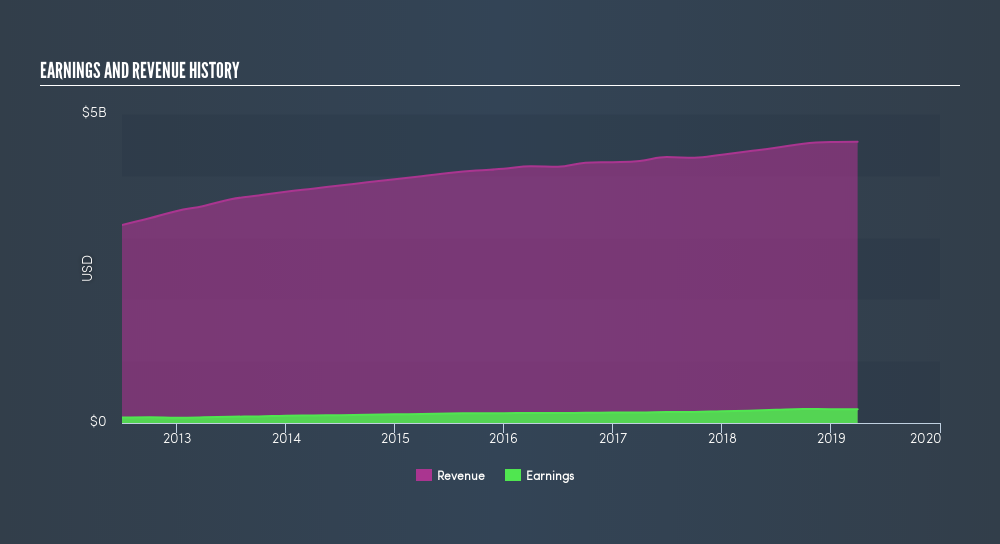

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Watsco maintained stable EBIT margins over the last year, all while growing revenue 3.5% to US$4.6b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Watsco's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Watsco Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$6.0b company like Watsco. But we are reassured by the fact they have invested in the company. Notably, they have an enormous stake in the company, worth US$558m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

Does Watsco Deserve A Spot On Your Watchlist?

One important encouraging feature of Watsco is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Watsco. You might benefit from giving it a glance today.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives