- United States

- /

- Banks

- /

- NasdaqCM:BWB

Top Growth Stocks With Insider Ownership For May 2025

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 2.2% in the last week and up 8.2% over the past year, with earnings projected to grow by 14% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 34.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.1% | 21.9% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39% |

| FTC Solar (NasdaqCM:FTCI) | 32.7% | 65.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 61.4% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.9% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

Let's explore several standout options from the results in the screener.

Bridgewater Bancshares (NasdaqCM:BWB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bridgewater Bancshares, Inc. is the bank holding company for Bridgewater Bank, offering a range of banking products and services in the United States with a market cap of $431.63 million.

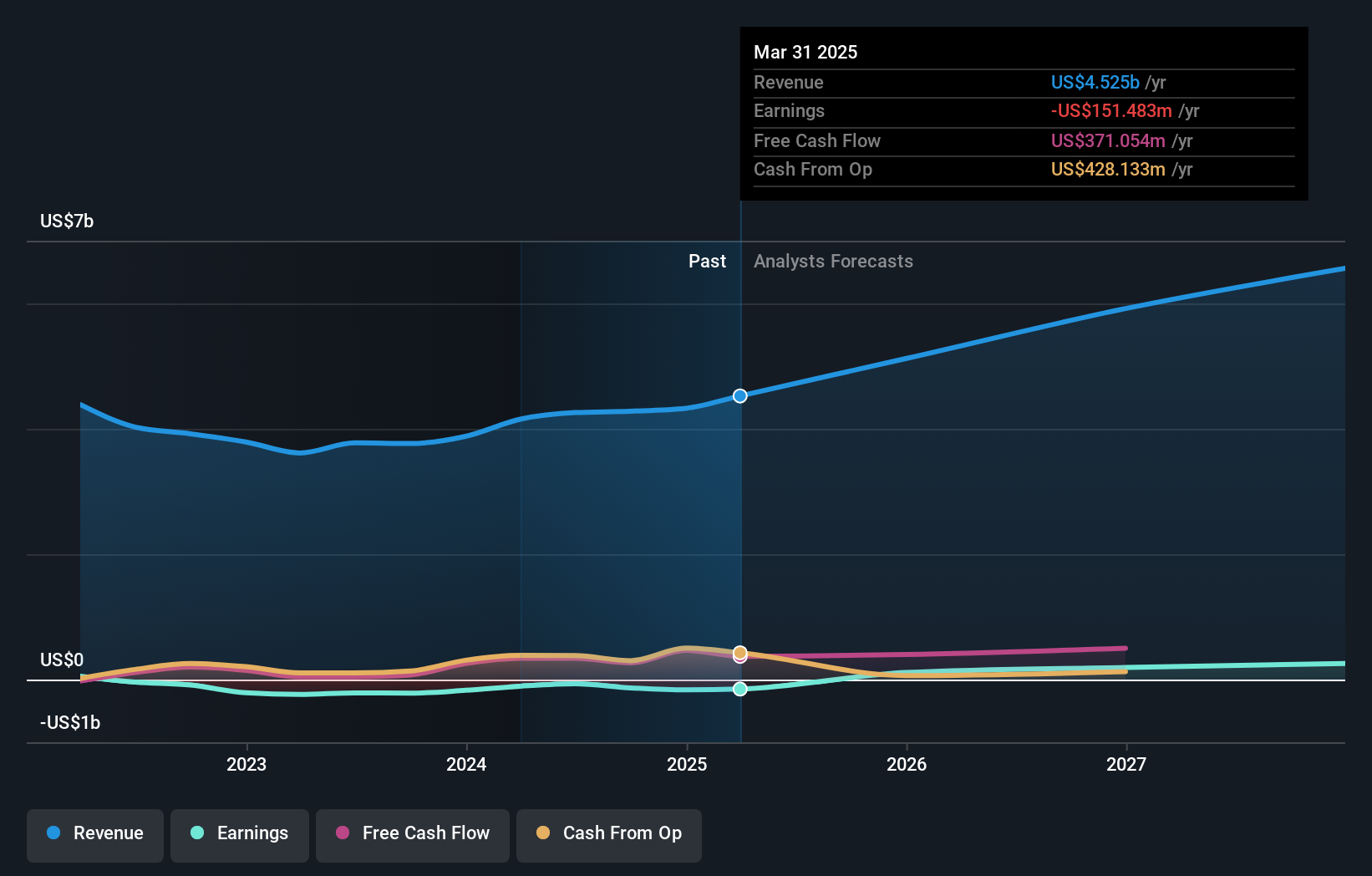

Operations: The company's revenue is primarily derived from its banking segment, which generated $111.39 million.

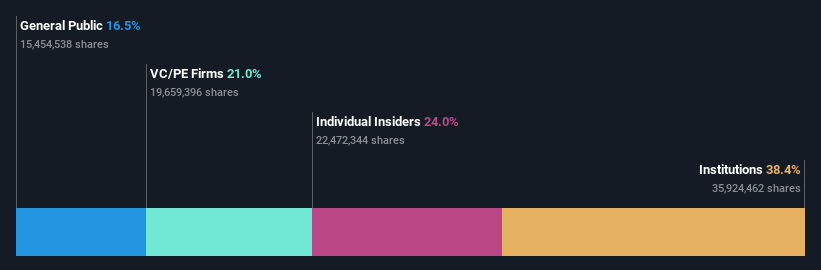

Insider Ownership: 20.5%

Earnings Growth Forecast: 22.8% p.a.

Bridgewater Bancshares is experiencing significant earnings growth, forecasted at 22.8% annually, outpacing the US market. Despite revenue growth of 15.1% per year being slower than earnings, it still surpasses the market average. The company trades at a substantial discount to its estimated fair value and recently reported strong Q1 results with net income rising to US$9.63 million from US$7.83 million a year prior, reflecting robust financial health without recent insider trading activity noted.

- Navigate through the intricacies of Bridgewater Bancshares with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Bridgewater Bancshares' share price might be on the cheaper side.

Agora (NasdaqGS:API)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and other international markets with a market cap of approximately $318.87 million.

Operations: The company's revenue is primarily derived from its Internet Telephone segment, which generated $133.26 million.

Insider Ownership: 24%

Earnings Growth Forecast: 136.4% p.a.

Agora is demonstrating strong growth potential, with earnings projected to increase significantly at 136.4% annually and revenue expected to grow faster than the US market at 13.5% per year. Although its share price has been highly volatile recently, it trades well below estimated fair value. Recent financial results show a return to profitability with net income of US$0.158 million in Q4 2024, despite a slight dip in revenue compared to the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Agora.

- In light of our recent valuation report, it seems possible that Agora is trading behind its estimated value.

Tutor Perini (NYSE:TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of approximately $1.21 billion.

Operations: Tutor Perini's revenue is derived from three main segments: Civil (Including Management Services) at $2.25 billion, Building (Including Management Services) at $1.67 billion, and Specialty Contractors at $590.82 million.

Insider Ownership: 13.6%

Earnings Growth Forecast: 87.7% p.a.

Tutor Perini is poised for growth with earnings projected to increase by 87.67% annually and revenue expected to grow faster than the broader US market at 12.2% per year. Despite recent financial challenges, including a net loss of US$79.43 million in Q4 2024, the company has secured significant contracts such as a US$3.76 billion Manhattan Jail Project and additional work on a Guam harbor project, bolstering its backlog and future prospects.

- Dive into the specifics of Tutor Perini here with our thorough growth forecast report.

- The analysis detailed in our Tutor Perini valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Click here to access our complete index of 204 Fast Growing US Companies With High Insider Ownership.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Bridgewater Bancshares, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bridgewater Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BWB

Bridgewater Bancshares

Operates as the bank holding company for Bridgewater Bank that provides banking products and services in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives