- United States

- /

- Machinery

- /

- NYSE:WAB

Wabtec (NYSE:WAB): Assessing Valuation After Steady Gains and Robust Earnings Growth

Reviewed by Simply Wall St

See our latest analysis for Westinghouse Air Brake Technologies.

Momentum has been steadily building for Westinghouse Air Brake Technologies as the company’s share price notched a 9.39% gain over the past 90 days, reflecting its robust annual earnings growth. The latest share price sits at $204.44. Long-term performance stands out with a 117.81% total shareholder return over three years and a 244.28% return over five years, demonstrating that patient investors have been well rewarded.

If you’re looking for your next compelling idea beyond established names, consider exploring See the full list for free..

But with shares hovering near all-time highs, some investors may wonder if Westinghouse Air Brake Technologies’ recent success is truly underappreciated, or if markets are already factoring in the company’s future growth prospects. Is there still a buying opportunity?

Most Popular Narrative: 10.5% Undervalued

Westinghouse Air Brake Technologies' fair value, according to the market's most popular narrative, stands notably above the last closing price of $204.44. This signals a potential pricing gap and reflects optimism that has not been fully captured in the current market value.

Strategic, accretive acquisitions (Inspection Technologies, Frauscher, DeLiner Couplers) are expanding Wabtec's technological capabilities and global market share. Management expects both immediate and substantial incremental EBITDA, margin expansion, and realization of cost and growth synergies to drive improved net margins and free cash flow over the next several years.

Curious how the market justifies a sizable premium over today's price? Discover which bullish forecasts and bold profitability assumptions fuel this ambitious narrative. The financial foundations behind this projection are more surprising than you think. See what could be driving future gains.

Result: Fair Value of $228.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a weakening North American railcar outlook and heavy reliance on acquisitions could quickly challenge Wabtec's pace of growth and profit expansion.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another View: Multiples Raise Caution

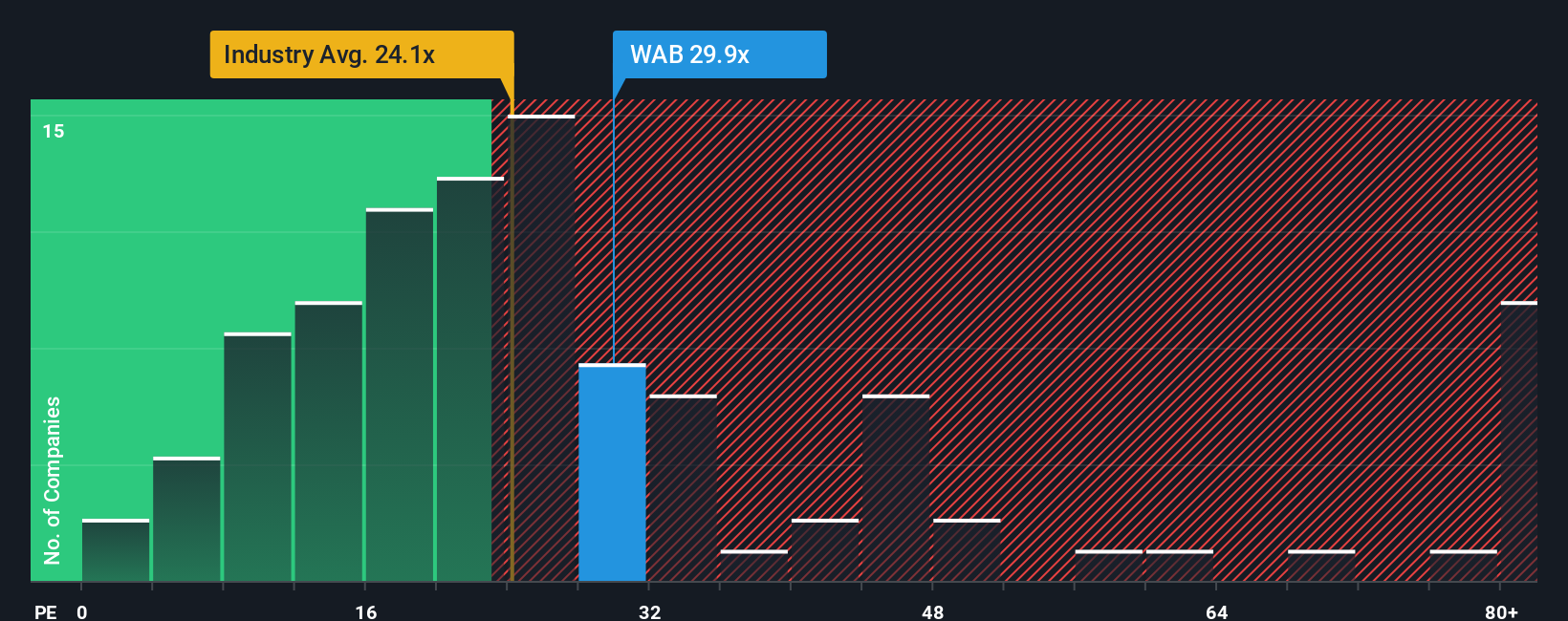

While the analyst consensus sees Westinghouse Air Brake Technologies as undervalued, a look at its price-to-earnings ratio tells a more cautious story. The stock trades at 29.7x earnings, which is well above the US Machinery industry average of 24x and higher than its own fair ratio of 27.9x. This suggests that investors are already factoring in a significant amount of future growth. Is the optimism justified or are markets overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you prefer forming your own view or analyzing the details for yourself, it’s easy to dive in and build your own perspective in just minutes. Do it your way.

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter decisions by taking action now. The right opportunities might be passing you by, so make your next move count. Don’t wait to find your advantage with these hand-picked ideas:

- Maximize income potential by tapping into these 22 dividend stocks with yields > 3% that consistently offer attractive yields above 3%.

- Seize the edge of tomorrow by targeting growth from these 26 AI penny stocks driving innovation in artificial intelligence and automation.

- Target overlooked value by investigating these 835 undervalued stocks based on cash flows based on robust cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives