- United States

- /

- Machinery

- /

- NYSE:SXI

What Does a Major Insider Sale Reveal About Standex International's (SXI) Long-Term Confidence?

Reviewed by Simply Wall St

- In the past week, Standex International disclosed an insider plan to sell 11,000 shares valued at approximately US$2.37 million, following its presentation at a major industrials conference in Nashville by CEO David A. Dunbar.

- Insider sales of this magnitude can trigger heightened market scrutiny, as they are sometimes viewed as signals from those closest to the company’s operations.

- We'll assess how the recent insider share sale shapes Standex International’s investment narrative and perceived long-term confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Standex International Investment Narrative Recap

To own Standex International today, investors need to believe in the company’s ability to convert growth from bolt-on acquisitions and exposure to fast-growing markets into consistent, quality earnings. The recently disclosed insider plan to sell 11,000 shares, while substantial, does not appear material to the most pressing short-term catalyst, which remains the continued ramp-up in fast-growth segments, nor does it directly impact the biggest risk: integration and organic growth uncertainty.

The recent announcement most relevant here is Standex’s optimistic earnings guidance for fiscal 2026, which forecasts over US$100 million in revenue growth driven by mid-to-high-single-digit organic gains and strong double-digit momentum in core engineering and electronics markets. This guidance underpins the company’s argument that secular trends and capacity expansion could offset execution risks tied to acquisitions, which remains a core question for shareholders.

Yet, against all this promising growth, investors should remember that persistent organic revenue softness, especially when masked by acquisition-led expansion, can matter more than it may seem...

Read the full narrative on Standex International (it's free!)

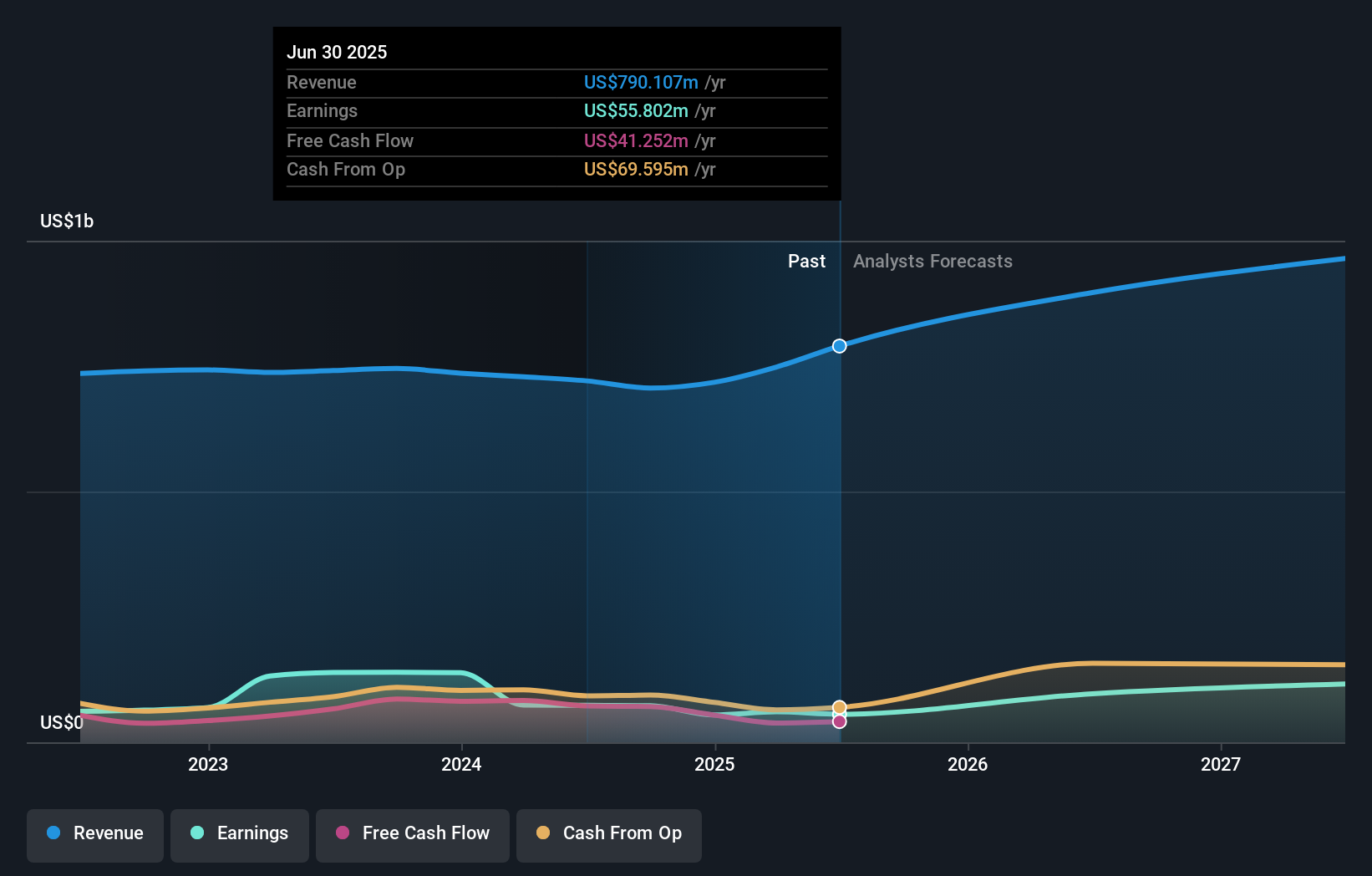

Standex International's outlook anticipates $1.1 billion in revenue and $155.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 10.3% and an increase in earnings of $99.5 million from the current level of $55.8 million.

Uncover how Standex International's forecasts yield a $209.80 fair value, in line with its current price.

Exploring Other Perspectives

One Simply Wall St Community valuation puts fair value at US$209.80, with all estimates clustered at that level. Against this uniform outlook, the ongoing integration risk from acquisition-led growth remains a factor that could reshape expectations over time, so consider a broad range of viewpoints.

Explore another fair value estimate on Standex International - why the stock might be worth just $209.80!

Build Your Own Standex International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Standex International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Standex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Standex International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXI

Standex International

Manufactures and sells products and services for commercial and industrial markets in the United States and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives