- United States

- /

- Aerospace & Defense

- /

- NYSE:VVX

V2X (VVX) Lands $84 Million Navy Task Order Is Its Pacific Expansion Strategy Gaining Momentum?

Reviewed by Sasha Jovanovic

- V2X, Inc. recently announced it has been awarded an US$84 million task order under the U.S. Navy's Global Contingency Services Multiple Award Contract III, supporting the military’s efforts to establish a safe and reliable water supply system in Red Hill, Hawaii.

- This award not only extends V2X’s ongoing work in Hawaii but also highlights the company’s expanding presence and mission-critical capabilities across the Pacific region.

- We’ll examine how V2X’s new US$84 million Navy contract strengthens the company’s long-term growth story and addressable market outlook.

Find companies with promising cash flow potential yet trading below their fair value.

V2X Investment Narrative Recap

For an investor to be a shareholder in V2X, belief in the company’s ability to secure large, high-value defense contracts, and consistently convert them into recurring revenue streams, is essential. The recent US$84 million Navy award affirms V2X’s core strength in winning critical defense work but, given its size relative to V2X’s total backlog, it does not materially shift the near-term catalyst: capturing a handful of major awards needed to drive revenue growth and rebuild backlog. The key risk remains the business’s ongoing reliance on new, timely contract wins, as any delays or protests could pressure earnings visibility.

Among recent announcements, the August 2025 US$4.3 billion T-6 aircraft support contract stands out, as it reinforces V2X’s foothold in large-scale, recurring U.S. defense projects. This contract, alongside the new Navy award, is closely tied to the company’s growth catalysts, securing high-value deals that help offset backlog declines and replenish work as other programs sunset. Yet, even with these wins, investors need to pay attention to...

Read the full narrative on V2X (it's free!)

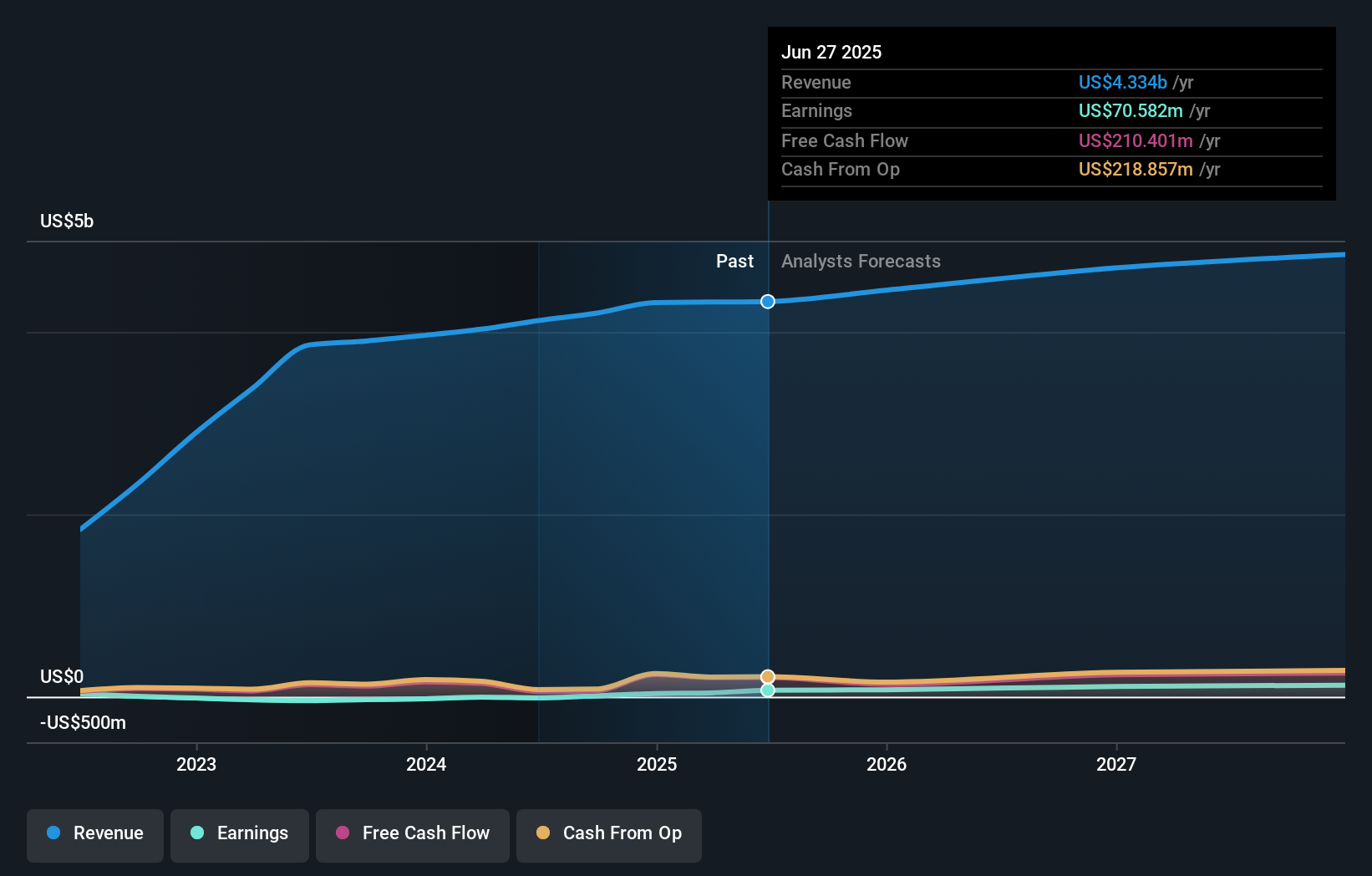

V2X's outlook anticipates $5.0 billion in revenue and $148.8 million in earnings by 2028. This is based on an annual revenue growth rate of 4.8% and a $78.2 million increase in earnings from the current level of $70.6 million.

Uncover how V2X's forecasts yield a $64.09 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered four fair value estimates for V2X, ranging from US$37.14 to US$141.58 per share. While opinions vary widely, many highlight the company’s concentration risk in episodic, large contract wins as a core performance factor, reminding you to consider multiple outcomes when assessing future prospects.

Explore 4 other fair value estimates on V2X - why the stock might be worth 38% less than the current price!

Build Your Own V2X Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V2X research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free V2X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V2X's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVX

V2X

Provides critical mission solutions and support services to defense customers worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives