- United States

- /

- Electrical

- /

- NYSE:VRT

Why Vertiv (VRT) Is Up 15.6% After a Wave of Analyst Upgrades on AI Demand Surge

Reviewed by Sasha Jovanovic

- In recent weeks, several analyst firms, including Barclays, Goldman Sachs, and UBS, have raised their ratings and price targets on Vertiv Holdings Co., citing increased confidence amid strong demand for AI infrastructure solutions. This surge in analyst optimism highlights Vertiv’s role as a key provider of critical data center thermal management and fluid solutions, with continued attention to its operational performance and growth outlook.

- We'll consider how this wave of analyst upgrades, driven by robust AI infrastructure demand, could influence Vertiv's investment narrative and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Vertiv Holdings Co Investment Narrative Recap

To be a shareholder in Vertiv Holdings Co., you need to believe in the accelerating growth of AI-driven data center infrastructure and Vertiv’s ability to deliver advanced power and cooling solutions to this rapidly expanding market. The recent wave of analyst upgrades reflects optimism about strong AI demand, which remains the most important short-term catalyst, while the main risk continues to be the threat that some large cloud customers may eventually build their own in-house solutions; the latest analyst calls do not materially change this risk at present.

Barclays’ recent price target hike, which triggered a notable jump in Vertiv’s share price, is closely tied to expectations of sustained demand for AI infrastructure and highlights the company’s central role in next-generation data centers. This comes on the heels of Vertiv’s new energy-efficient cooling product launch for NVIDIA applications, reinforcing that continued technology leadership is closely connected to near-term performance catalysts and expectations for organic sales growth.

On the other hand, investors should remain aware that as the sector evolves, the risk of large clients gradually pursuing their own power and cooling solutions could become increasingly relevant...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co's outlook anticipates $13.9 billion in revenue and $2.3 billion in earnings by 2028. This projection assumes 15.2% annual revenue growth and a $1.49 billion increase in earnings from the current $812.3 million.

Uncover how Vertiv Holdings Co's forecasts yield a $157.42 fair value, a 3% downside to its current price.

Exploring Other Perspectives

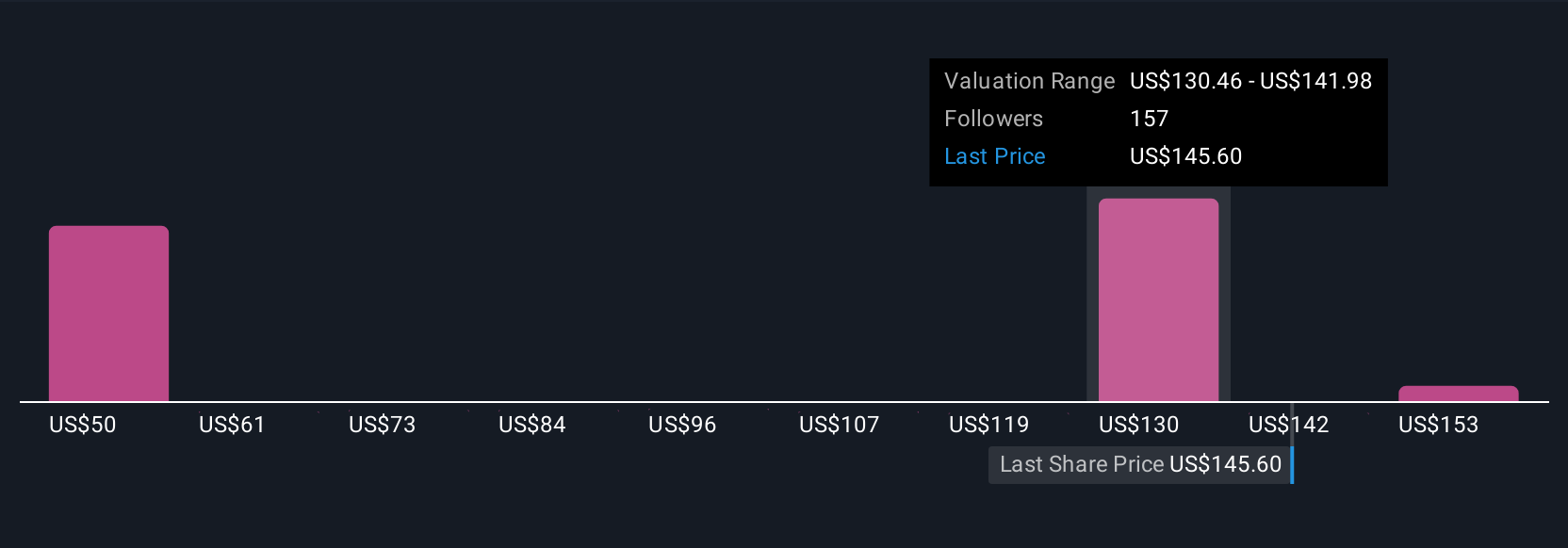

You’ll find 13 fair value estimates from the Simply Wall St Community, spanning US$100.42 to US$165 per share. While many market participants highlight accelerating AI-driven demand as a key driver, wide valuation ranges show opinions can differ, so it is worth exploring a variety of views before making decisions.

Explore 13 other fair value estimates on Vertiv Holdings Co - why the stock might be worth as much as $165.00!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives