- United States

- /

- Building

- /

- NYSE:TGLS

Can Tecnoglass Rebound After Its 16% Pullback in 2025?

Reviewed by Bailey Pemberton

Have you caught yourself eyeing Tecnoglass lately, unsure whether it is time to buy, hold, or just watch from the sidelines? You are definitely not alone. Over the past several years, Tecnoglass has treated long-term investors to jaw-dropping gains, climbing an incredible 1,018% across five years and posting 217.2% returns in just three. But the road has had some bumps. In the last year, Tecnoglass shares dipped 3.5%, and more recently the price slid 16.1% year-to-date, including a 2.7% drop over the last week. Those moves have some investors questioning whether the growth narrative is still intact, or whether the market is starting to view risk a little differently.

Amid these swings, the overall story stays compelling. Tecnoglass currently sports a valuation score of 4 out of 6, meaning it looks undervalued by four separate measures. That kind of score is rare, especially for a company that can point to years of explosive performance. So, how do we actually judge what Tecnoglass is worth, and where it might be headed from here?

In the next section, we will dig into the valuation checks behind that score, exploring different methods investors use to gauge whether a stock really is a bargain. And, if you stick around to the end, there is another angle on valuation that many investors overlook, which could give you the best read on Tecnoglass’s real potential.

Why Tecnoglass is lagging behind its peers

Approach 1: Tecnoglass Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to the present. This offers a clear look at what those future earnings are worth in today’s dollars.

Tecnoglass's DCF calculation uses a 2 Stage Free Cash Flow to Equity approach. As of the latest data, Tecnoglass has reported $70.27 million in Free Cash Flow (FCF) over the last twelve months. Analysts have projected steady growth in FCF, expecting it to reach $199 million by 2029. For years beyond the analyst horizon, Simply Wall St extrapolates FCF and continues a gradual increase out to 2035.

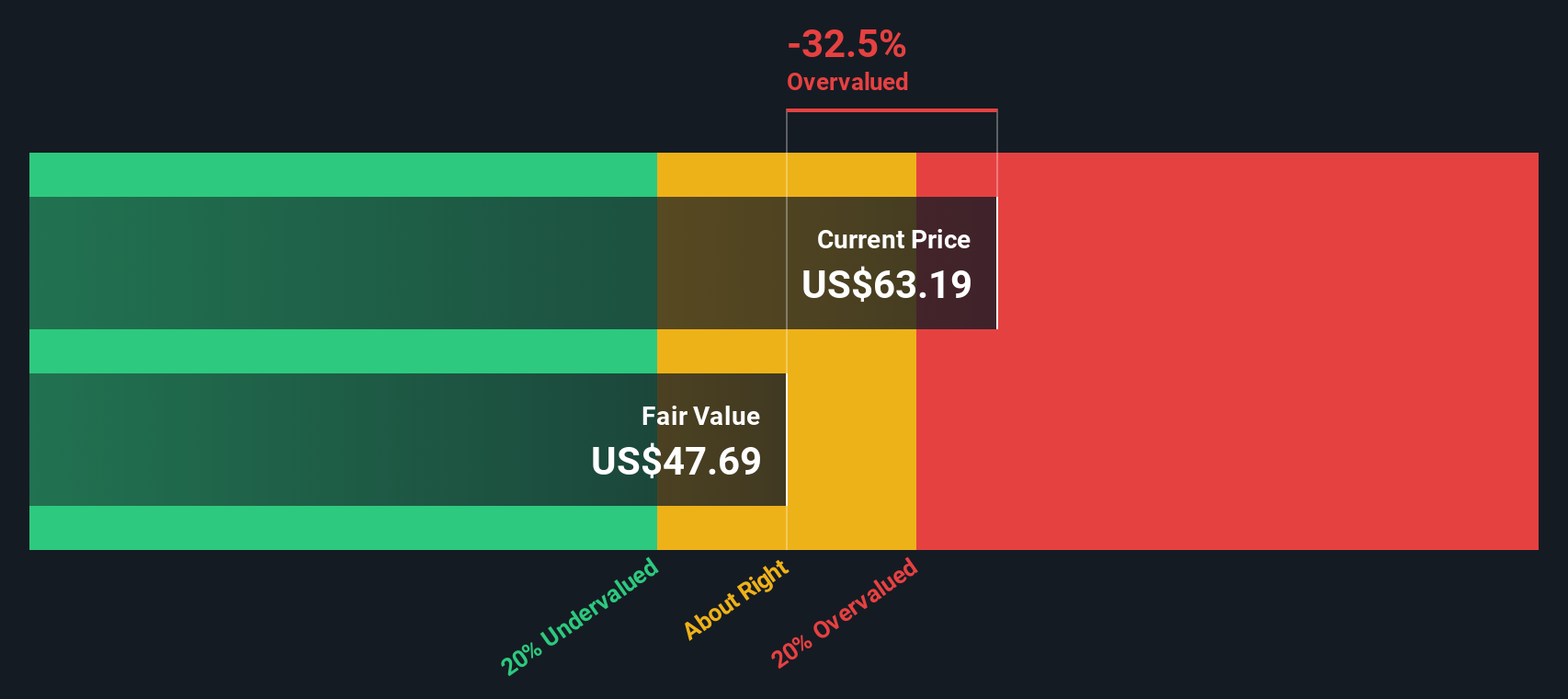

Bringing together all these projections and discounting them with reasonable assumptions, the DCF model arrives at an estimated intrinsic value of $47.57 per share. That sounds appealing, but there is a critical catch: Tecnoglass's current share price is trading 39.1% above this valuation, making the stock look overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tecnoglass may be overvalued by 39.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tecnoglass Price vs Earnings

For profitable companies like Tecnoglass, the Price-to-Earnings (PE) ratio is a time-tested way to gauge whether shares offer good value. The PE ratio gives investors a quick snapshot of how much they are paying for each dollar of reported profit, providing a practical shortcut for judging growth versus risk.

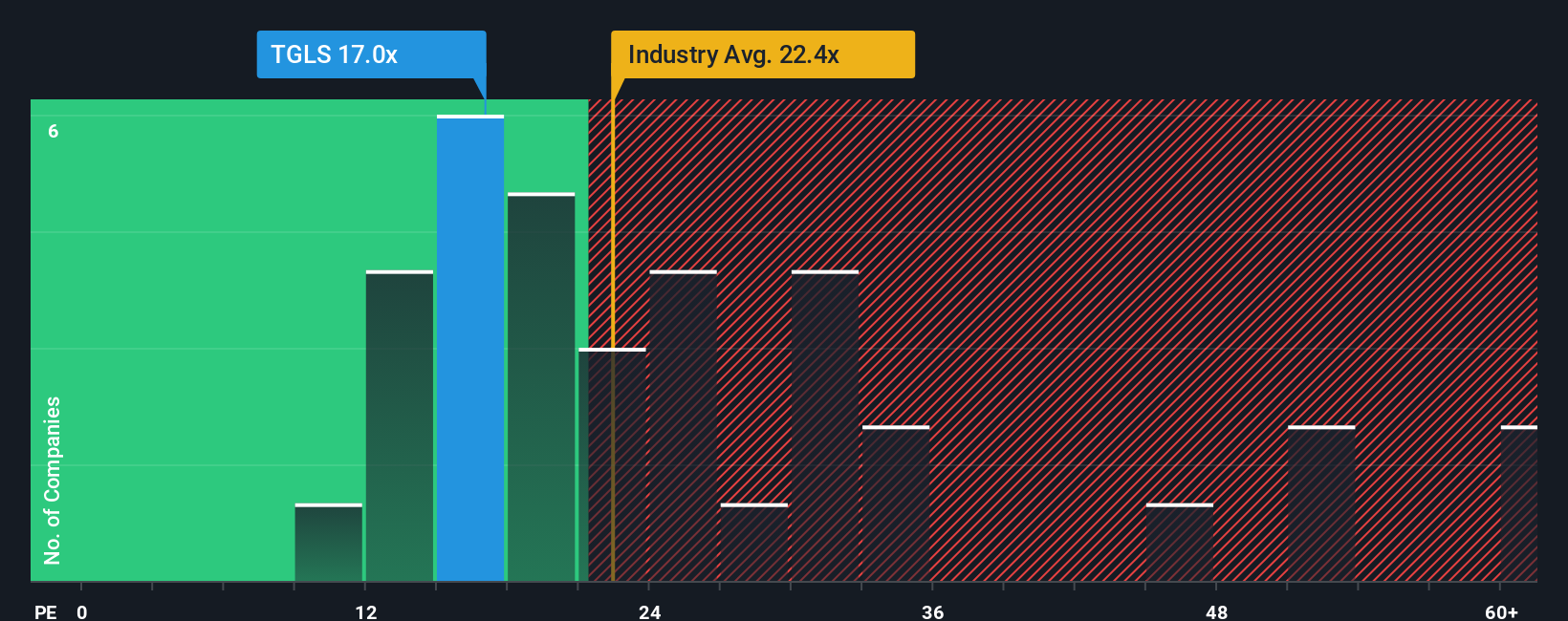

Growth expectations and risk levels play a big role in what a “normal” or “fair” PE ratio should be. Faster-growing, lower-risk companies typically deserve a higher PE, while slower or riskier firms trade at a discount. Tecnoglass is currently trading at a PE of 17x. That is noticeably lower than the building industry average of 22.4x, and even further below the peer average of 30x. This suggests the stock is priced more conservatively than much of its sector.

This is where Simply Wall St’s “Fair Ratio” comes in. Rather than just looking at generic averages, the Fair Ratio crunches the numbers based on Tecnoglass’s unique profile. The calculation factors in not just growth rates, but also profit margins, industry nuances, market cap, and specific company risks. For Tecnoglass, the Fair Ratio is 22.7x, which is above its current 17x PE and provides a clearer context than simply comparing to peers or industry averages.

When Tecnoglass’s actual PE is lined up with the Fair Ratio, the stock appears undervalued on this measure. Its PE is well below what would typically be justified by its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tecnoglass Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, pairing your personal perspective on Tecnoglass’s strengths, weak points, and future prospects with what you believe are reasonable estimates for its revenue, earnings, margins, and ultimately, fair value.

By linking a company’s big-picture story to concrete financial forecasts, Narratives let you connect the “why” behind your expectations with the “how much is it really worth?” They are designed to be intuitive and accessible, and are available to all investors (including millions globally) on Simply Wall St’s Community page.

Narratives help you decide when to buy or sell by continually comparing your estimated Fair Value to the current share price, so you can see right away if your outlook suggests opportunity or caution. Even better, Narratives automatically refresh whenever new information such as company announcements or earnings reports hits the market, ensuring your view stays up to date.

For Tecnoglass, some investors see huge upside and might target a fair value as high as $100 if they expect U.S. expansion and energy-efficient products will keep driving profits. More cautious investors have set that number closer to $84 based on risks around input costs and industry changes.

Do you think there's more to the story for Tecnoglass? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tecnoglass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TGLS

Tecnoglass

Manufactures, supplies, and installs architectural glass, windows, and associated aluminum and vinyl products for commercial and residential construction markets in Colombia, the United States, Panama, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives