- United States

- /

- Trade Distributors

- /

- NYSE:WCC

Did Wesco's New Genpact-Powered Invoice Automation Just Shift WESCO International's (WCC) Investment Narrative?

Reviewed by Sasha Jovanovic

- Genpact recently announced that Wesco has modernized its accounts payable operations by adopting the full Genpact AP Suite, incorporating specialized AI agents that automate data extraction, exception handling, duplication detection, and helpdesk functions.

- This transformation has enabled Wesco to automate 40% of its more than three million annual invoices with zero human intervention, sharply reducing manual workloads and boosting real-time visibility into its AP process health.

- We’ll consider how Wesco’s automation of high-volume invoice processing could influence its broader investment outlook and efficiency narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

WESCO International Investment Narrative Recap

To stake a claim as a Wesco International shareholder, an investor must believe in the company’s ability to execute on long-term catalysts like data center expansion and electrification, while managing margin risk tied to project mix and cost inflation. Wesco’s recent adoption of Genpact’s AP Suite marks a step forward in process automation, but this action is unlikely to move the needle materially on the immediate, central risk of margin compression from lower-margin projects or pricing pressures.

The most relevant recent development alongside this news is Wesco’s raised earnings guidance for 2025, which recognizes some positive sales momentum. While further automation could support efficiency, the ultimate impact on margins and earnings remains shaped by broader trends in project mix, price dynamics, and cyclical recovery in challenged end-markets such as utilities and broadband.

Yet, even with these operational improvements, investors need to keep in mind that persistent pressure on gross margins could still...

Read the full narrative on WESCO International (it's free!)

WESCO International's outlook anticipates $25.9 billion in revenue and $909.7 million in earnings by 2028. This reflects a 5.2% annual revenue growth rate and a $275.5 million increase in earnings from the current $634.2 million figure.

Uncover how WESCO International's forecasts yield a $236.45 fair value, a 11% upside to its current price.

Exploring Other Perspectives

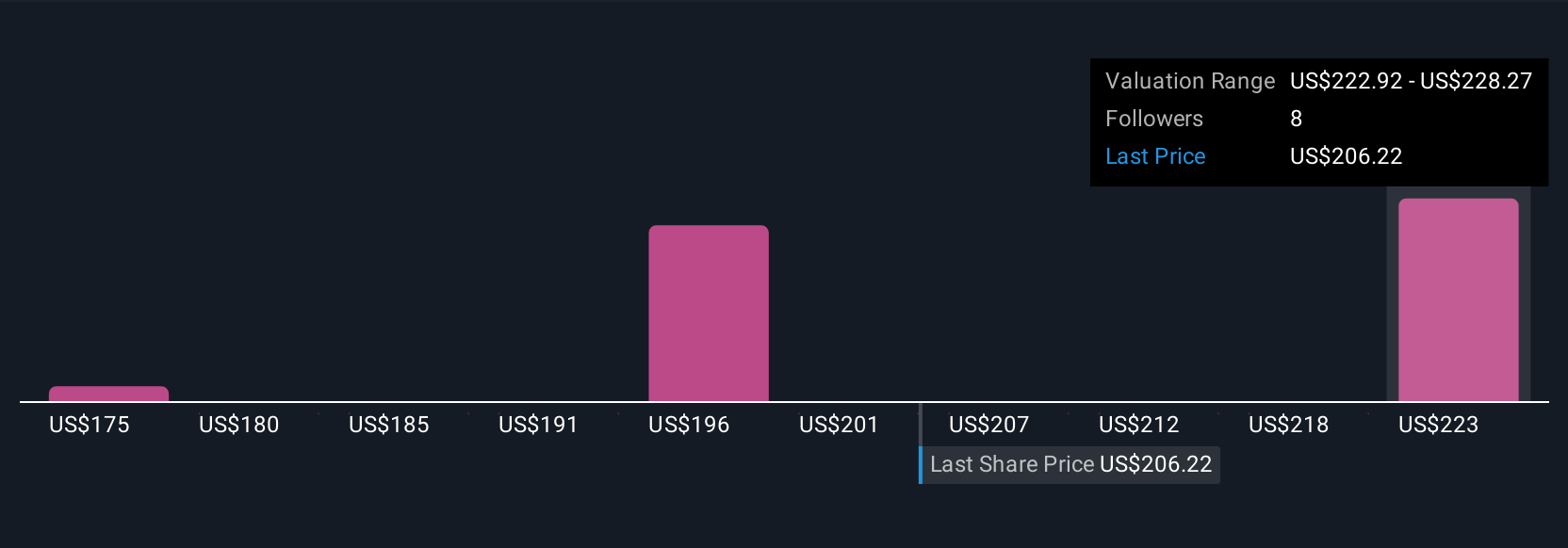

Simply Wall St Community members put Wesco’s fair value in a wide band from US$174.72 to US$236.45, based on three unique forecasts. While these opinions differ, many participants remain attentive to potential margin risk and shifts in project mix that could shape Wesco’s earnings outlook, reminding you to consider a spectrum of perspectives when evaluating opportunity and risk.

Explore 3 other fair value estimates on WESCO International - why the stock might be worth 18% less than the current price!

Build Your Own WESCO International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WESCO International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WESCO International's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives