- United States

- /

- Mortgage REITs

- /

- NYSE:EFC

Heritage Financial And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a turbulent period marked by significant fluctuations in major indices and shifting expectations around Federal Reserve interest rate decisions, investors are increasingly seeking opportunities to capitalize on undervalued stocks. In such an environment, identifying stocks that may be trading below their estimated value can offer potential for growth, especially when broader market sentiments are influenced by concerns over AI spending and tech valuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.33 | $62.85 | 48.6% |

| Northwest Bancshares (NWBI) | $11.30 | $22.10 | 48.9% |

| Mobileye Global (MBLY) | $10.77 | $20.98 | 48.7% |

| Li Auto (LI) | $17.65 | $34.84 | 49.3% |

| Horizon Bancorp (HBNC) | $15.72 | $30.82 | 49% |

| Hasbro (HAS) | $76.76 | $150.45 | 49% |

| Griffon (GFF) | $68.00 | $133.45 | 49% |

| First Solar (FSLR) | $245.84 | $480.58 | 48.8% |

| Crocs (CROX) | $78.51 | $156.32 | 49.8% |

| BCB Bancorp (BCBP) | $7.53 | $14.65 | 48.6% |

Underneath we present a selection of stocks filtered out by our screen.

Heritage Financial (HFWA)

Overview: Heritage Financial Corporation, with a market cap of $754.18 million, operates as the bank holding company for Heritage Bank, offering a range of financial services to small and medium-sized businesses and individuals in the United States.

Operations: Heritage Bank's revenue is primarily derived from its Commercial Banking segment, which generated $232.88 million.

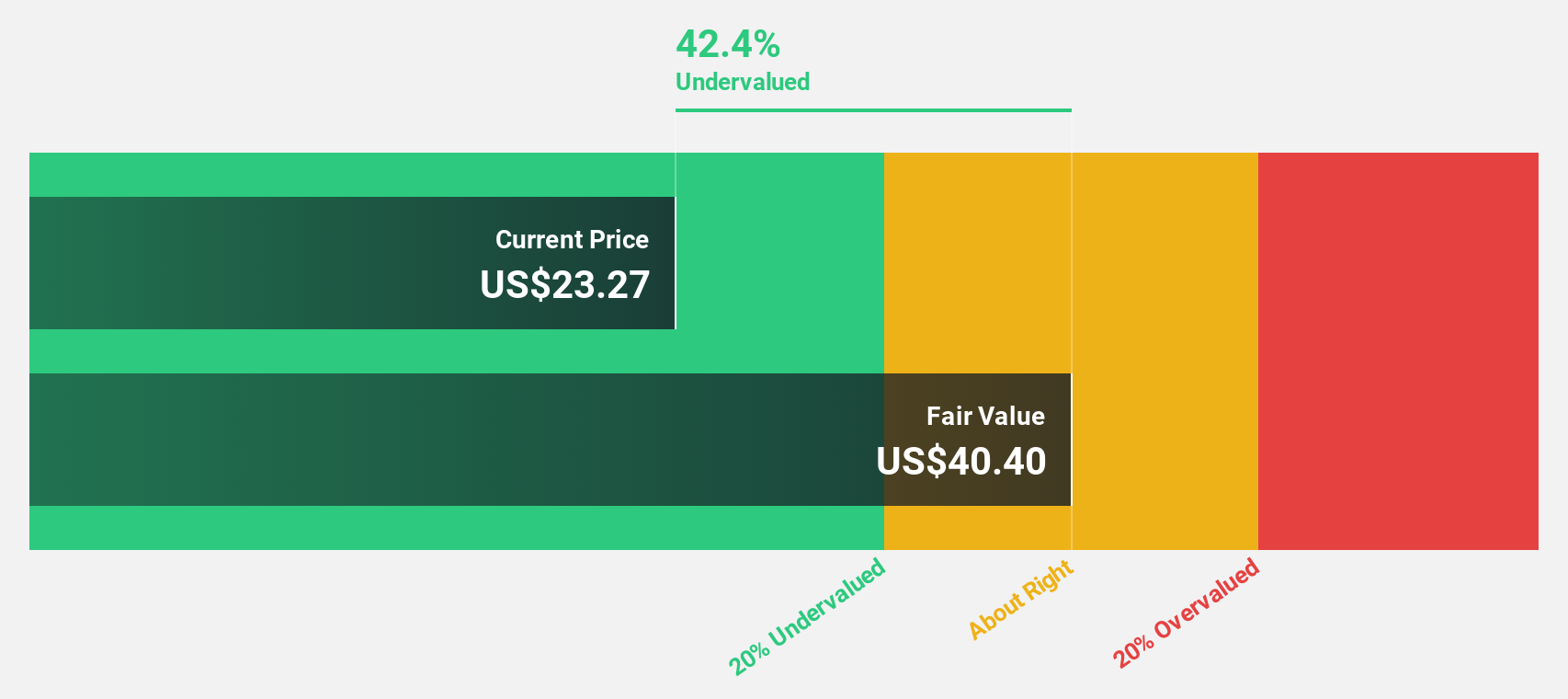

Estimated Discount To Fair Value: 44.7%

Heritage Financial's recent earnings report shows strong growth, with net income rising to US$19.17 million from US$11.42 million year-over-year for Q3 2025. The company is trading at a significant discount, approximately 44.7% below its estimated fair value of US$40.4 per share, based on discounted cash flow analysis. Despite an unstable dividend history, its earnings are forecasted to grow significantly over the next three years, outpacing the broader U.S. market growth expectations.

- In light of our recent growth report, it seems possible that Heritage Financial's financial performance will exceed current levels.

- Dive into the specifics of Heritage Financial here with our thorough financial health report.

Ellington Financial (EFC)

Overview: Ellington Financial Inc., operating through its subsidiary Ellington Financial Operating Partnership LLC, focuses on acquiring and managing a diverse portfolio of mortgage-related, consumer-related, corporate-related, and other financial assets in the United States, with a market cap of approximately $1.48 billion.

Operations: The company's revenue segments include $187.52 million from Longbridge and $165.64 million from its Investment Portfolio.

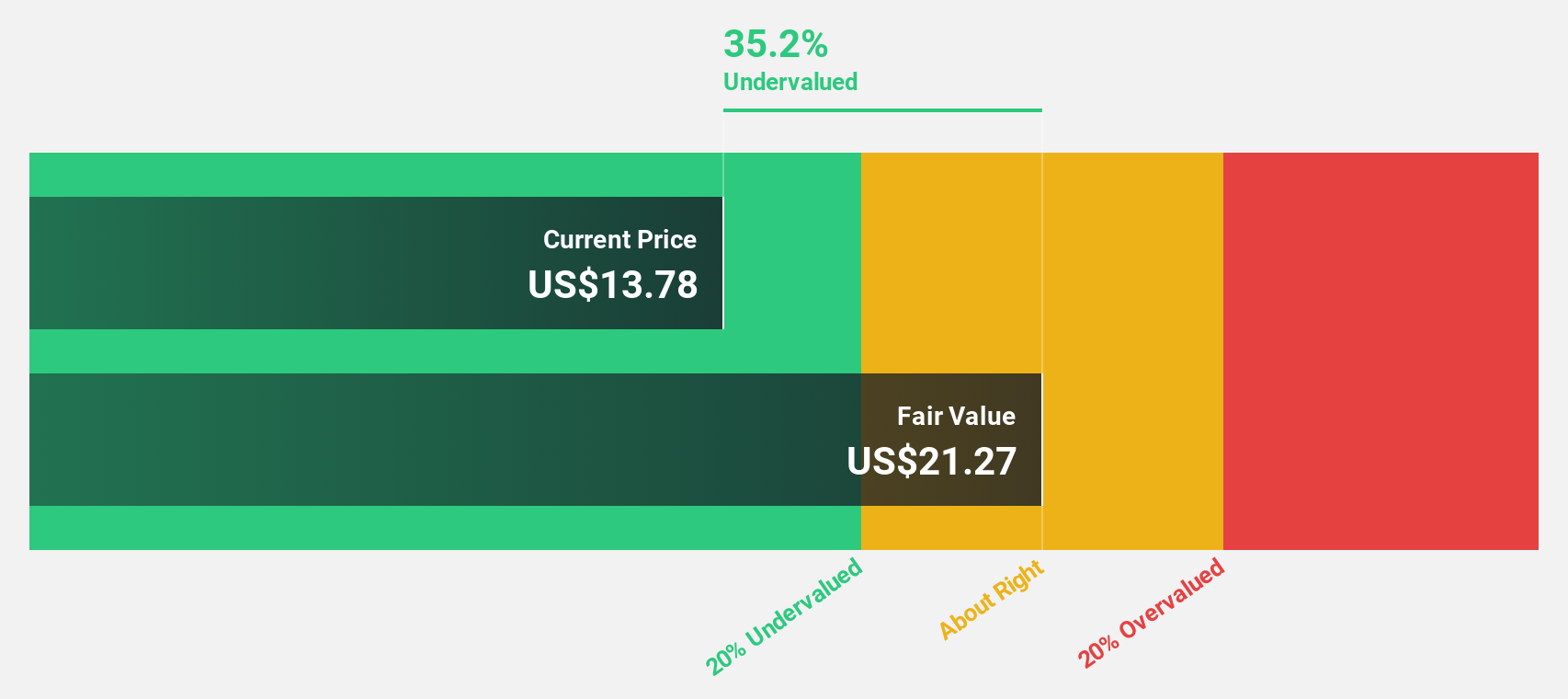

Estimated Discount To Fair Value: 35.8%

Ellington Financial's recent earnings report highlights a net income of US$36.58 million for Q3 2025, with its stock trading over 20% below fair value estimates of US$21.27 per share. Despite being undervalued based on discounted cash flow analysis, the company's debt coverage by operating cash flow is weak, and dividends are not well supported by earnings or free cash flows. Earnings are expected to grow significantly over the next three years, surpassing U.S. market growth forecasts.

- Our expertly prepared growth report on Ellington Financial implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Ellington Financial's balance sheet by reading our health report here.

Tutor Perini (TPC)

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of $3.17 billion.

Operations: The company's revenue segments include Civil (Including Management Services) at $2.86 billion, Building (Including Management Services) at $1.77 billion, and Specialty Contractors at $742.35 million.

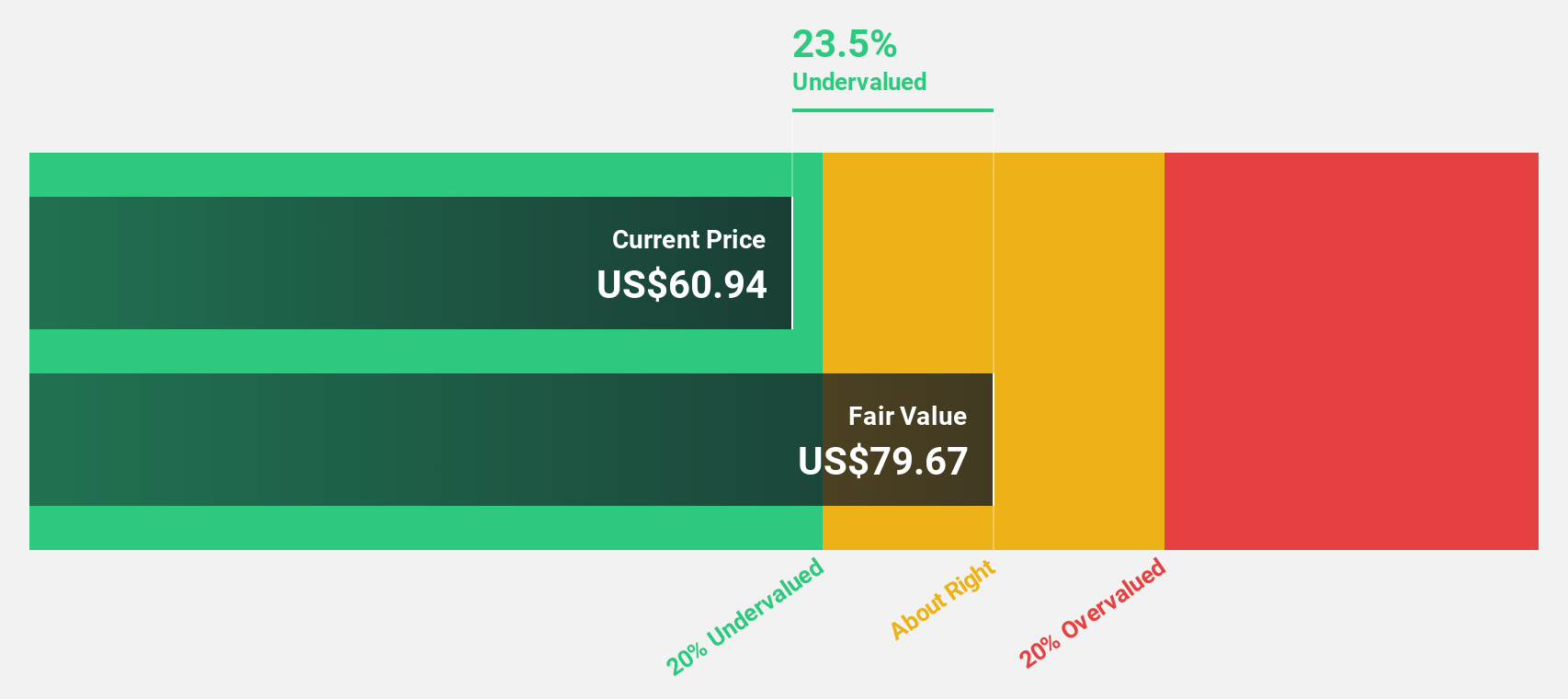

Estimated Discount To Fair Value: 24.8%

Tutor Perini's recent financial results show a net income of US$3.63 million for Q3 2025, reversing a prior year's loss, and revenues increased to US$1.42 billion. The stock is trading over 20% below its estimated fair value of US$79.48 per share, indicating it may be undervalued based on discounted cash flow analysis. A new dividend and a US$200 million buyback program have been announced, potentially enhancing shareholder value amidst expected profitable growth in the next three years.

- The growth report we've compiled suggests that Tutor Perini's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Tutor Perini.

Where To Now?

- Embark on your investment journey to our 215 Undervalued US Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ellington Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EFC

Ellington Financial

Through its subsidiary, Ellington Financial Operating Partnership LLC, acquires and manages mortgage-related, consumer-related, corporate-related, and other financial assets in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives