- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (WCC): Evaluating Value After Analyst Upgrades and New Financial Concerns

Reviewed by Simply Wall St

If you’re looking at WESCO International (WCC) right now, you’re not alone. The stock is drawing serious attention after a mix of upbeat analyst commentaries and some conflicting warning signs. The company posted solid growth across key business units like data centers and saw encouraging volume improvements, prompting analysts to boost their outlook. At the same time, however, there has been an uptick in insider selling and a fresh wave of investor worry following WESCO’s latest quarterly results, which highlighted a noticeable jump in debt and a dip in profitability.

This push-and-pull between optimism and caution is showing up in the stock price. WESCO has climbed an impressive 36% over the past year, outpacing many in the industrial sector, and momentum has accelerated in the past three months. Still, insiders lightening up their stakes and concerns around rising leverage are starting to weigh on sentiment, creating a more complicated picture for anyone considering what’s next.

With the stock trading near its highs after this year’s strong run, the question is whether investors are getting a bargain on future growth, or if the market is already pricing it all in.

Most Popular Narrative: 2.7% Undervalued

According to community narrative, WESCO International is currently seen as slightly undervalued. The latest analyst consensus points to a fair value a bit above the current market price, factoring in both future growth potential and existing risks.

Massive acceleration in data center spending, especially from hyperscale and AI-related builds, is driving outsized growth (+65% year-over-year in Q2; outlook increased from +20% to +40% for 2025). WESCO has deep end-user relationships and an expanding role in both white space and gray space of data centers. This positions the company to capture a multi-year expansion in its addressable market, which could lift revenue growth, operating leverage, and backlog visibility.

Ready for the story behind this valuation? There is one core business trend that has analysts optimistic about WESCO’s next chapter, and one number hidden in the consensus is shaping the price target. Want to know what key assumptions could set the pace for the stock’s next big move? See what community analysts believe will fuel this upside, if their forecast comes true.

Result: Fair Value of $228.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure from large low-margin projects and ongoing volatility in the utility segment could quickly undermine analyst optimism for WESCO.

Find out about the key risks to this WESCO International narrative.Another View: Discounted Cash Flow Check

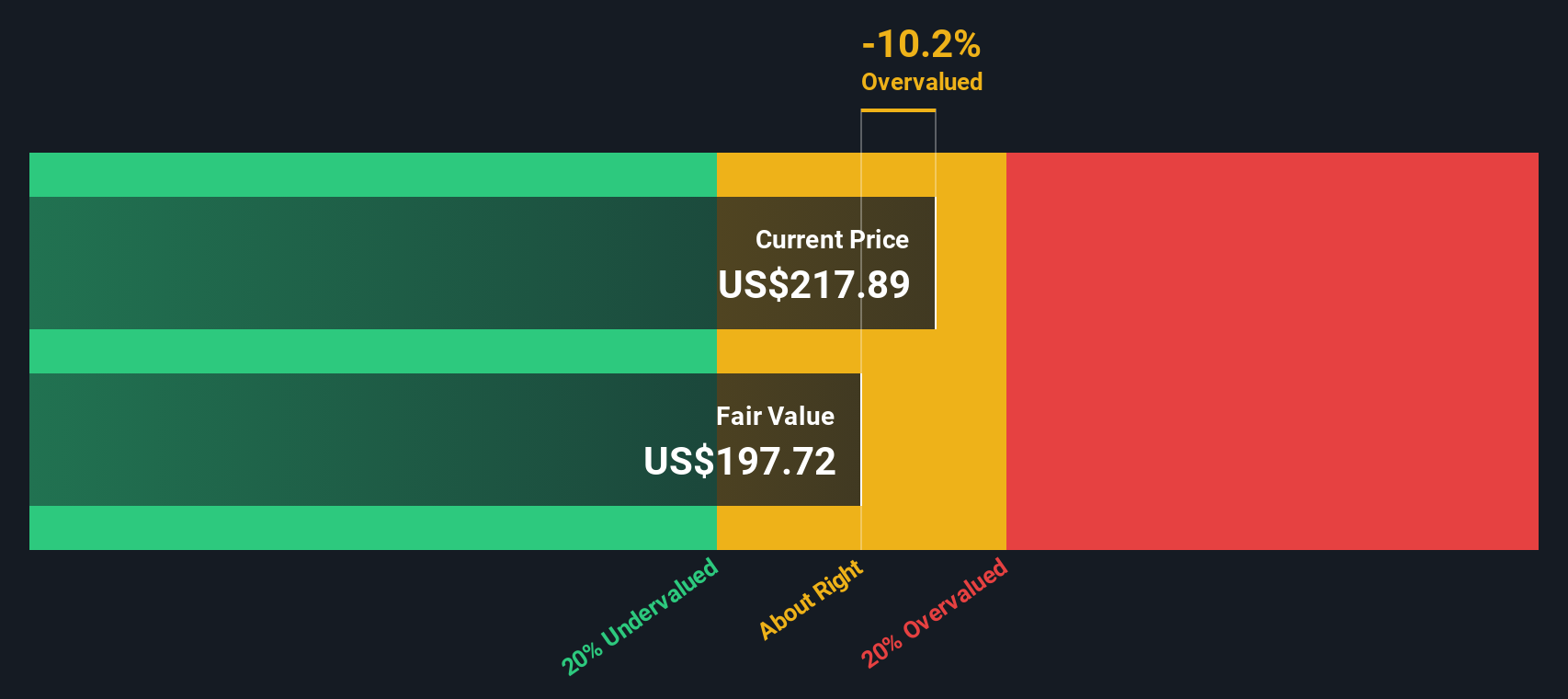

While analysts lean toward upside based on future earnings, the SWS DCF model takes a stricter approach. This method suggests the current share price is a bit optimistic. Which outlook should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WESCO International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WESCO International Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, it only takes a few minutes to craft your own narrative. do it your way.

A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity when there are so many compelling trends taking shape. Make your portfolio work harder by seizing unique angles across the market right now. These handpicked strategies are where sharp money is headed. Miss them and you might just miss the next big winner.

- Unleash your portfolio’s income power by checking out stocks offering yields above 3% and unlock new levels of reliable returns with dividend stocks with yields > 3%.

- Capture the explosive growth in artificial intelligence by targeting trailblazing businesses with AI penny stocks and position yourself at the vanguard of technology.

- Ride the wave of undervalued gems and put smart cash flows on your side by getting ahead of the crowd with undervalued stocks based on cash flows before the market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives