- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

TransDigm Group (TDG): Evaluating Valuation Following Strong Quarterly Growth and Upbeat 2026 Outlook

Reviewed by Simply Wall St

TransDigm Group's recent quarterly report revealed solid growth in sales and net income, driven by strong aftermarket performance and prudent capital allocation. The company followed this with an encouraging fiscal 2026 outlook, highlighting expected revenue gains.

See our latest analysis for TransDigm Group.

TransDigm Group has continued to reward patient shareholders. Its robust aftermarket gains and deft share buybacks have helped the stock notch a 15.7% total return over the last year. Recent results and upbeat guidance have added to an already impressive long-term record, and the company’s momentum suggests investors remain optimistic about its growth potential.

Inspired by TransDigm’s ongoing strength, now is a great time to expand your watchlist and discover See the full list for free.

With a strong run behind it and analysts boosting their targets, the big question for investors now is whether TransDigm remains undervalued or if the market has already priced in the next phase of its growth trajectory.

Most Popular Narrative: 13.2% Undervalued

TransDigm Group's latest narrative fair value lands at $1,557.89, notably higher than the most recent closing price of $1,352.54. This significant gap between fair value and market price grabs attention and raises the stakes for investors weighing future upside.

The growing age of the global aircraft fleet, combined with heightened airline investment in refurbishments and mandatory regulatory maintenance, is increasing the need for proprietary replacement parts. This trend is positively impacting TransDigm's high-margin aftermarket revenues and supporting continued margin expansion.

The narrative leans on assumptions of unbroken revenue acceleration and ambitious margin targets. What is the secret sauce behind this bold valuation jump? Discover the crucial drivers, including analyst projections, margin forecasts, and market-shaking growth bets, in the full story.

Result: Fair Value of $1,557.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent moderation in aftermarket demand and compressed valuation multiples could challenge the bullish narrative and temper expectations for near-term upside.

Find out about the key risks to this TransDigm Group narrative.

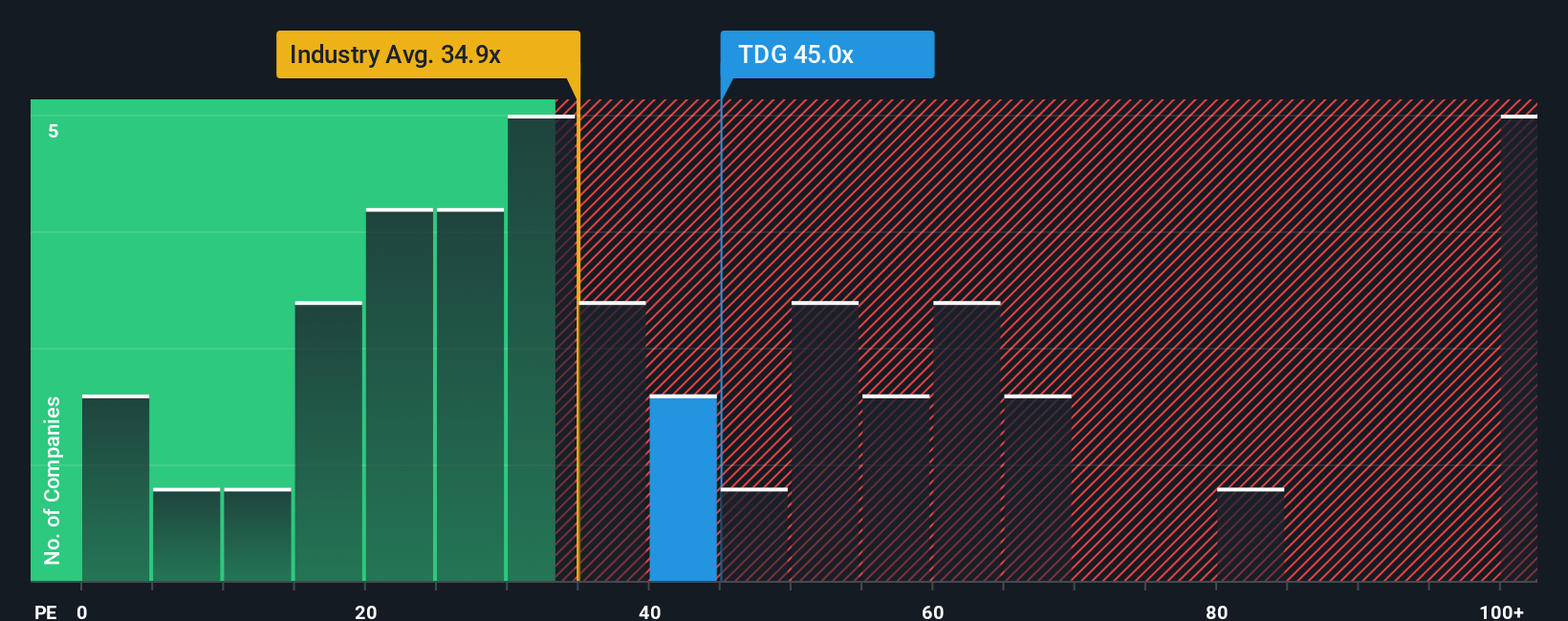

Another View: The P/E Ratio Raises Caution

Comparing TransDigm Group’s valuation using the price-to-earnings ratio paints a more expensive picture. Its P/E ratio stands at 40.8x, which is notably higher than both the US Aerospace & Defense industry average of 36.6x and the peer average of 32x. This is also above the fair ratio of 32.9x. This sizeable gap amplifies valuation risk and suggests that the stock may need exceptional future performance to justify its premium. Could the market’s optimism be overdone, or is there a hidden upside yet to play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative and insights in just a few minutes: Do it your way

A great starting point for your TransDigm Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond a single stock. Don’t let opportunity slip by. Harness the edge with these handpicked stock ideas designed to spark your next move.

- Capitalize on market mispricings with these 924 undervalued stocks based on cash flows that show strong potential based on rigorous cash flow analysis.

- Amplify your ROI by targeting companies offering consistent income through these 14 dividend stocks with yields > 3% with attractive yields above 3%.

- Uncover breakthrough innovation by following these 26 AI penny stocks as artificial intelligence transforms industries and defines the leaders of tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Acceptable track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.