- United States

- /

- Machinery

- /

- NYSE:TRN

How Trinity Industries’ (TRN) Raised 2025 EPS Guidance Reflects Management Confidence and Investment Outlook

Reviewed by Sasha Jovanovic

- On October 30, 2025, Trinity Industries raised and tightened its full-year 2025 earnings per share guidance to a range of US$1.55 to US$1.70, following the release of its third-quarter results that showed strong performance in the Railcar Leasing and Services segment and high fleet utilization rates.

- This guidance increase came despite a challenging manufacturing environment, with management citing robust lease rates, favorable secondary market conditions, and improved operational efficiencies as key contributors to the outlook.

- We will explore how Trinity's increased full-year earnings guidance underscores management's confidence and informs the company's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Trinity Industries Investment Narrative Recap

To own shares in Trinity Industries, I believe an investor needs to see the company as well-positioned to benefit from ongoing strength in railcar leasing and high utilization rates, even as its manufacturing segment faces a slow order recovery. The raised full-year EPS guidance reinforces management’s optimism, but the most significant short-term catalyst remains recurring gains in the secondary railcar market, and for now the biggest risk, continued weak demand for new railcars, has not been fundamentally altered by this update.

Among Trinity’s recent announcements, the completion of a large buyback tranche in July stands out; while not directly linked to the EPS guidance raise, it signals management’s commitment to shareholder returns at a time when capital deployment decisions could impact flexibility if market conditions shift. This activity provides useful context as investors weigh earnings catalysts against operational and industry headwinds.

In contrast, investors should pay particular attention to the possibility that a sustained contraction in new railcar orders might...

Read the full narrative on Trinity Industries (it's free!)

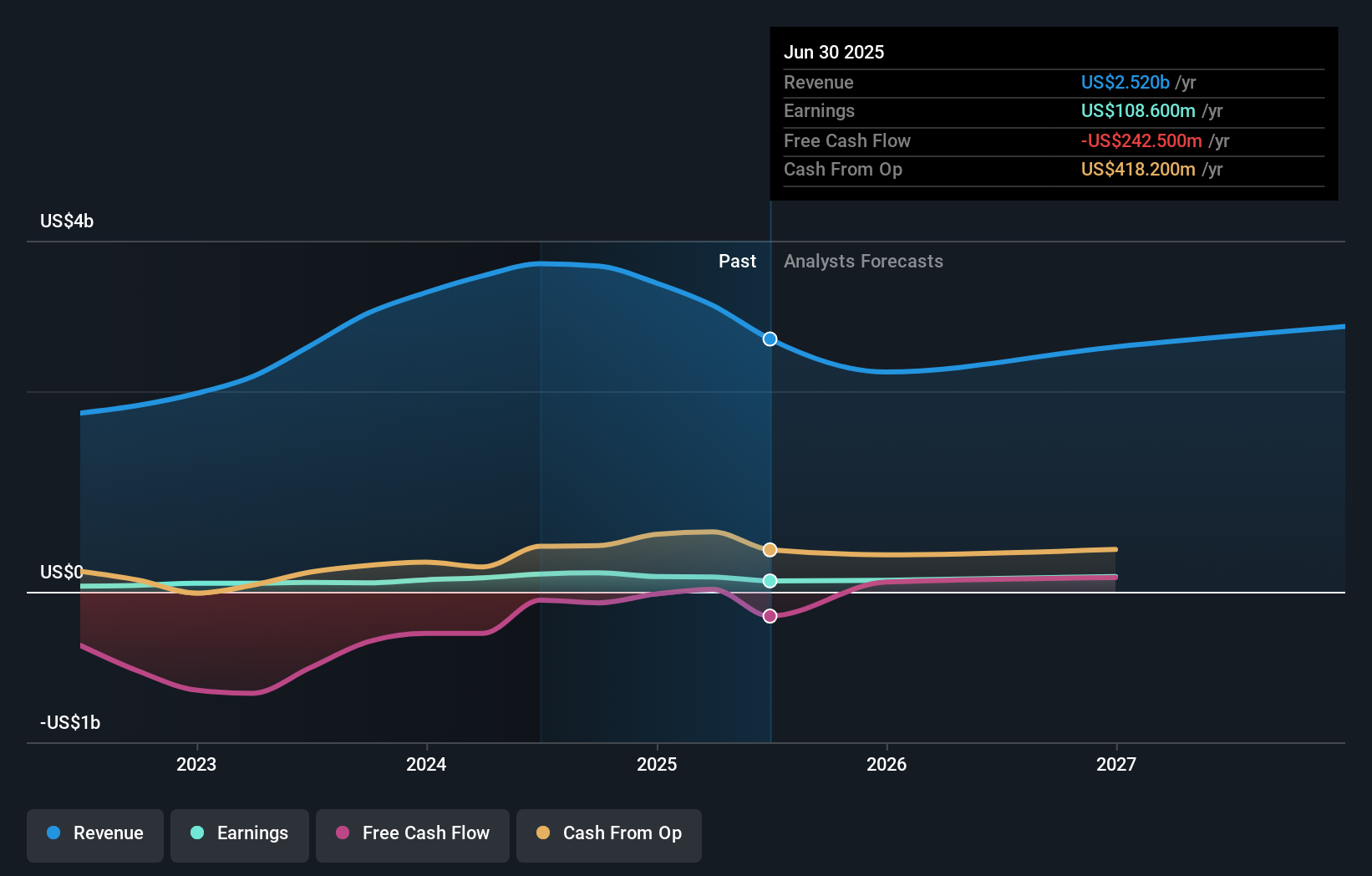

Trinity Industries' narrative projects $2.6 billion revenue and $207.4 million earnings by 2028. This requires 1.3% yearly revenue growth and a $98.8 million increase in earnings from $108.6 million currently.

Uncover how Trinity Industries' forecasts yield a $27.00 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for Trinity Industries’ fair value range widely from US$16.73 to US$27 across two members. As many market participants debate future order volumes in the North American railcar sector, be sure to consider multiple viewpoints to shape your expectations.

Explore 2 other fair value estimates on Trinity Industries - why the stock might be worth 39% less than the current price!

Build Your Own Trinity Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trinity Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Trinity Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trinity Industries' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trinity Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRN

Trinity Industries

Provides railcar products and services under the TrinityRail trade name in North America.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives