- United States

- /

- Aerospace & Defense

- /

- NYSE:TDG

TransDigm Group Stock Faces Fresh Scrutiny After Sharp 13% Monthly Pullback

Reviewed by Simply Wall St

Thinking about what to do with TransDigm Group stock right now? You are not alone. With its share price closing last at $1,389.98 and recent moves catching more than a few eyes, it is natural to wonder whether it is time to buy in, take profits, or simply watch from the sidelines. Over the past week, shares slipped by 0.6%, and the 30-day window shows a deeper dip of 13.5%. Looking further back, the numbers tell a different story: up 10.8% year to date, 10.7% over the last year, and an increase of 150.7% and 210.6% over the past three and five years, respectively. While there have not been major new developments causing sudden swings, shifts across the broader market have clearly impacted investor appetite, with risk perceptions always in flux.

Curious if these moves have made the stock a bargain? According to a standardized valuation score, TransDigm checks just one of six boxes indicating undervaluation, giving it a value score of 1. That might sound low, but as any seasoned investor will tell you, there is a lot more to valuation than just scoring well across a handful of methods. Next, I will break down the main valuation approaches used to analyze TransDigm and set the stage for a deeper look at what truly matters most when assessing the company's worth.

TransDigm Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: TransDigm Group Cash Flows

A discounted cash flow (DCF) model estimates a company's value by projecting the cash it is expected to generate in the future and discounting those amounts back to what they are worth today. This method gives investors a sense of what the business should be worth, based on its long-term earnings power.

TransDigm Group's most recently reported Free Cash Flow is $1.91 billion. Analyst forecasts suggest that cash flows may increase in the coming years, reaching $2.60 billion by 2026 and $3.92 billion by 2029. Since analyst estimates extend only five years into the future, cash flows beyond that period are extrapolated using industry-standard assumptions.

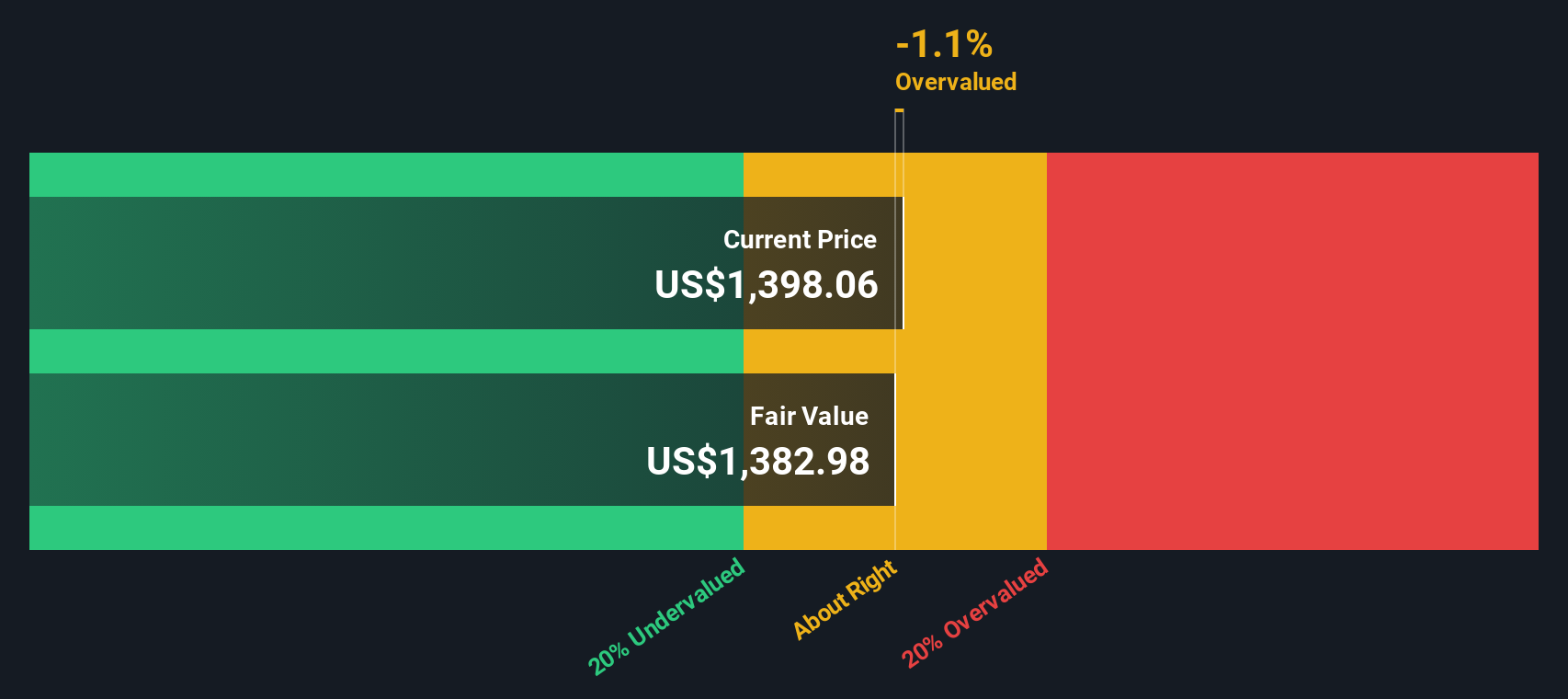

After converting all projected cash flows into today's terms, the DCF model calculates an estimated intrinsic value for TransDigm Group shares of $1,382.83. With a current share price of $1,389.98, the stock is trading at approximately 0.5 percent above its DCF-based fair value. This suggests that, according to the model, shares are slightly overvalued.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for TransDigm Group.

Approach 2: TransDigm Group Price vs Earnings

For established, profitable companies like TransDigm Group, the price-to-earnings (PE) ratio is a widely used and trusted valuation measure. It compares a company's current share price to its per-share earnings, serving as a gauge of what investors are willing to pay for each dollar of profit. The "right" PE ratio depends not just on the company but also on market expectations for growth and risk. Businesses with higher anticipated earnings growth and lower perceived risks can reasonably trade at higher PE multiples.

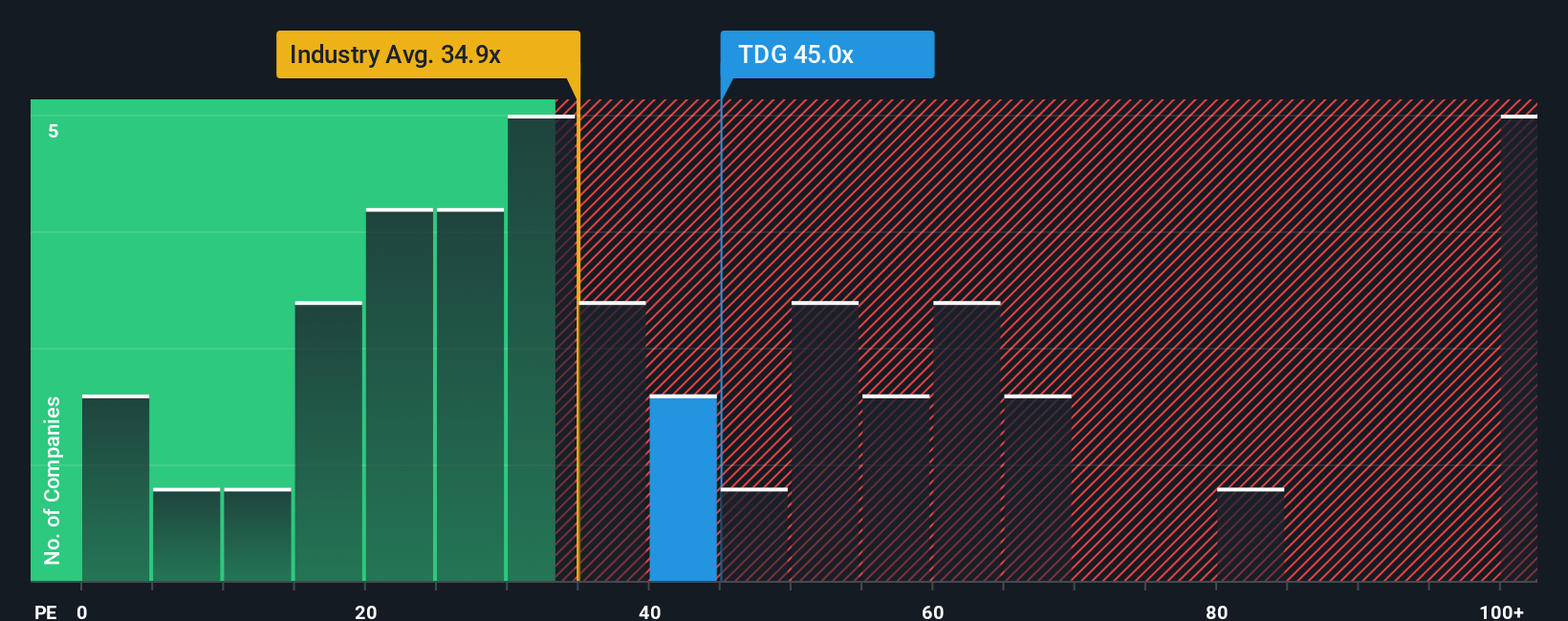

TransDigm currently trades at a PE ratio of 44.7x. Against key benchmarks, this figure stands out; the average for the Aerospace & Defense industry is 34.6x, while close peers average an even higher 68.9x. However, raw comparisons can be misleading without context. To provide a more tailored benchmark, Simply Wall St calculates a proprietary "Fair Ratio." In this case, the Fair Ratio for TransDigm is 31.2x. This Fair Ratio distills expectations for growth, profitability, risk, size, and industry dynamics into a single actionable number.

Comparing against the Fair Ratio offers deeper insight than industry or peer averages alone, as it specifically considers the factors most likely to move this company’s valuation up or down. Currently, with TransDigm’s PE ratio exceeding the Fair Ratio by more than 10 points, the stock appears somewhat expensive relative to what would generally be considered fair value.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your TransDigm Group Narrative

Earlier, we mentioned that numbers alone do not tell the full story when it comes to understanding valuation. This is why investors are turning to Narratives, a smarter and more dynamic framework for decision making. A Narrative is simply your interpretation of a company, connecting its unique business story to a set of forward-looking financial assumptions and arriving at a calculated fair value. Through Narratives, you are empowered to go beyond static ratios and step into a more flexible, story-driven approach; they allow you to share your perspective on TransDigm Group’s prospects, explaining how you see its growth, risks, or industry position affecting future numbers.

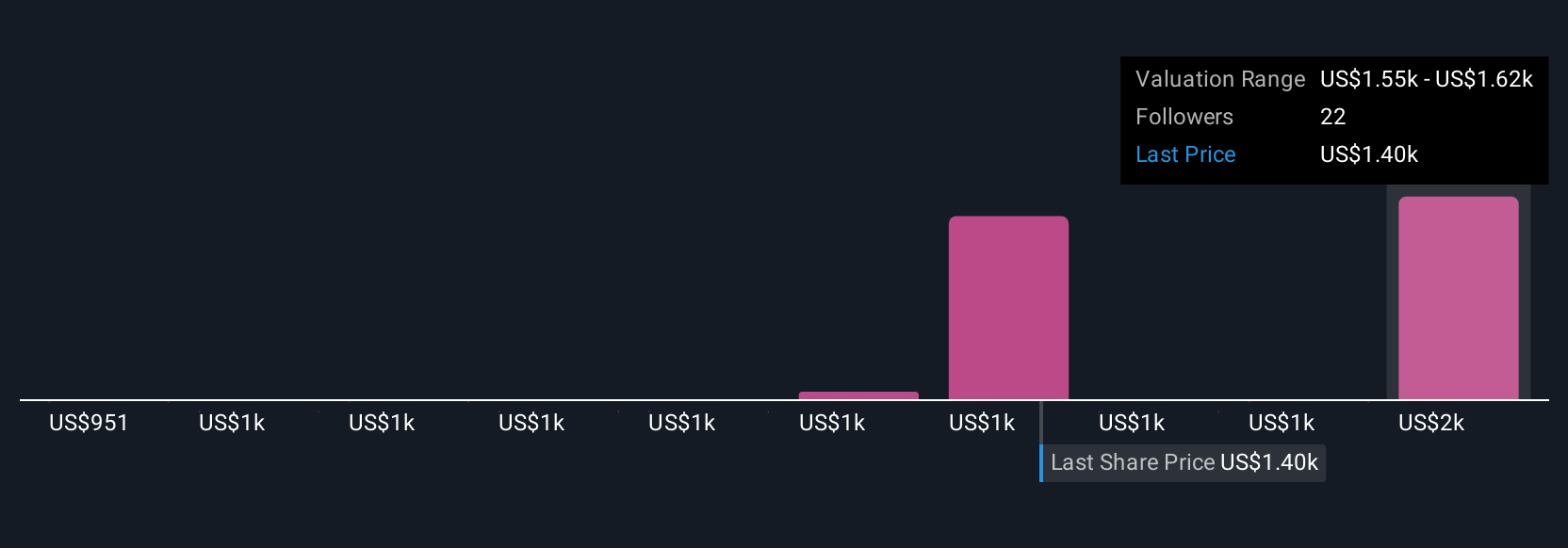

Available to millions of investors on Simply Wall St’s Community page, Narratives help you answer crucial questions like whether to buy, sell, or hold by directly comparing your own Fair Value estimate with the live market price. They update automatically as new earnings reports or news headlines are released. For instance, some investors’ Narratives for TransDigm are very bullish, forecasting price targets up to $1,839, while others see downside risk, with targets as low as $1,430. Whether you are optimistic or cautious, Narratives invite you to see how your view compares and give you the tools to invest with more confidence and clarity.

Do you think there's more to the story for TransDigm Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransDigm Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDG

TransDigm Group

Designs, produces, and supplies aircraft components in the United States and internationally.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives