- United States

- /

- Machinery

- /

- NYSE:TTC

Toro (TTC) Margin Compression Reinforces Cautious Narrative Despite Solid Q3 Revenue Base

Reviewed by Simply Wall St

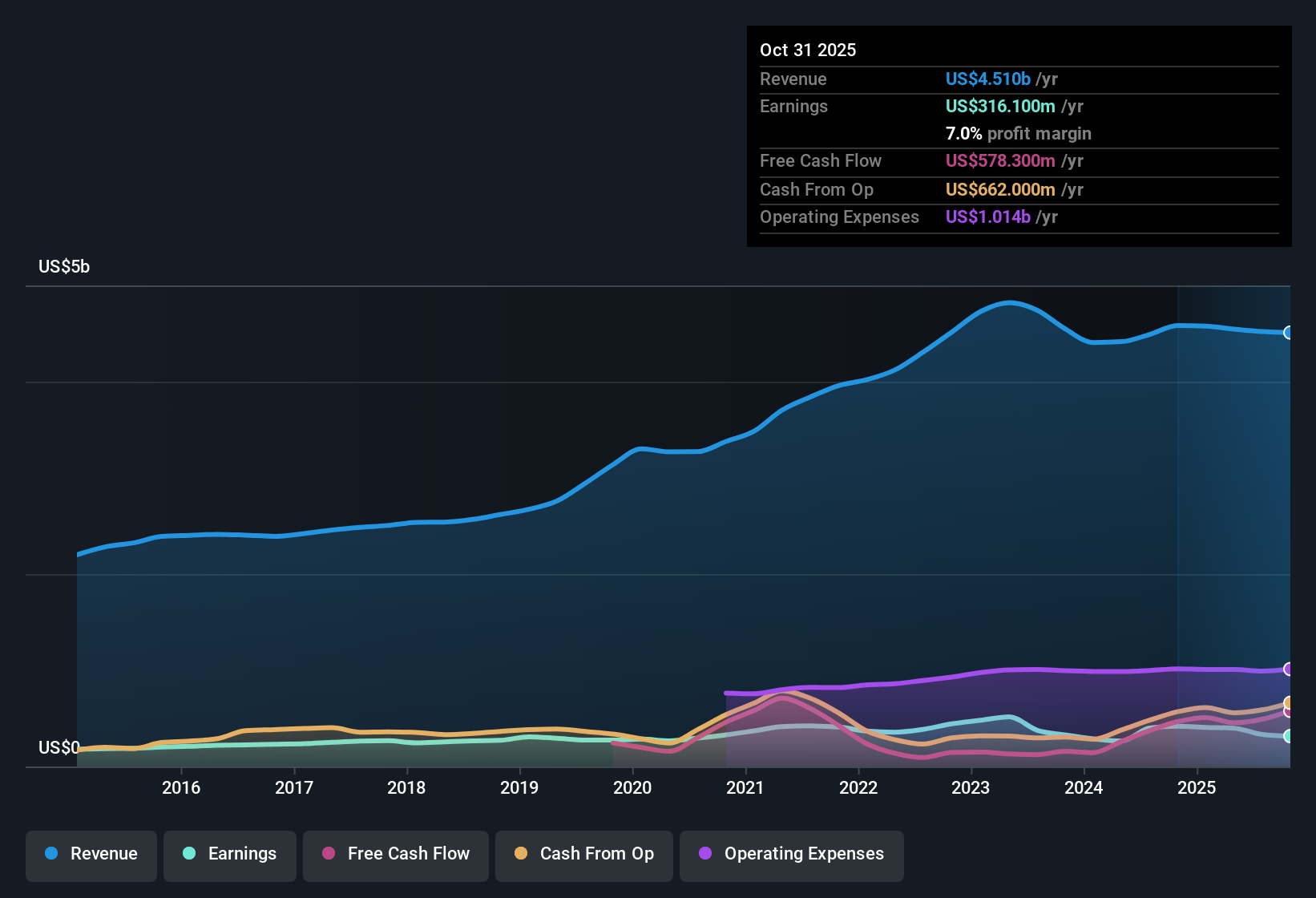

Toro (TTC) just posted its FY 2025 third quarter numbers with revenue of $1.1 billion, basic EPS of $0.54 and net income of $53.5 million, putting another data point on what has been a mixed year so far. The company has seen quarterly revenue move from $1.3 billion in Q2 2025 and $1.0 billion in Q1 2025 while EPS has ranged from $1.37 in Q2 to $0.52 in Q1. This gives investors a clear view of how profit per share is tracking through the fiscal year as they weigh the current 7.4% net margin against the stock’s longer term growth prospects. Overall, the latest print keeps the focus squarely on how efficiently Toro is converting its sales base into consistent, sustainable margins.

See our full analysis for Toro.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around Toro’s growth, risk and long term profitability trajectory.

See what the community is saying about Toro

Margins Slip From 8.9% To 7.4%

- Net margin over the last twelve months is 7.4%, down from 8.9% a year earlier, even as trailing revenue sits around $4.5 billion.

- Analysts' consensus view expects margin improvement toward 10.9% over the next three years, which contrasts with the recent step down in profitability.

- Consensus highlights automation and productivity programs targeting more than $75 million in cost savings as a route back to higher margins, while the margin data right now shows compression instead of expansion.

- The same view points to premium, smart turf and irrigation products as margin drivers, yet the decline from 8.9% to 7.4% shows that these benefits have not fully offset cost and demand pressures so far.

Slower Growth Than Market Peers

- Forecasts point to earnings growth of about 5.5% per year and revenue growth of roughly 1.9% per year, both below the broader US market expectations of 16% and 10.5% respectively.

- Bears focus on this slower growth profile, arguing that weaker residential demand and macro and weather exposure could keep Toro trailing faster growing peers.

- Residential demand has already shown pressure, including notable year over year declines and an impairment in the Spartan brand, aligning with concerns that this segment could drag on overall growth.

- The business is also heavily exposed to macro cycles and weather swings, with two years of low snowfall cited as a headwind, which fits the cautious view around the modest 1.9% revenue growth forecast.

Valuation Hints At Upside

- The stock trades at about $80.43 per share, below both the $92.20 analyst price target and a DCF fair value of roughly $93.02, while its 23.6x P E is under the broader US Machinery industry average of 25.6x.

- Bullish investors argue that steady earnings growth, a 1.94% dividend, and productivity gains can justify this valuation gap over time.

- Forecast earnings growth of about 5.5% per year, combined with expected margin expansion from 7.4% to 10.9%, is the core of the case that current pricing underestimates future profit levels.

- The consensus narrative also points to automation and electrification initiatives plus cost savings of at least $75 million as structural drivers that could support a higher multiple than the 18.7x implied on projected 2028 earnings.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Toro on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a few minutes to explore the data, sharpen your own view, and turn it into a concise narrative: Do it your way.

A great starting point for your Toro research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Toro’s slipping margins, modest revenue outlook, and exposure to macro and weather swings suggest its growth profile may stay uneven compared to faster moving peers.

If you want companies with a clearer record of compounding results through different cycles, use our stable growth stocks screener (2095 results) to quickly find steadier performers that may fit your strategy better.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTC

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion