- United States

- /

- Machinery

- /

- NYSE:TEX

Terex (TEX): A Fresh Look at Valuation as Q3 Earnings Optimism Lifts Market Sentiment

Reviewed by Simply Wall St

Terex (NYSE:TEX) shares got a lift as third-quarter earnings kicked off. Investors responded positively to companies across the S&P 500 beating expectations, with broader optimism about global economic and political trends fueling the move.

See our latest analysis for Terex.

Terex has enjoyed a surge in momentum, with the stock posting a 9.6% one-month share price return and a strong 27.6% gain so far this year as investors responded to sector-wide earnings optimism and anticipation around the company's upcoming results. Over the longer term, Terex’s 5-year total shareholder return stands at an impressive 144%, underscoring the company’s ability to reward patient investors through periods of shifting sentiment and steady business progress.

If Terex’s run has sparked your curiosity about wider opportunities, now is the perfect moment to broaden your perspective and check out fast growing stocks with high insider ownership

With Terex at the center of this wave of optimism, the real question now is whether the stock’s current momentum signals further upside for investors, or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 2.9% Overvalued

With Terex's fair value from this widely followed narrative now at $55.20, the recent closing price of $56.82 sits just above that mark, signaling that the current rally may have pushed shares slightly beyond what analysts consider justified. This sets the context for a closer look at the assumptions shaping that viewpoint.

The sustained increase in global infrastructure and manufacturing investment, supported by recent policy incentives such as enhanced bonus depreciation and significant federal construction allocations, is driving multi-year demand for Terex's construction, utility, and materials processing equipment. This is positioning the company for steady revenue growth as both U.S. and international markets upgrade infrastructure and manufacturing capacity.

Curious what record-setting forecasts are baked into this price target? Want to know the surprisingly optimistic earnings trajectory that underpins the fair value? There is a bold outlook inside these numbers that could change your view on Terex’s future, but the real catalyst might catch you off guard.

Result: Fair Value of $55.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or weaker construction demand could undermine Terex’s revenue visibility. These factors could act as catalysts for a narrative shift ahead.

Find out about the key risks to this Terex narrative.

Another View: What Does the SWS DCF Model Say?

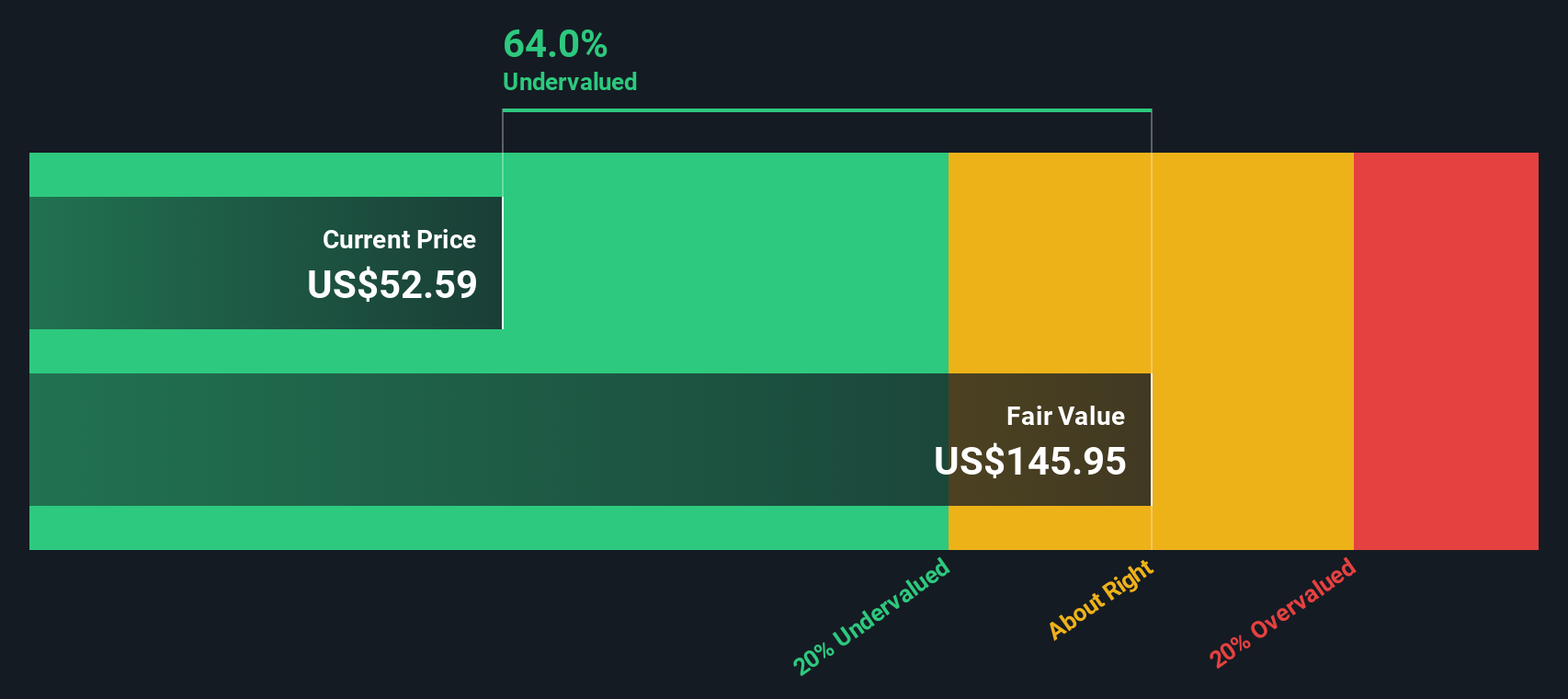

While analysts see Terex trading just above fair value, the SWS DCF model offers a starkly different perspective. According to this approach, Terex shares are trading at a 36% discount to fair value, with an estimated intrinsic value of $89.18 per share. This suggests the market may be underestimating Terex’s long-term cash flow potential in spite of recent run-ups. Which approach better captures where Terex is heading?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Terex for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Terex Narrative

If you want to test your own assumptions or take a closer look at the data, you can quickly map out your own view in just a few minutes using Do it your way.

A great starting point for your Terex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Markets move fast and so do the smartest investors. Don’t let great opportunities slip by. Use the tools below to spot companies positioned for the next big growth stories.

- Tap into next-generation breakthroughs by checking out these 27 AI penny stocks making headlines in artificial intelligence, automation, and smart technologies.

- Boost your income with these 17 dividend stocks with yields > 3% offering attractive yields and a history of solid, reliable payouts, even in unpredictable markets.

- Ride the momentum of digital innovation by seizing these 80 cryptocurrency and blockchain stocks capturing the waves of blockchain adoption and emerging financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEX

Terex

Provides materials processing machinery and mobile elevating work platform worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives