- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv Holdings Co (NYSE:VRT) Surges 50% In Past Month Amid Q1 Earnings Report

Reviewed by Simply Wall St

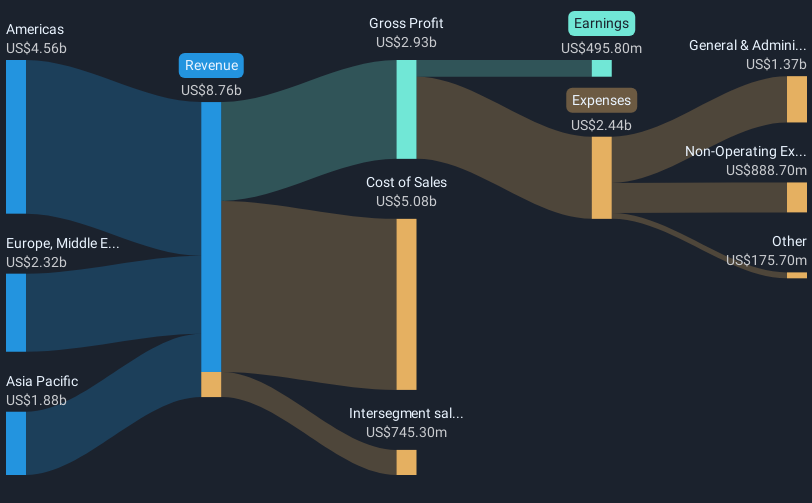

Vertiv Holdings Co (NYSE:VRT) experienced a significant monthly share price increase of 50%, which likely reflects strong investor optimism around its recent Q1 2025 earnings report and the announcement of increased guidance for the year. Revenue growth and net income turned positive, marking a substantial recovery from the previous year's losses. The company's collaboration with NVIDIA for an AI data center and the confirmation of no share repurchases also indicate stability and forward momentum. Set against a backdrop of broader market gains due to positive economic developments, Vertiv's recent announcements have contributed to bolstering its share performance.

We've spotted 2 possible red flags for Vertiv Holdings Co you should be aware of.

The recent developments at Vertiv Holdings Co, specifically the collaboration with NVIDIA and the promising Q1 2025 earnings report, are poised to enhance the company's narrative of driving future success through AI data center solutions. These initiatives underscore the company's strategy to leverage AI infrastructure and data center demand, reinforcing its potential for revenue growth. Analysts' expectations further illustrate this optimism, forecasting a steady revenue increase of 13.3% annually and a rise in profit margins from the current 7.9% to 15.2% in three years. Such prospects align with the 13.6% share price discount to the consensus target price of US$108.14, suggesting potential upside.

Over the past three years, Vertiv's share price, including dividends, has surged by a very large percentage, significantly outperforming typical market expectations. However, in the shorter term, the company underperformed the US Electrical industry, which achieved a 6.8% rise over the last year. This contrast may partially reflect volatility and market adjustments post the company's massive gains in prior periods.

While current news supports an optimistic revenue and earnings trajectory, the actualization of these forecasts depends on Vertiv's ability to manage global trade challenges and solidify its strategic collaborations. These factors are critical to justifying the price movement towards the analyst consensus price target, with current shares trading at US$93.48, leaving room for potential capital appreciation. Investors should factor in these elements, as well as the company's ability to mitigate tariff and supply chain risks, when evaluating its future performance.

Our expertly prepared valuation report Vertiv Holdings Co implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vertiv Holdings Co, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives