- United States

- /

- Building

- /

- NYSE:TT

Trane Technologies (TT): A Fresh Look at Valuation After Landmark NYC Retrofit and Smart Tech Launches

Reviewed by Kshitija Bhandaru

Trane Technologies has just completed a significant electrification upgrade at 55 Water Street, the largest office building in New York City. This highlights the company’s strength in delivering practical and scalable sustainability projects.

This landmark retrofit, along with recent product launches aimed at advanced building management, is drawing fresh interest to how Trane continues to innovate across energy efficiency and smart technology.

See our latest analysis for Trane Technologies.

Momentum is clearly building for Trane Technologies lately, with major projects like the 55 Water Street retrofit and new AI-powered products fueling fresh optimism about its innovation leadership. Over the past year, the total shareholder return has reached just over 10%, while the five-year total shareholder return stands out at an impressive 249%. This shows that long-term investors have been well rewarded even as the pace of gains steadies. Recent executive changes and solid quarterly results add to the confidence that Trane remains focused on both operational strength and forward-looking tech.

If Trane’s progress has you curious about broader opportunities, now’s an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Trane’s stock up significantly over the past five years and its current price trading well above some fair value estimates, investors must now ask themselves: Is there still a buying opportunity here, or has future growth already been priced in?

Most Popular Narrative: 7.4% Undervalued

Trane Technologies trades at $423.53, while the most widely followed narrative pegs fair value around $457.60. This marks a notable gap, with strong optimism built into expectations for future earnings growth and profit margins.

Trane Technologies is poised for significant growth in the Commercial HVAC segment. Strong bookings and pipeline visibility indicate sustainable revenue growth. The focus on energy efficiency and the ability to deliver attractive paybacks for customers could bolster future sales and market share, positively impacting revenue.

Want to know the growth blueprint behind this valuation? The secret lies in robust profit expansion and ambitious assumptions about future sales momentum. What drives analyst confidence this high? Dive in to see the bold projections powering this fair value call.

Result: Fair Value of $457.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in key sectors like data centers or an inability to pass on higher costs could present challenges to Trane’s current growth outlook.

Find out about the key risks to this Trane Technologies narrative.

Another View: What About Price Multiples?

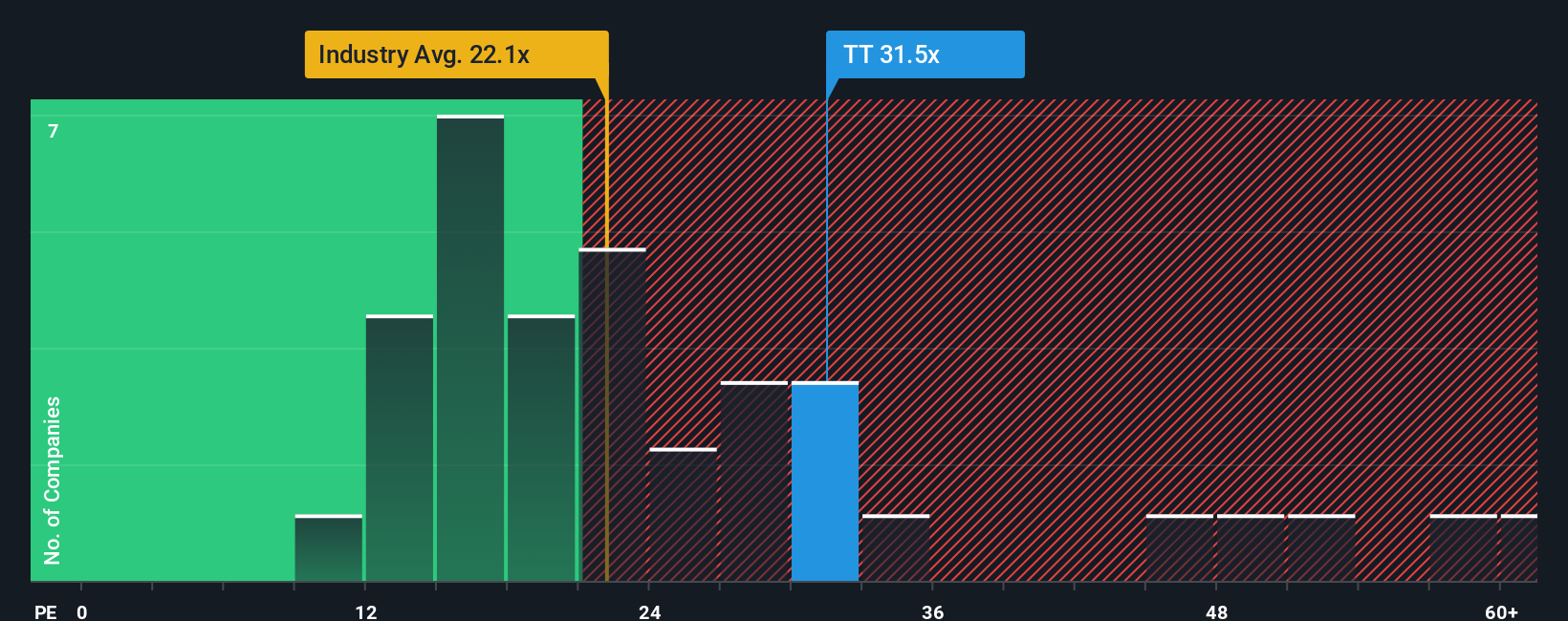

Looking beyond analyst optimism, Trane Technologies is trading at a price-to-earnings ratio of 32.8x, which stands notably higher than both its industry average of 21.8x and the peer average of 28.9x. The fair ratio, where the market could recalibrate, is estimated at just 28.6x. This sizeable premium suggests the market is willing to pay up for Trane’s growth, but it also means shares are more exposed if expectations shift. Is this a signal of long-term conviction or a risk that investors should weigh carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trane Technologies Narrative

Prefer a deeper dive, or want to see where your research leads? You can quickly craft your own take in just a few minutes with Do it your way

A great starting point for your Trane Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip past you. Broaden your portfolio with standout stocks benefiting from powerful industry trends, breakthrough tech, and solid fundamentals.

- Maximize your yield and unlock steady income by reviewing these 19 dividend stocks with yields > 3% which offers reliable returns above the market average.

- Position yourself at the forefront of innovation by exploring these 24 AI penny stocks that are transforming industries with artificial intelligence advancements.

- Catch undervalued gems with strong cash flow potential by screening through these 909 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trane Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TT

Trane Technologies

Designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, and custom and transport refrigeration.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives