- United States

- /

- Building

- /

- NYSE:TREX

Will a New CFO Amid Revenue Declines Change Trex Company's (TREX) Strategic Direction?

Reviewed by Sasha Jovanovic

- Earlier this year, Trex Company appointed Prithvi Gandhi as its new Chief Financial Officer, a move that followed a period of challenging business conditions and declining revenue for the company.

- This leadership change suggests a possible shift in strategic direction as Trex seeks to address ongoing headwinds in its core markets and fortify its long-term positioning.

- We’ll explore how the arrival of a new CFO during a difficult year could impact Trex’s growth strategy and risk outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Trex Company Investment Narrative Recap

To be a shareholder in Trex Company today, you have to believe in the long-term shift toward sustainable, composite decking and the company’s leadership in this niche. The appointment of Prithvi Gandhi as CFO follows a tough year for Trex, but the leadership transition alone does not substantially shift the most immediate catalyst, which is upcoming earnings, nor does it materially change the biggest risk, persistent softness in the broader repair and remodel market.

Amid Trex’s recent challenges, the expansion of its partnership with International Wood Products stands out. By increasing regional distribution in Utah and the Intermountain West, Trex aims to support its channel reach, potentially reinforcing sales as the market awaits clearer signs of a rebound in residential improvement activity.

However, investors should also consider that, even as Trex strengthens its network and product offerings, the company remains heavily concentrated in decking, meaning that if demand continues to lag in this core market…

Read the full narrative on Trex Company (it's free!)

Trex Company's outlook anticipates $1.5 billion in revenue and $333.1 million in earnings by 2028. This scenario assumes annual revenue growth of 10.2% and a $146.4 million increase in earnings from the current $186.7 million level.

Uncover how Trex Company's forecasts yield a $68.41 fair value, a 38% upside to its current price.

Exploring Other Perspectives

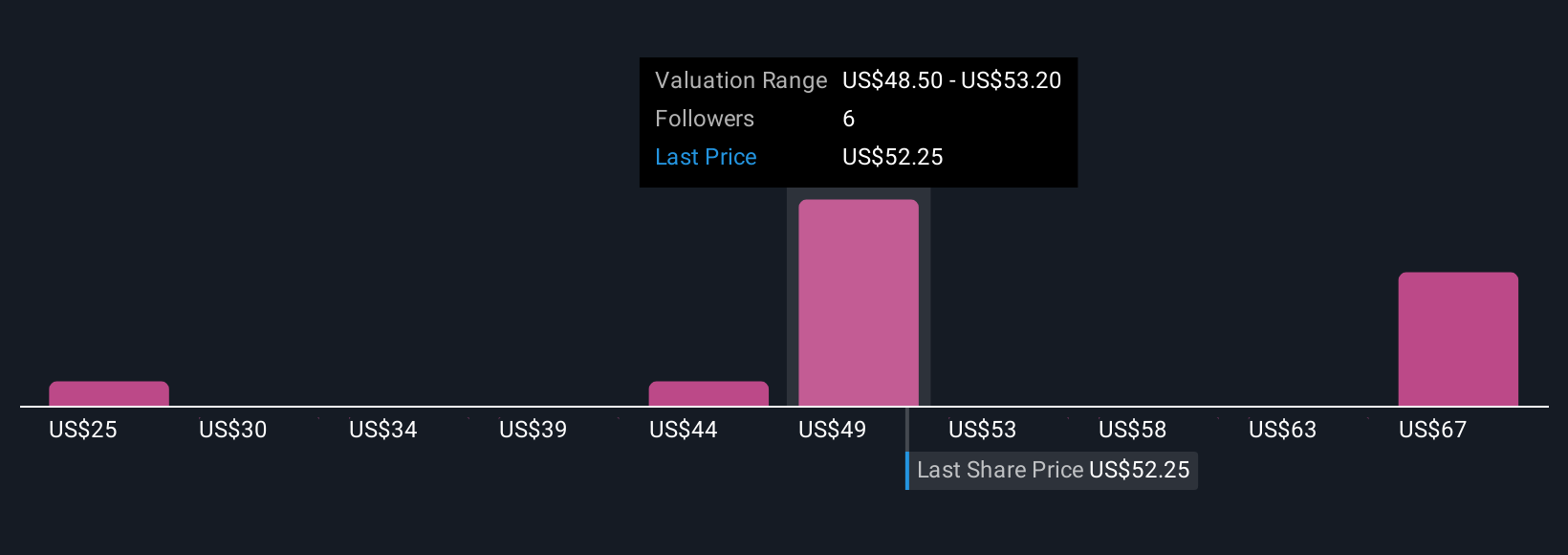

Simply Wall St Community members place Trex’s fair value between US$25 and US$68.41 based on 4 individual forecasts. While these views span a wide range, the continued risk of weaker core market demand may be top of mind for many as you compare different outlooks.

Explore 4 other fair value estimates on Trex Company - why the stock might be worth as much as 38% more than the current price!

Build Your Own Trex Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trex Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trex Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trex Company's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trex Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TREX

Trex Company

Manufactures and sells composite decking and railing products in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives