- United States

- /

- Trade Distributors

- /

- NYSE:URI

Why Did United Rentals (URI) Fall After Beating Revenue Estimates and Raising Guidance?

Reviewed by Sasha Jovanovic

- United Rentals, Inc. recently reported third-quarter 2025 financial results, posting US$4.23 billion in revenue, surpassing analyst forecasts, and announced a quarterly dividend of US$1.79 per share payable in November.

- While the company raised its full-year revenue outlook, ongoing margin pressures and an earnings miss highlighted the costs associated with growth in its core and specialty businesses.

- We'll take a look at how United Rentals' revenue beat and higher guidance could reshape its investment narrative, especially amid profitability concerns.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

United Rentals Investment Narrative Recap

To be a shareholder in United Rentals, it's key to believe in the company's ability to drive revenue growth through strong execution in core and Specialty rental markets, while managing margin pressures linked to expansion and cost control. The recent Q3 results reinforced the top-line momentum with revenue beating forecasts and higher guidance for full-year revenue, but highlighted short-term risks as margins came under pressure and EPS fell short of analyst expectations. These factors mean the immediate catalyst remains strong demand for large projects, while the leading risk continues to be further margin compression due to ongoing cost challenges, a situation the latest results neither materially resolved nor worsened.

Of the recent announcements, the maintained quarterly dividend of US$1.79 per share stands out, signaling that United Rentals is keeping its commitment to capital returns even as profitability faced headwinds this quarter. This decision supports confidence in near-term cash generation, even as investors monitor how ongoing investments and cost trends may impact both margins and financial flexibility moving forward.

But, margin pressures from fleet repositioning and higher operating costs remain information every investor should watch for when considering...

Read the full narrative on United Rentals (it's free!)

United Rentals' outlook anticipates $18.8 billion in revenue and $3.5 billion in earnings by 2028. This is based on a projected 6.1% annual revenue growth rate and a $1.0 billion increase in earnings from the current $2.5 billion.

Uncover how United Rentals' forecasts yield a $1001 fair value, a 10% upside to its current price.

Exploring Other Perspectives

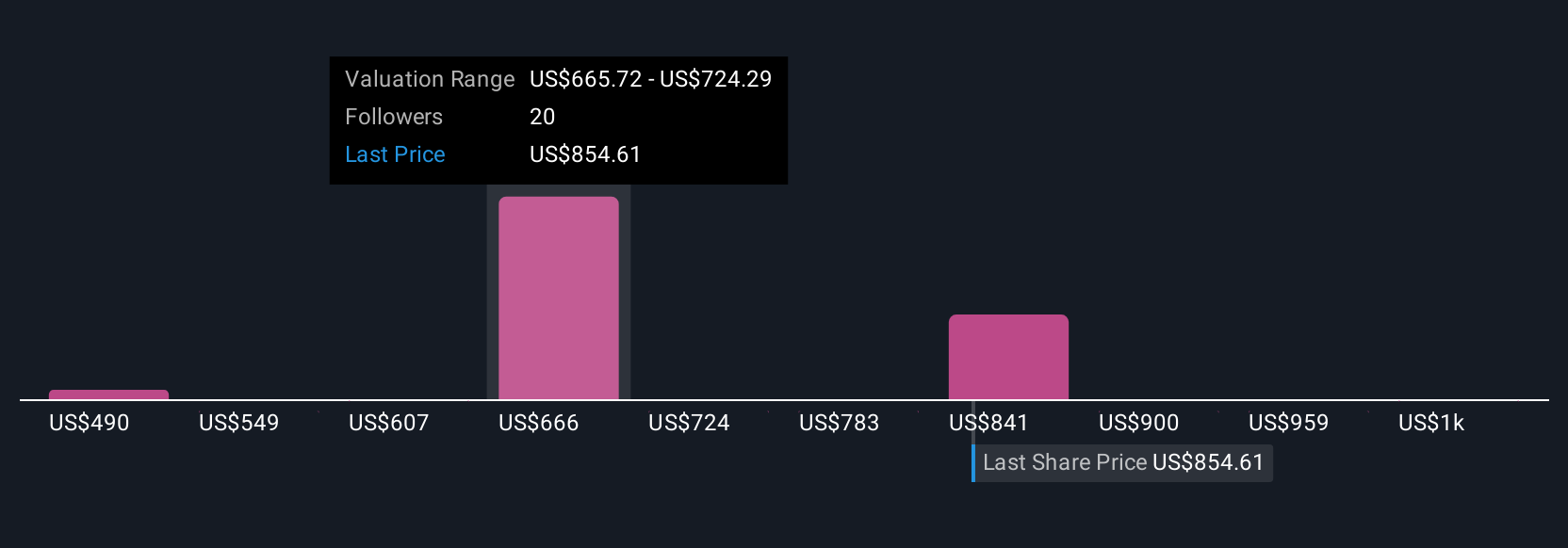

Fair value estimates from the Simply Wall St Community range from US$532.90 to US$1,171.10, based on five individual views. While opinions differ greatly, ongoing concerns about margin compression caused by higher expenses may influence how these valuations play into United Rentals' performance over the coming quarters.

Explore 5 other fair value estimates on United Rentals - why the stock might be worth as much as 28% more than the current price!

Build Your Own United Rentals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Rentals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Rentals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Rentals' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives