- United States

- /

- Building

- /

- NYSE:WMS

Are Shares of Advanced Drainage Systems Attractive After Infrastructure Bill Talks in 2025?

Reviewed by Bailey Pemberton

If you're on the fence about what to do with Advanced Drainage Systems stock, you're definitely not alone. Sometimes it feels like the market can’t quite decide how to price this one, and lately, the ride has been a little bumpy. Over the past week and month, the stock has slipped by about 5.6% and 5.3% respectively. However, if you pull the lens back, you’ll spot a very different picture: up 17.2% year-to-date and an impressive 93.3% over the last five years. Even factoring in a 1-year drop of 11.9%, that type of long-term growth is hard to ignore.

Some of these swings can be traced back to ongoing market buzz about infrastructure development. When news breaks about increased government spending or innovations in sustainable water management, stocks like Advanced Drainage Systems sometimes move aggressively as investors try to price in future demand. Still, the multi-year gains seem to reflect more than just day-to-day headlines. They hint at a company that has managed to keep growing, even when overall market sentiment is shaky.

But is Advanced Drainage Systems really trading at a great price right now? According to a standard valuation scoring system that checks six different metrics, the company passes only 2 out of 6 undervaluation tests, giving it a value score of 2. This paints a picture of a stock that is not cheap on most typical measures, but there might still be compelling arguments for where it is headed next.

Let’s take a closer look at how different valuation methods measure up, and later, I’ll share an even more insightful approach to understanding what this company might really be worth.

Advanced Drainage Systems scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Drainage Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to their value today. This approach aims to capture the value an investor could expect to receive from free cash flow over time, rather than focusing solely on current earnings or assets.

For Advanced Drainage Systems, the latest reported Free Cash Flow (FCF) stands at $479.9 million. Analysts expect this number to fluctuate over the next several years, projecting $494.1 million in FCF by 2027. Beyond that, projections extend for a total of ten years and reach an estimated $525.9 million in 2035 based on Simply Wall St’s extrapolation methods. All figures are presented in US dollars.

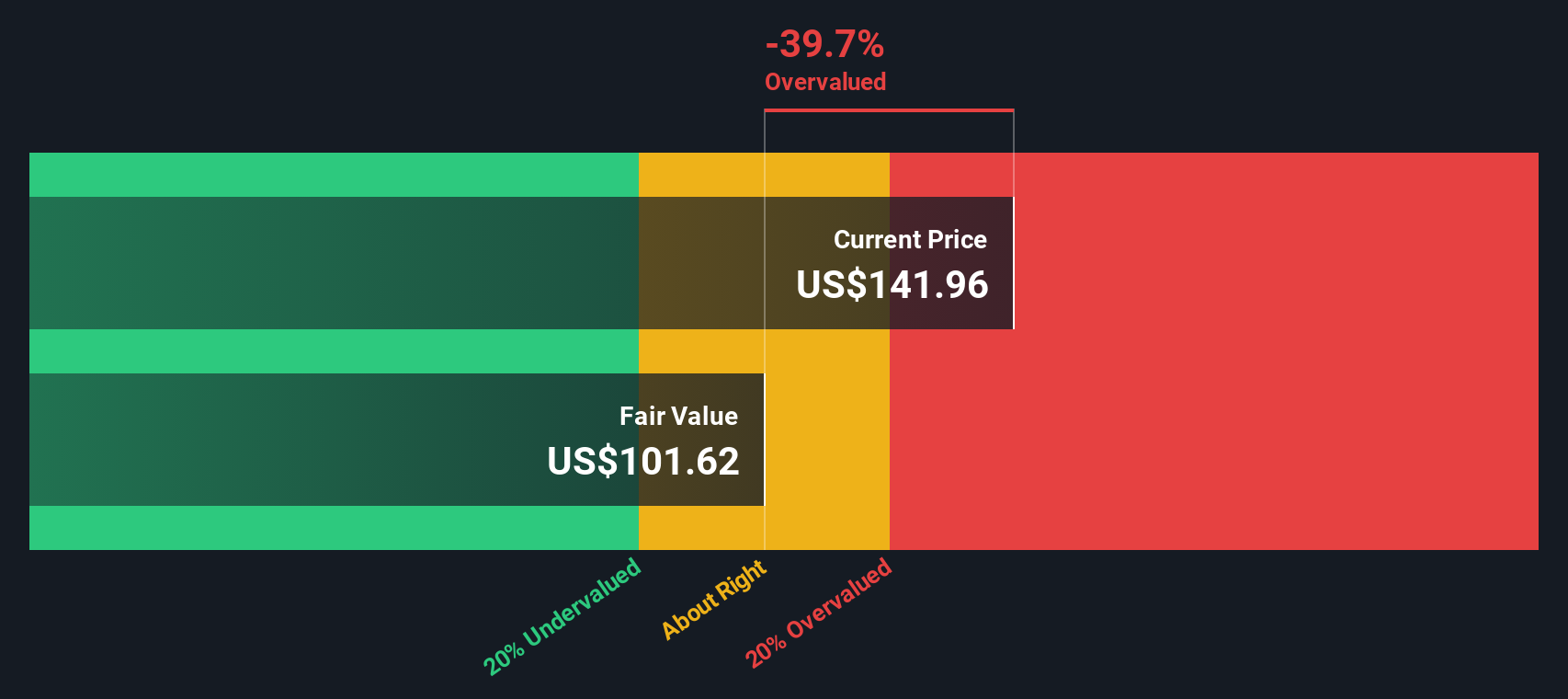

According to the DCF model, the fair value of Advanced Drainage Systems shares is calculated at $100.62. When this intrinsic value is compared to the company’s current share price, the model signals the stock is about 33.2% overvalued. This suggests that despite the company’s strong growth prospects and solid cash flow performance, investors are currently paying too high a premium for future growth potential.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Drainage Systems may be overvalued by 33.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advanced Drainage Systems Price vs Earnings

For profitable companies like Advanced Drainage Systems, the Price-to-Earnings (PE) ratio is a tried-and-true tool that helps investors weigh the current stock price against the company’s earnings. It provides a straightforward snapshot of how much investors are paying for each dollar of earnings, which is especially helpful when evaluating firms that consistently generate profits.

What’s considered a “fair” PE ratio usually depends on growth prospects and underlying business risks. Companies with strong growth or low risk tend to command higher PE multiples, while more mature or riskier businesses usually trade at lower ratios. This is why it’s critical to look at both the numbers and the context behind them.

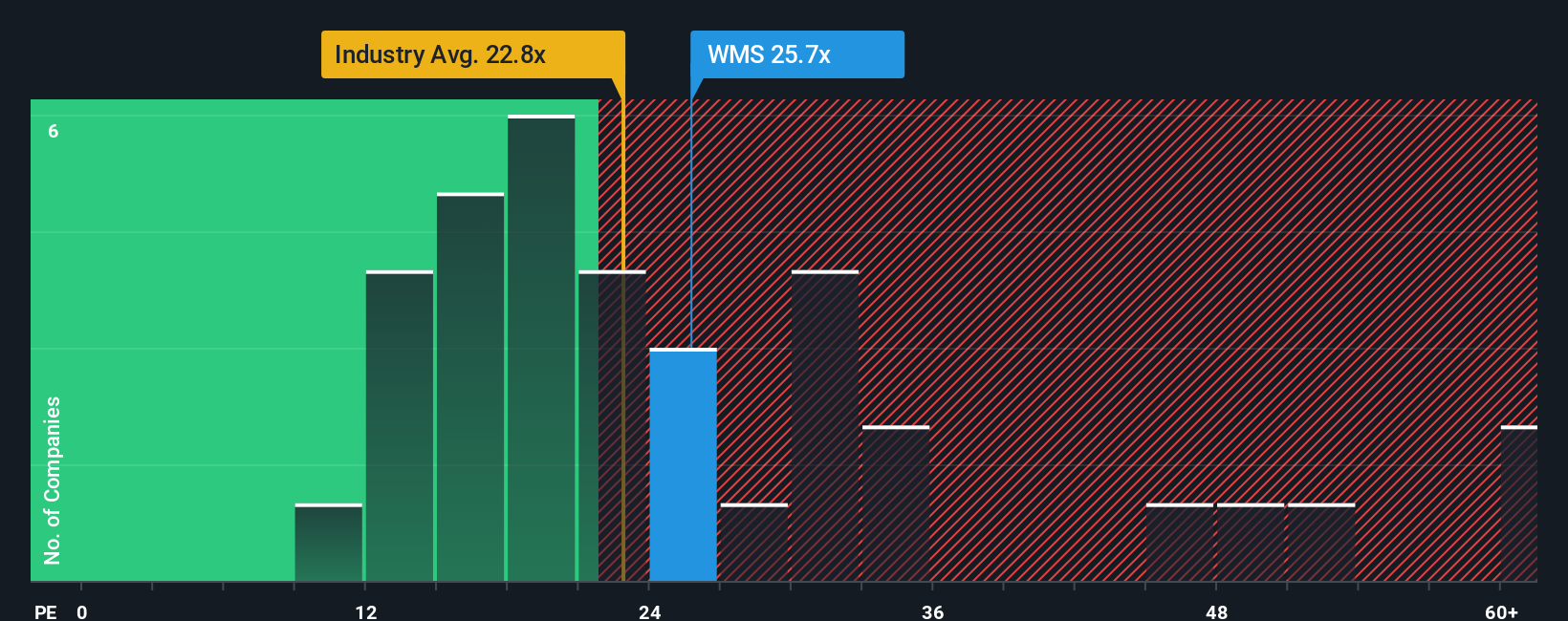

Advanced Drainage Systems trades at a PE ratio of 24.1x. For context, this is higher than its peer average of 16.9x and also above the building industry average of 21.5x. But industry and peer comparisons can only tell part of the story. That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This metric, which is 26.6x for Advanced Drainage Systems, factors in not just growth and profitability, but also risk profile, margins, and company size, providing a more holistic view than simple averages.

Comparing the current PE of 24.1x with the “Fair Ratio” of 26.6x, the company is trading a bit below its fundamentally justified range. This indicates the stock is undervalued on a multiples basis even if it looks expensive next to the broader market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Drainage Systems Narrative

Earlier we mentioned that there is a more insightful way to evaluate stocks. Let us introduce Narratives, a dynamic, story-driven technique investors use to connect what they believe about a company with the numbers behind its fair value and future performance.

A Narrative combines your view of where a company is heading, your forecasts for revenue, earnings, and margins, and what you believe the stock should be worth, all in one place. On Simply Wall St's Community page, millions of investors use Narratives to articulate why they are bullish or bearish on companies like Advanced Drainage Systems, making this tool both powerful and accessible to anyone.

By tying the company’s real-world story directly to a financial model and fair value, Narratives help you decide when the price is right by showing if it is above or below your target. Because they update automatically when news or earnings break, Narratives provide the most current way to track your thesis over time.

Take Advanced Drainage Systems: some investors see growing demand and operational efficiency pushing its value as high as $167.0 per share, while others remain cautious about risks and peg it closer to $130.0. With Narratives, you can easily explore and compare these perspectives and see where your own story fits in.

Do you think there's more to the story for Advanced Drainage Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives