- United States

- /

- Machinery

- /

- OTCPK:VLDX

Investors Still Aren't Entirely Convinced By Velo3D, Inc.'s (NYSE:VLD) Revenues Despite 121% Price Jump

Velo3D, Inc. (NYSE:VLD) shares have had a really impressive month, gaining 121% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 74% share price drop in the last twelve months.

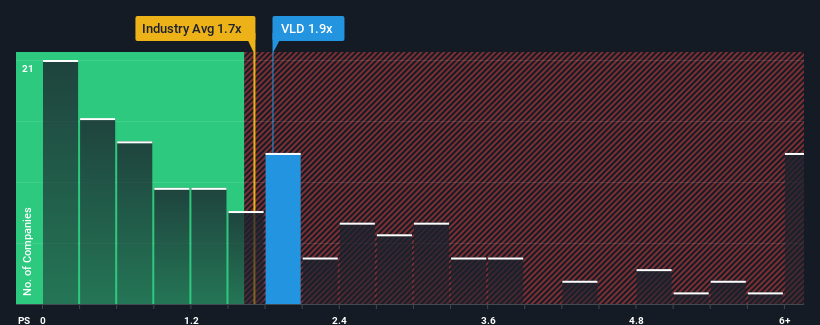

Although its price has surged higher, you could still be forgiven for feeling indifferent about Velo3D's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in the United States is also close to 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Velo3D

What Does Velo3D's P/S Mean For Shareholders?

Velo3D hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Velo3D's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Velo3D?

Velo3D's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.0%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should generate growth of 56% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.7%, which is noticeably less attractive.

In light of this, it's curious that Velo3D's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Velo3D's P/S Mean For Investors?

Velo3D's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Velo3D's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 4 warning signs for Velo3D (1 can't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:VLDX

Velo3D

Produces metal additive three dimensional printers in the Americas, Europe, and internationally.

Flawless balance sheet slight.

Market Insights

Community Narratives