- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International (WCC): Assessing Valuation Following Strategic AI Supply Chain Investment in Kojo

Reviewed by Simply Wall St

WESCO International (WCC) has made a strategic investment in Kojo, aiming to blend its well-established distribution network with Kojo’s AI-driven supply chain technology. This latest partnership highlights WESCO’s ongoing digital transformation efforts.

See our latest analysis for WESCO International.

WESCO International’s push into AI-powered supply chains comes at a time when momentum is building in the share price, with a 23.84% year-to-date return and a strong 27.30% total shareholder return over the past year. The stock’s longer-term track record is even more impressive, rising 69.7% in three years and over 440% for five years. This highlights growing investor confidence as WESCO continues advancing its digital transformation.

If you’re curious what other companies are making bold moves and gaining attention, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares not far off their latest price target and trading just under an 11 percent discount to analyst estimates, the critical question now is whether the stock’s current valuation leaves room for further upside or if markets have already accounted for WESCO’s next chapter of growth.

Most Popular Narrative: 8.5% Undervalued

WESCO’s current share price remains below the narrative’s implied fair value, setting the stage for a closer look at why analysts believe more upside could be ahead.

Massive acceleration in data center spend, especially from hyperscale and AI-related builds, is driving outsized growth (+65% YoY in Q2; outlook increased from +20% to +40% for 2025). WESCO has deep end-user relationships and an expanding role in both white space and gray space of data centers. This positions the company to capture a multi-year expansion in its addressable market, likely lifting revenue growth, operating leverage, and backlog visibility.

How bold are the numbers driving this narrative? Industry-defying growth estimates are supported by a blueprint built on expanding margins, accelerated infrastructure demand, and a projected multiple that only a select few companies achieve. The story behind this valuation is both ambitious and surprising. Want to see why consensus bets on WESCO’s transformative growth?

Result: Fair Value of $241 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure on margins and delays in large data center projects could quickly challenge the ongoing growth narrative that investors have come to expect.

Find out about the key risks to this WESCO International narrative.

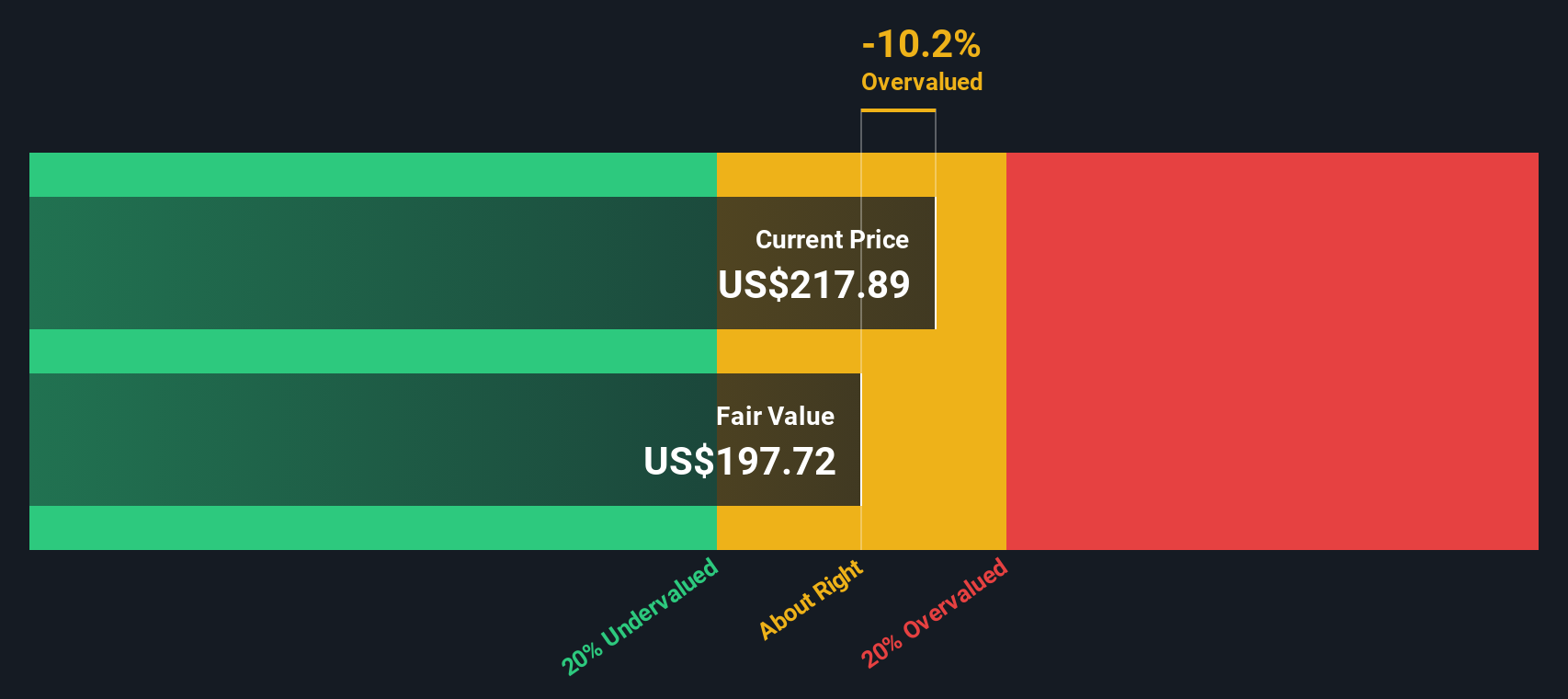

Another View: DCF Model Yields a Different Verdict

While analysts see WESCO as undervalued using a forward earnings approach, our SWS DCF model tells a different story. According to this method, WESCO is actually trading above its estimated fair value. This suggests that much of the future growth may already be priced in, which could challenge the optimistic narrative and raise the bar for future upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WESCO International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WESCO International Narrative

If you see things differently or want to dig into the numbers on your own terms, it’s fast and simple to build your own perspective for WESCO International. Give it a try and Do it your way.

A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of smart investors are finding their next breakout opportunity thanks to the Simply Wall Street Screener. Don’t let the best ideas pass you by.

- Maximize your search for value by evaluating these 879 undervalued stocks based on cash flows, where cash flow strength and potential returns could surprise you.

- Capture income and stability by reviewing these 17 dividend stocks with yields > 3%, which consistently deliver yields above 3 percent and help power up your portfolio.

- Stay ahead of future tech disruption by targeting these 25 AI penny stocks, as they make bold advances in artificial intelligence and transform industries worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives