- United States

- /

- Construction

- /

- NYSE:TPC

Should Upgraded Earnings Estimates And Valuation Re-Rating Require Action From Tutor Perini (TPC) Investors?

Reviewed by Sasha Jovanovic

- In recent weeks, Tutor Perini has drawn increased attention on Zacks.com, earning a Zacks Rank #2 rating after analysts raised earnings estimates on the back of results that exceeded consensus and solid revenue growth.

- What stands out is that these improved earnings expectations are occurring while the company is still viewed as attractively valued relative to many construction peers, suggesting analysts see room for further fundamental improvement rather than just a short-term rebound.

- Next, we will examine how this wave of positive earnings estimate revisions may influence Tutor Perini’s existing long-term investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Tutor Perini Investment Narrative Recap

To own Tutor Perini, you need to believe the company can turn its large, complex project pipeline into more consistent profitability while keeping legacy contract risks contained. The recent Zacks Rank upgrade, driven by stronger earnings estimates and revenue beats, supports the near term catalyst of improved earnings visibility, but does little to reduce the key risk that new mega projects could still introduce fresh cost overruns and litigation exposure.

Among recent announcements, the Q3 2025 results are most relevant here, with revenue and earnings both improving versus last year and beating expectations. That operational progress aligns with analysts raising forecasts, but it does not fully resolve concerns about execution risk on the next wave of large public projects that will drive results over the coming years.

Yet behind the improved earnings outlook, investors should still be aware of how concentrated exposure to a few mega projects could...

Read the full narrative on Tutor Perini (it's free!)

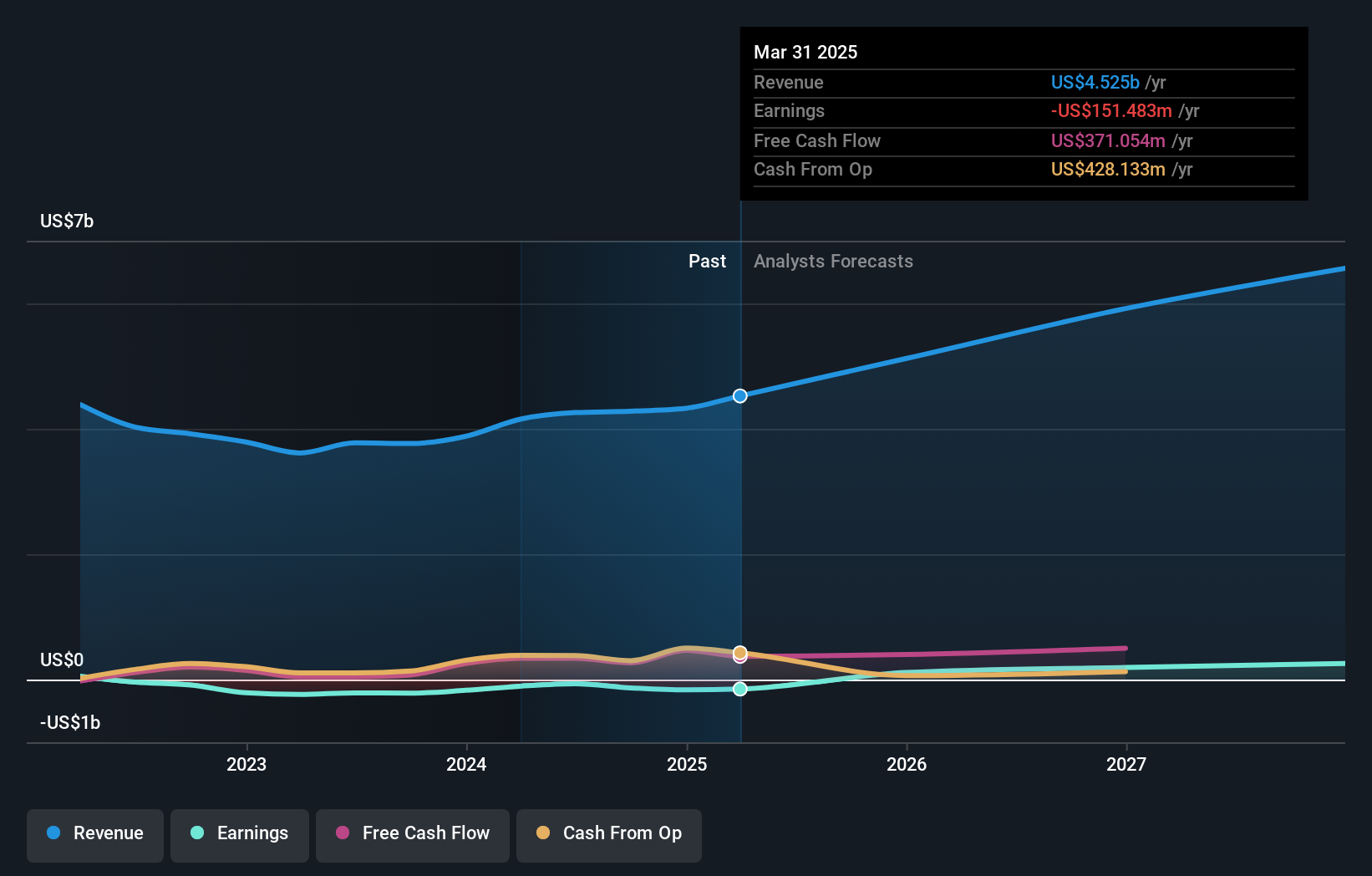

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028. This requires 14.2% yearly revenue growth and a $648.2 million earnings increase from -$132.3 million today.

Uncover how Tutor Perini's forecasts yield a $89.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place Tutor Perini’s fair value between US$67 and US$89 per share, highlighting wide individual judgment. You should weigh these views against the execution risks tied to future mega projects, which could heavily influence how the business ultimately performs.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth just $67.00!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026