- United States

- /

- Machinery

- /

- NYSE:TEX

Analyst Optimism and Digital Innovation Could Be a Game Changer for Terex (TEX)

Reviewed by Sasha Jovanovic

- Terex Corporation recently presented at the 18th Annual New York Global Innovation Summit at The Yale Club, with Senior VP & Chief Digital Officer David Jutcawitz as a featured speaker.

- This event coincided with renewed analyst confidence in Terex, linking improved business mix and sector momentum to an enhanced earnings outlook.

- We'll examine how analyst optimism, supported by trends in digital innovation and heavy equipment demand, could affect Terex's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Terex Investment Narrative Recap

To be a Terex shareholder today, you need to believe in a sustained cycle of infrastructure and manufacturing investment that keeps driving heavy equipment demand, even as macro and cyclical risks remain present. The recent analyst optimism following Terex’s innovation summit highlights confidence in the company’s improved business mix and digital strategy, but persistent high interest rates and delayed equipment purchases by core customers remain critical short-term risks. The conference event itself encourages optimism but hasn’t changed these fundamental catalysts or risks in a material way.

Most relevant to recent developments, Terex’s latest earnings announcement showed stable revenue growth but lower year-on-year profit margins, reinforcing how tariff-related inflation and changes in customer mix continue to challenge operating leverage. This keeps the spotlight firmly on Terex’s ability to balance robust order flow, supported by policy tailwinds, against margin pressures as equipment pricing, costs, and end-market demand fluctuate.

In contrast, while some segments show resilience and backlog growth, investors should be aware that margin compression remains a risk if...

Read the full narrative on Terex (it's free!)

Terex's narrative projects $6.1 billion in revenue and $525.7 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $346.7 million increase in earnings from $179.0 million today.

Uncover how Terex's forecasts yield a $59.70 fair value, a 30% upside to its current price.

Exploring Other Perspectives

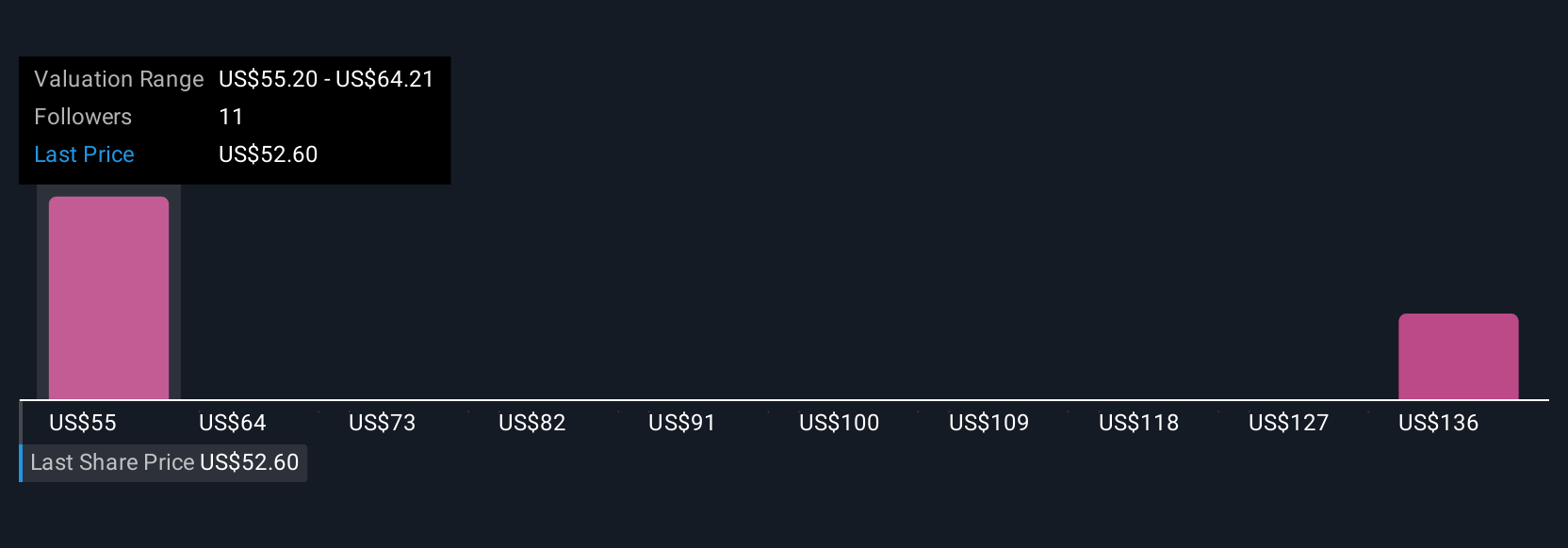

Four members of the Simply Wall St Community estimate Terex’s fair value between US$51.89 and US$91.44 per share. While community valuations span a wide range, many are watching the effect of tariff-related cost pressures on margins as a signpost for future performance, making it essential to consider how varied outlooks may affect your own view.

Explore 4 other fair value estimates on Terex - why the stock might be worth just $51.89!

Build Your Own Terex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Terex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Terex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Terex's overall financial health at a glance.

No Opportunity In Terex?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Terex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEX

Terex

Provides materials processing machinery and mobile elevating work platform worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives