- United States

- /

- Construction

- /

- NYSE:TPC

Should Passaic Valley Project Win and Rising Backlog Spur New Optimism for Tutor Perini (TPC) Investors?

Reviewed by Sasha Jovanovic

- Five Star Electric, a subsidiary of Tutor Perini Corporation, has been awarded an electrical subcontract by Skanska/Railroad SPGF JV for a resiliency project constructing an emergency backup power system at the Passaic Valley Sewerage Commission’s Newark facility, with substantial completion expected by late 2027 and the contract value added to Tutor Perini’s backlog in the third quarter of 2025.

- This major infrastructure award arrives alongside heightened investor anticipation for Tutor Perini’s upcoming earnings, which are projected to show a very large year-over-year increase according to analyst estimates.

- We’ll now examine how the significant new backlog addition from the Passaic Valley project impacts Tutor Perini’s long-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tutor Perini Investment Narrative Recap

For shareholders of Tutor Perini, the investment thesis centers on the company's ability to capitalize on a record-high backlog and a robust pipeline for large-scale infrastructure work. The recent Passaic Valley Sewerage Commission award expands the backlog even further, strengthening near-term revenue visibility, but does not fundamentally change the most important short-term catalyst, strong earnings growth driven by project execution. However, the biggest risk remains the company's exposure to cost overruns or execution missteps on these new mega-projects. The most relevant recent announcement is the Midtown Bus Terminal Redevelopment Program contract, valued at US$1.87 billion and set to begin in late 2025. Like the Passaic Valley Sewer project, this award underscores the company's strategic focus on high-value transit and public infrastructure work, further intensifying attention on Tutor Perini’s ability to consistently execute major contracts without repeating past issues with fixed-price or complex projects. Yet, while these large project wins bolster growth visibility, investors should also consider the possible downside if setbacks from cost overruns or litigation arise...

Read the full narrative on Tutor Perini (it's free!)

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028. This requires 14.2% yearly revenue growth and a $648.2 million increase in earnings from the current level of -$132.3 million.

Uncover how Tutor Perini's forecasts yield a $75.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

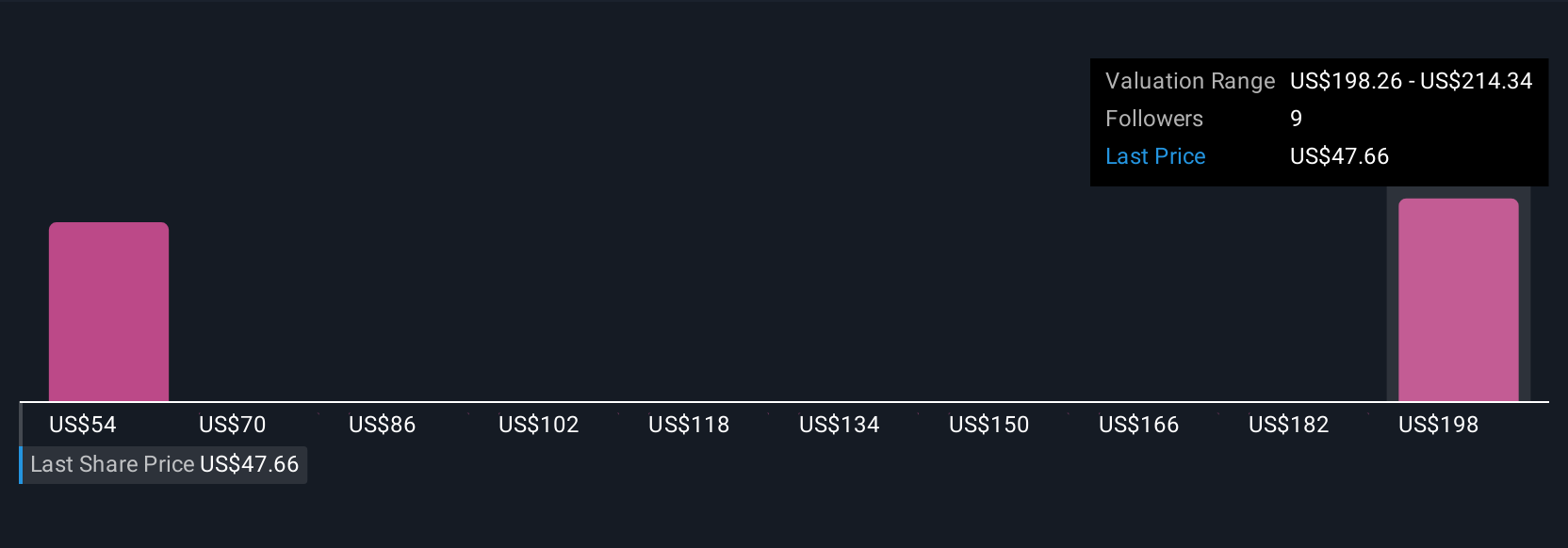

Four members of the Simply Wall St Community put Tutor Perini’s fair value between US$67 and US$149.88 per share. These wide-ranging views reflect ongoing debate about risks tied to fixed-price mega-projects and support a closer look at divergent outlooks before making portfolio decisions.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth over 2x more than the current price!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tutor Perini might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPC

Tutor Perini

A construction company, provides diversified general contracting, construction management, and design-build services to private customers and public agencies worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives