- United States

- /

- Machinery

- /

- NYSE:SXI

Rebranding as Standex Detect, Edge, and Grid Might Change the Case for Investing in SXI

Reviewed by Sasha Jovanovic

- On October 21, 2025, Standex Electronics unveiled a comprehensive rebrand, introducing three aligned divisions, Standex Detect, Standex Edge, and Standex Grid, under a unified brand architecture aimed at emphasizing engineering partnership and supporting customers in electrification and digitalization initiatives.

- This rebrand signals Standex Electronics’ transformation from a precision component supplier to a global partner in advanced engineering, with a focus on collaborative innovation and customer-centric solutions driving value beyond component manufacturing.

- We’ll now consider how this rebrand and strategic repositioning could shape Standex International’s narrative as a collaborative innovator in high-growth sectors.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Standex International Investment Narrative Recap

For an investor in Standex International, belief in the company's ability to capitalize on automation, electrification, and digitalization themes is key. The October 2025 Standex Electronics rebrand strengthens its positioning as a collaborative engineering partner, but is unlikely to materially shift the biggest short-term catalyst: accelerating demand in high-growth sectors. The primary risk, continued reliance on acquisitions over organic growth, remains unchanged, as the rebrand does not address integration or margin pressures linked to M&A activity.

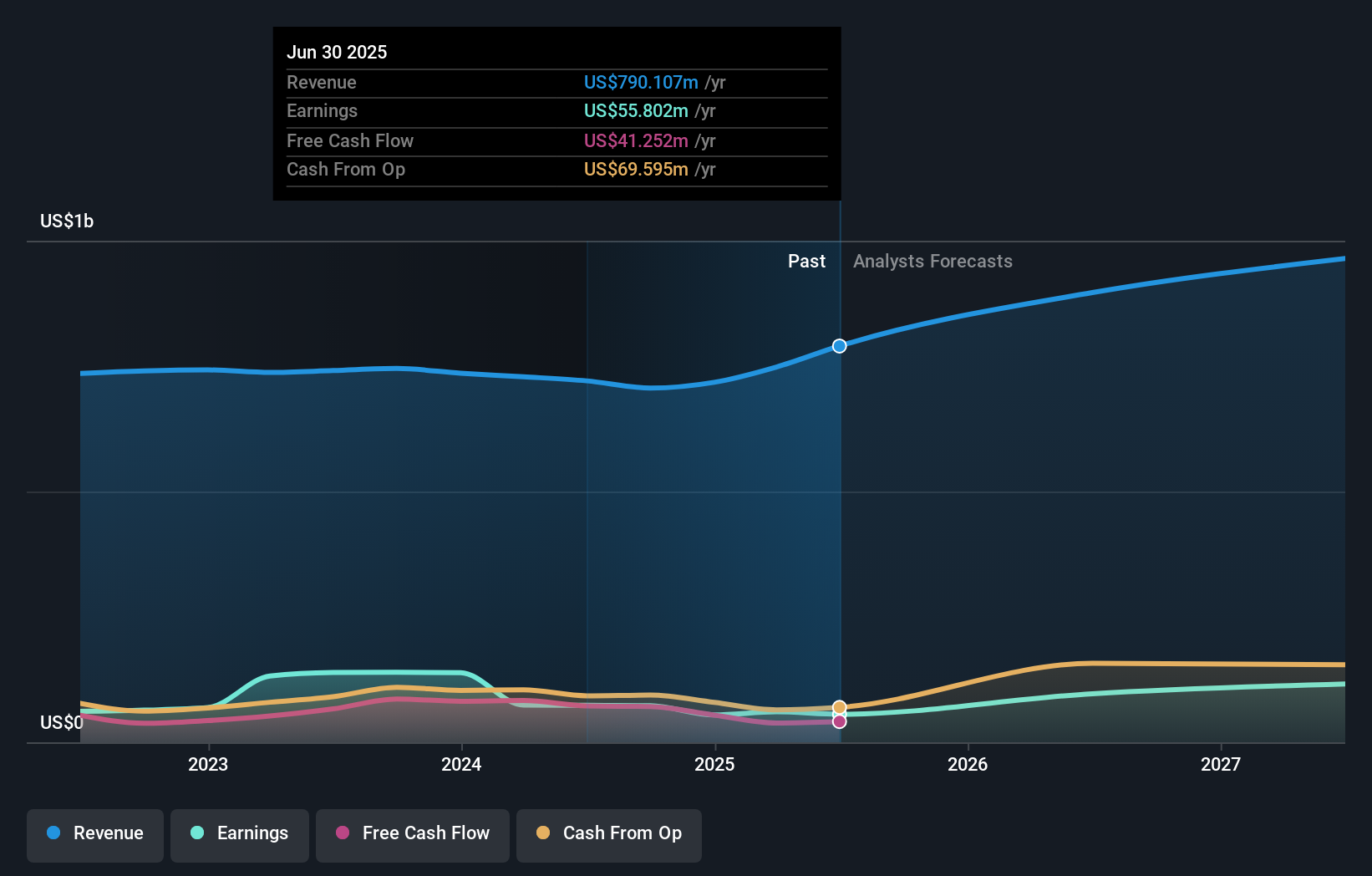

Amid recent news, the company’s July 2025 guidance stands out, highlighting expectations of over US$100 million in added revenue for FY 2026, with fast-growing markets projected to surge about 45 percent year-on-year to more than US$265 million in sales. This forward-looking guidance reinforces the relevance of the company’s transformation into a partner for advanced engineering solutions and supports optimism around end-market growth, especially in electronics and grid modernization.

Yet, against this growth narrative, investors should consider the potential for revenue volatility stemming from Standex International’s acquisition-driven strategy…

Read the full narrative on Standex International (it's free!)

Standex International's outlook anticipates $1.1 billion in revenue and $155.3 million in earnings by 2028. This is based on a 10.3% annual revenue growth rate and a $99.5 million increase in earnings from the current $55.8 million.

Uncover how Standex International's forecasts yield a $209.80 fair value, a 11% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s only fair value estimate before this week pegs Standex International at US$209.80 per share. While optimism is high for organic revenue growth, most market participants are watching how the shift toward value-added solutions will affect integration risks and long-term profitability. Explore multiple community viewpoints on possible outcomes.

Explore another fair value estimate on Standex International - why the stock might be worth as much as $209.80!

Build Your Own Standex International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Standex International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Standex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Standex International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SXI

Standex International

Manufactures and sells products and services for commercial and industrial markets in the United States and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives