- United States

- /

- Building

- /

- NYSE:WMS

Advanced Drainage Systems (NYSE:WMS) Expands with Orenco Acquisition and Faces Rising Material Costs

Reviewed by Simply Wall St

Advanced Drainage Systems (NYSE:WMS) has recently strengthened its market position with a 6% increase in residential sales, driven by an 11% growth in infiltrator systems and strategic acquisitions like Orenco Systems. The establishment of a new Engineering and Technology Center underscores its commitment to innovation, despite challenges in the nonresidential construction segment and rising material costs impacting profitability. This report will explore ADS's market strategies, financial health, growth prospects, and the key risks and challenges it faces.

Unique Capabilities Enhancing Advanced Drainage Systems's Market Position

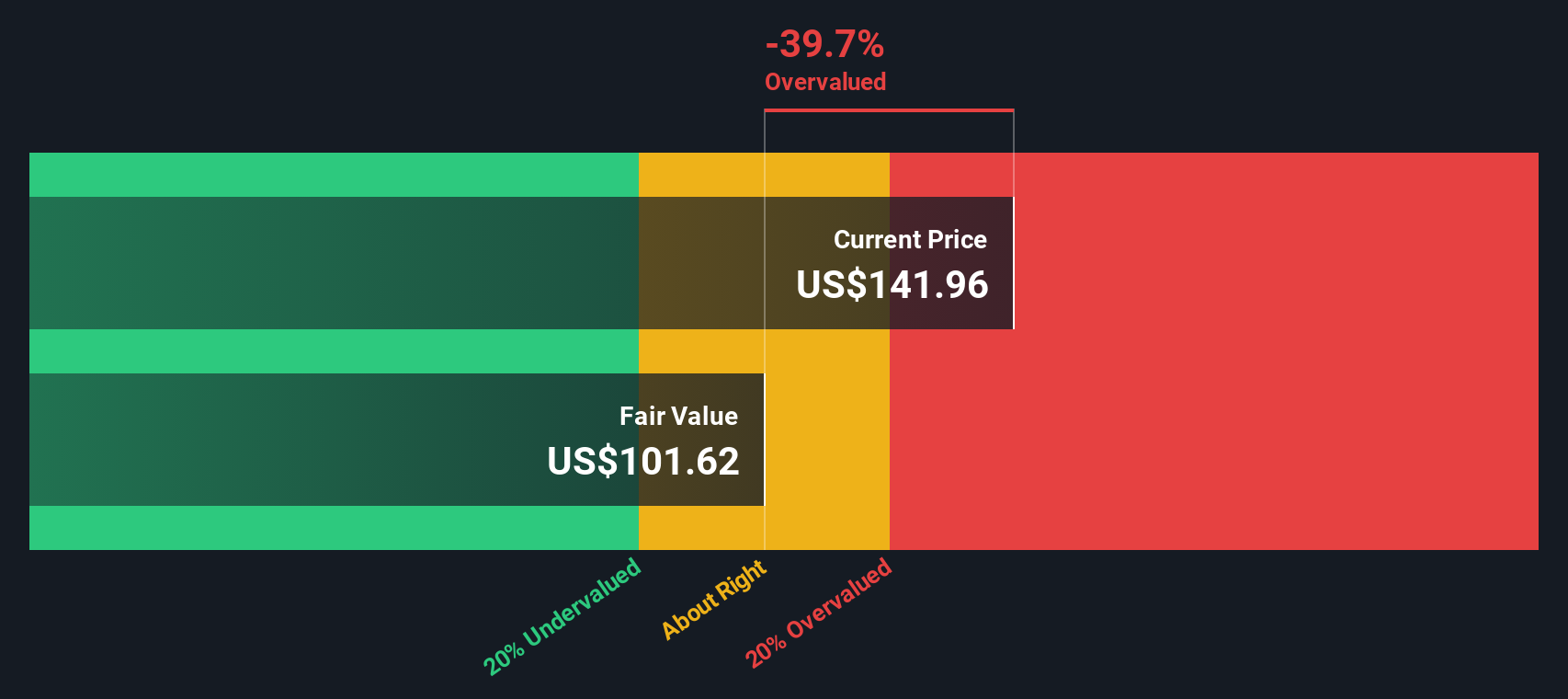

Advanced Drainage Systems (ADS) has demonstrated significant growth in its residential and infrastructure markets, with a 6% increase in residential sales driven by 11% growth in infiltrator systems. This growth is bolstered by strategic partnerships with homebuilders, enhancing market penetration. The company's profitability is underscored by its consistent adjusted EBITDA margins exceeding 30%, reflecting the resilience of its business model. Capital investments have been steadily increased, yielding significant operational efficiencies and product enhancements. The strategic acquisition of Orenco Systems and the establishment of the new Engineering and Technology Center further solidify ADS's commitment to innovation and expanding its portfolio in advanced wastewater management solutions. Additionally, the company is trading below its estimated fair value, suggesting a potential alignment with SWS fair ratio, which might indicate a strong market position relative to its peers.

Strategic Gaps That Could Affect Advanced Drainage Systems

ADS faces challenges in the nonresidential construction segment, which contributes significantly to revenue but has shown inconsistent demand across regions. This variability impacts overall sales performance. Rising material costs have posed a challenge, as highlighted in the latest earnings call, where it was noted that these costs are moving more unfavorably than expected, affecting profitability. Furthermore, the company's revenue growth forecast of 5.5% per year lags behind the US market average of 8.9% and the industry average of 20%, which could indicate potential vulnerabilities in maintaining competitive growth rates. The high net debt to equity ratio of 46.3% also underscores financial leverage that may need careful management.

Future Prospects for Advanced Drainage Systems in the Market

The acquisition of Orenco Systems presents a significant opportunity for ADS to expand its footprint in the growing market for advanced wastewater treatment solutions. This move aligns with the favorable outlook for infrastructure projects, supported by government funding and initiatives such as the IIJA. The company's new Engineering and Technology Center is poised to accelerate product development and innovation, reinforcing its leadership in stormwater management. Analysts predict a substantial increase in target prices, suggesting potential future gains and enhancing ADS's market position. These strategic initiatives are designed to capitalize on emerging opportunities and drive performance.

Key Risks and Challenges That Could Impact Advanced Drainage Systems's Success

Economic and political uncertainties present risks to demand stability, particularly in the nonresidential sector, which is a major revenue contributor. Material cost inflation remains a significant threat to margins, necessitating strategic pricing and cost management to mitigate impacts. Regulatory and environmental challenges, as highlighted by the EPA's estimate of $630 billion needed for infrastructure investments over the next two decades, require substantial adaptation and investment. These external factors could influence ADS's growth trajectory and market share, necessitating proactive measures to address these challenges effectively.

To learn about how Advanced Drainage Systems's valuation metrics are shaping its market position, check out our detailed analysis of Advanced Drainage Systems's Valuation.

Conclusion

Advanced Drainage Systems is strategically positioned to capitalize on growth opportunities in the residential and infrastructure markets, evidenced by its strong partnerships and commitment to innovation through acquisitions like Orenco Systems. However, challenges in the nonresidential segment and rising material costs necessitate careful management to sustain profitability. The company's trading position below its estimated fair value suggests a potentially attractive investment opportunity, as it indicates room for price appreciation relative to its peers. As ADS continues to enhance its product offerings and operational efficiencies, it is poised to improve its market share and financial performance, provided it navigates the highlighted risks effectively.

Taking Advantage

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.