- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Unveils AI-Focused Systems To Enhance Data Center Performance

Reviewed by Simply Wall St

Last week, Vertiv Holdings Co (NYSE:VRT) saw its stock climb 17%, potentially driven by the global launch of its innovative AI-focused systems aimed at enhancing data center performance. These announcements included a suite of new products such as the Vertiv™ Unify software and the SmartRun Solution, which may have fueled positive investor sentiment. Despite the broader market's 5% rise, Vertiv's surge was more pronounced, likely due to the impactful nature of these product launches in meeting modern technological demands. This positive trend within Vertiv was aligned with the market's overall upward trajectory, albeit at a more accelerated pace.

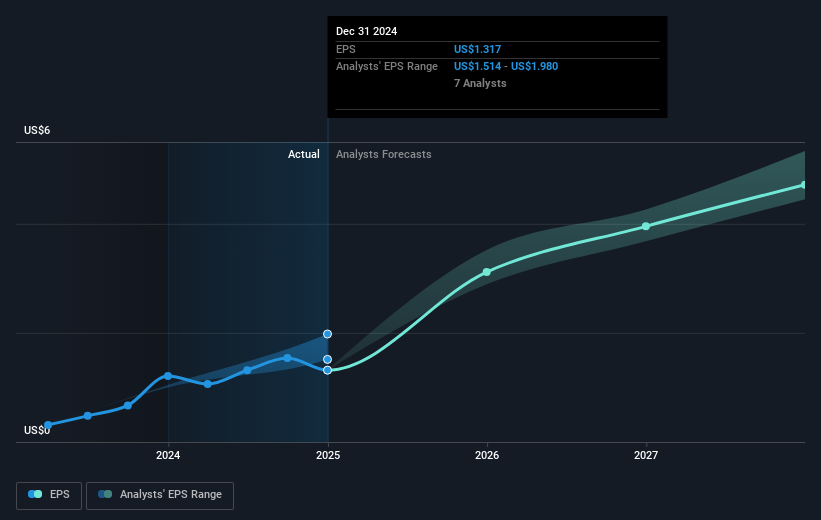

The recent surge in Vertiv Holdings Co's stock, powered by its AI-focused product launches, holds significant implications for its future performance narrative. The introduction of Vertiv™ Unify software and the SmartRun Solution may enhance revenue and earnings forecasts by aligning with the rising demand for data center efficiency. This proactive approach in technology could help solidify Vertiv’s position in meeting evolving industry needs, potentially supporting the anticipated revenue growth and profit margin expansion over the coming years. Analysts' forecasts of 13.6% annual revenue growth and a profit margin increase from 6.2% to 14.9% over three years underline the company's optimistic future outlook.

Over the past five years, Vertiv's total shareholder return, encompassing share price appreciation and dividends, was very large at 579.75%. In contrast, over the last year, the company underperformed the US Electrical industry, which recorded a 3.6% return, highlighting the relative short-term volatility. Considering the company's forecasted growth, this recent market response might be perceived as a recalibration by investors aligning with constructive long-term prospects.

Despite the strong price movement, with current shares trading at US$62.9, there remains a significant discount to the consensus analyst price target of US$124.92. This suggests potential headroom in Vertiv's valuation if anticipated operational improvements ultimately materialize. Investors should weigh these potential growth avenues against current market uncertainties, including technological upheavals and potential currency impacts. Given the present performance and analyst expectations, maintaining a holistic view and personal insight is advisable when evaluating Vertiv's future trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives