- United States

- /

- Trade Distributors

- /

- NYSE:URI

Assessing United Rentals (URI) Valuation Following Recent 15% Decline in Share Price

Reviewed by Simply Wall St

United Rentals (URI) has been catching some attention as investors size up the latest stock movement over the past month, with shares down about 15%. This shift prompts a closer look at what might be driving the action.

See our latest analysis for United Rentals.

Zooming out, United Rentals’ 1-month share price return of -14.9% follows a string of impressive longer-term results, including a 3-year total shareholder return of 149% and a 5-year return of nearly 292%. While recent momentum has faded, the big picture still shows substantial value creation for patient investors.

If this shift in momentum has you thinking about new opportunities, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

So with recent declines and solid long-term growth, is United Rentals trading below its true value today, or has the market already accounted for its future prospects, leaving little room for upside?

Most Popular Narrative: 18.9% Undervalued

United Rentals’ fair value, according to the most widely followed narrative, stands well above its recent closing price. There is a clear gap between what the market currently pays and the value projected by this consensus, hinting at meaningful upside if the narrative’s logic holds true.

The analysts have a consensus price target of $900.222 for United Rentals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1075.0, and the most bearish reporting a price target of just $592.0.

What is hiding beneath this valuation? The narrative leans on a powerful mix of earnings acceleration, profit margin expansion, and market-defying assumptions. Which of these levers truly drive the fair value call? Find out why the full forecast might surprise you.

Result: Fair Value of $1,028.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as margin compression or project delays. Both factors could limit upside and challenge the current bullish outlook.

Find out about the key risks to this United Rentals narrative.

Another View: Check the Multiples

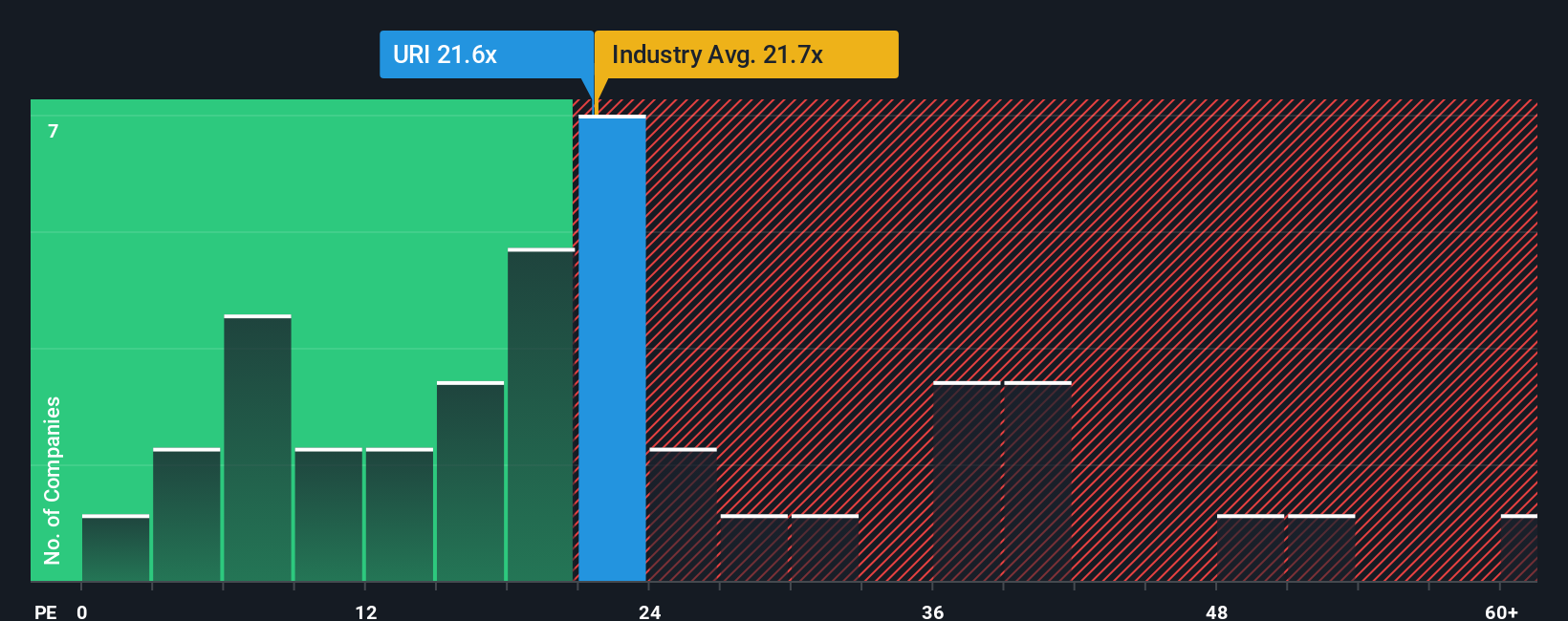

Not everyone looks at value the same way. When we compare United Rentals’ price-to-earnings ratio of 21x to its sector peers at 23.8x and the industry average of 19.8x, it appears reasonably valued. The fair ratio, however, sits even higher at 31.3x. Could the market be missing a re-rating opportunity, or is there a risk in expecting these numbers to converge?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Rentals Narrative

If you see things differently or want to dig deeper into the data, you can shape your own perspective and story for United Rentals in just a few minutes. Do it your way

A great starting point for your United Rentals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Opportunities?

Smart investing starts with finding the right ideas. Don't sit on the sidelines while others take action. The Simply Wall Street Screener sets you up with unique strategies and hidden gems you'll want to see now.

- Secure your portfolio with consistency by targeting companies offering reliable income. these 16 dividend stocks with yields > 3% delivers yields above 3%.

- Position yourself at the forefront of innovation by tapping into future-defining companies within these 26 quantum computing stocks.

- Benefit from Wall Street’s inefficiencies and uncover fresh opportunities trading below their real worth in these 886 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:URI

United Rentals

Through its subsidiaries, operates as an equipment rental company.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives