If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So while Toro (NYSE:TTC) has a high ROCE right now, lets see what we can decipher from how returns are changing.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Toro:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = US$538m ÷ (US$3.7b - US$984m) (Based on the trailing twelve months to August 2024).

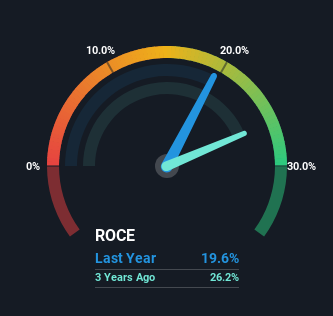

So, Toro has an ROCE of 20%. That's a fantastic return and not only that, it outpaces the average of 14% earned by companies in a similar industry.

Check out our latest analysis for Toro

Above you can see how the current ROCE for Toro compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Toro .

The Trend Of ROCE

On the surface, the trend of ROCE at Toro doesn't inspire confidence. To be more specific, while the ROCE is still high, it's fallen from 25% where it was five years ago. On the other hand, the company has been employing more capital without a corresponding improvement in sales in the last year, which could suggest these investments are longer term plays. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

The Bottom Line On Toro's ROCE

To conclude, we've found that Toro is reinvesting in the business, but returns have been falling. And with the stock having returned a mere 25% in the last five years to shareholders, you could argue that they're aware of these lackluster trends. As a result, if you're hunting for a multi-bagger, we think you'd have more luck elsewhere.

Like most companies, Toro does come with some risks, and we've found 1 warning sign that you should be aware of.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Toro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TTC

Toro

Designs, manufactures, markets, and sells professional turf maintenance equipment and services.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives