- United States

- /

- Electrical

- /

- NYSE:VRT

A Look at Vertiv (VRT) Valuation After Renewed Institutional Interest and Digital Infrastructure Spotlight

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 8.8% Undervalued

The prevailing narrative views Vertiv Holdings Co as undervalued, based on strong future growth projections and shifting industry dynamics.

"Accelerating global demand for high-density, AI-driven data centers is driving robust growth in Vertiv's sales pipeline and backlog. This is evidenced by recurring record order levels, backlog growth, and management's raised organic sales growth guidance, which support potentially higher future revenue."

Curious about the engine powering this bullish outlook? The key to Vertiv's valuation is a bold blend of aggressive growth assumptions and ambitious profit targets, all underpinned by a future analyst multiple that outpaces most rivals. Which game-changing drivers underpin this eye-catching price target? Dig into the full narrative to see the core projections behind the fair value call.

Result: Fair Value of $157.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing supply chain disruptions and the risk of key customers moving critical infrastructure in house could quickly shift Vertiv's promising outlook.

Find out about the key risks to this Vertiv Holdings Co narrative.Another View

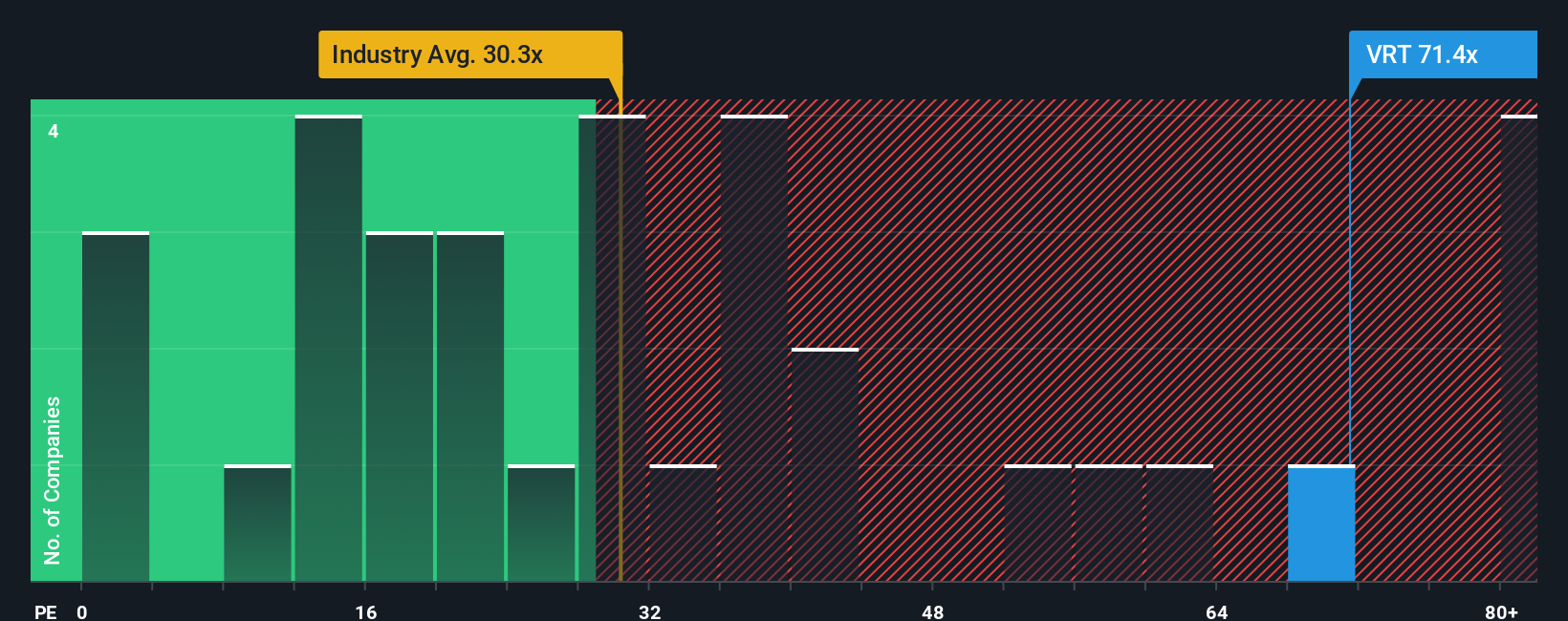

Looking through the lens of market valuation ratios, Vertiv looks much pricier than the rest of its industry right now. This snapshot counters the bullish narrative and invites the question: has the market already run too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Vertiv Holdings Co to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Vertiv Holdings Co Narrative

If you see things differently or want to test your own assumptions, building your personal take on Vertiv Holdings Co is just a few minutes away with Do it your way.

A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next timely opportunity slip by. Harness the Simply Wall Street screener to uncover stocks that fit your unique strategy, whether you want resilient income, tech innovation, or overlooked bargains. Here are three powerful ways to get started:

- Boost your potential returns by locking in stable payouts with dividend stocks with yields > 3%, which spotlights companies offering impressive dividend yields above 3%.

- Tap into future trends early by scanning AI penny stocks for emerging businesses at the forefront of artificial intelligence advancements.

- Catch market inefficiencies quickly and find great value opportunities with undervalued stocks based on cash flows, focusing on stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives