- United States

- /

- Construction

- /

- NYSE:VMI

Earnings Momentum and Analyst Optimism Could Be a Game Changer for Valmont Industries (VMI)

Reviewed by Sasha Jovanovic

- Valmont Industries recently reached a new 52-week high after several quarters of surpassing earnings estimates, with analysts maintaining a favorable outlook and recognizing the company's strong growth and asset efficiency.

- Notably, Valmont's consistent positive earnings surprises and high industry rankings have highlighted its operational momentum and attracted increased investor interest.

- We'll explore how analyst confidence in Valmont's earnings momentum could influence the company's investment narrative and market positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Valmont Industries Investment Narrative Recap

To be a Valmont Industries shareholder, you need to align with the idea that the long-term demand for infrastructure and agricultural solutions will outweigh periodic volatility from economic cycles and end-market shifts. The recent 52-week high and ongoing earnings momentum reinforce analyst optimism, yet they do not materially change the primary short-term catalyst, continued infrastructure investment, or the core risk of demand sensitivity to economic downturns and changes in public or private spending.

Among recent company actions, Valmont's inclusion in the Russell 1000 Value-Defensive and Defensive Indexes is especially relevant, boosting visibility and potentially supporting capital inflows around infrastructure market catalysts. This recognition dovetails with growing interest following earnings outperformance, yet neither signal nor guarantee insulation from economic headwinds or sector rotation.

Yet, investors should also be mindful, especially if economic or agricultural spending softens, revenue stability could face...

Read the full narrative on Valmont Industries (it's free!)

Valmont Industries' outlook forecasts revenue of $4.5 billion and earnings of $462.5 million by 2028. This implies an annual revenue growth rate of 3.5% and an earnings increase of $244.8 million from current earnings of $217.7 million.

Uncover how Valmont Industries' forecasts yield a $415.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

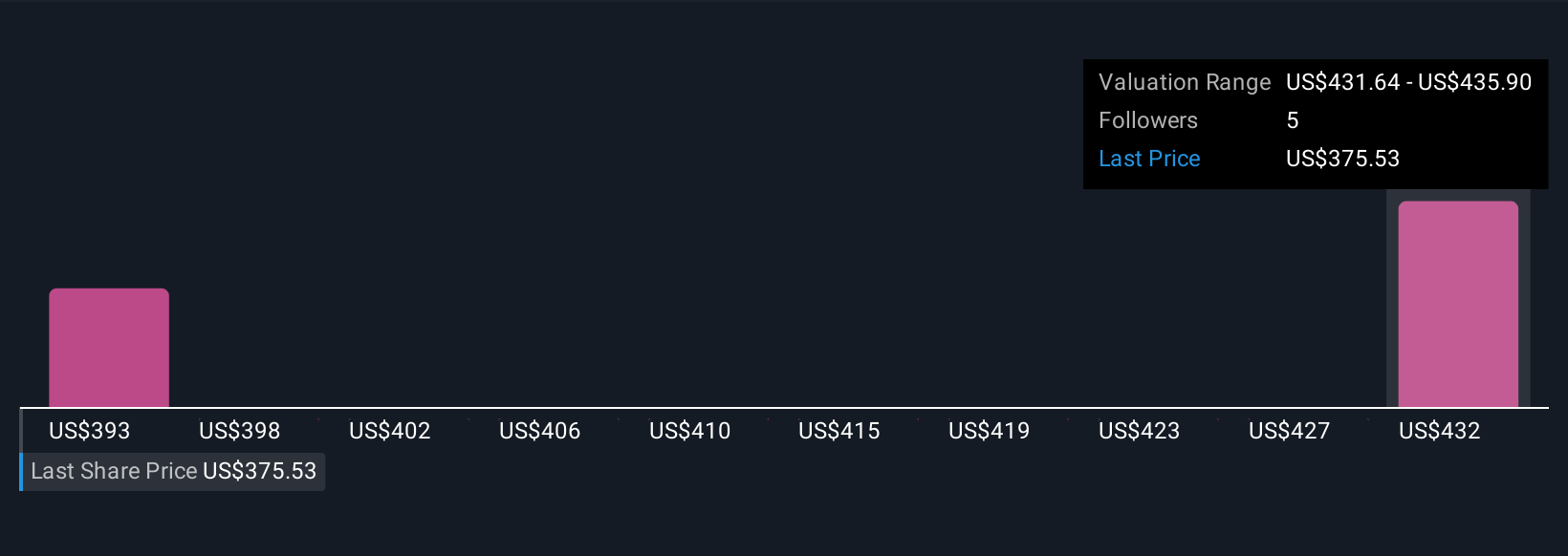

Two fair value estimates from the Simply Wall St Community range between US$415 and US$434.80 per share. While infrastructure investments continue to support the business outlook, you’ll find a breadth of opinion about potential risks and returns, explore other viewpoints below.

Explore 2 other fair value estimates on Valmont Industries - why the stock might be worth just $415.00!

Build Your Own Valmont Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmont Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valmont Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmont Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VMI

Valmont Industries

Operates as a manufacturer of products and services for infrastructure and agriculture markets in the United States, Australia, Brazil, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives