- United States

- /

- Machinery

- /

- NYSE:SWK

Could a Key Legal Departure at SWK Shape Long-Term Governance Priorities for Stanley Black & Decker?

Reviewed by Sasha Jovanovic

- Stanley Black & Decker recently announced that Janet M. Link, Senior Vice President, General Counsel and Secretary, informed the company of her decision to resign, effective November 30, 2025, to pursue an external opportunity.

- This change follows a series of senior leadership transitions and leaves a key legal and compliance position open during an important time for the company's governance and direction.

- We’ll explore how the departure of the firm's top legal executive may impact Stanley Black & Decker’s broader investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Stanley Black & Decker Investment Narrative Recap

To be a shareholder in Stanley Black & Decker, you need to believe in the long-term demand for construction, DIY, and professional tools, as well as the company’s evolving global strategy and operational improvements. While the resignation of Janet M. Link, the company’s Senior Vice President, General Counsel and Secretary, leaves a crucial leadership position open, it does not materially impact the most important short-term catalyst for the stock: progress on supply chain transformation and cost reduction. However, the biggest risk remains limited pricing power in a market exposed to tariffs and volatile consumer demand.

Alongside leadership changes, Stanley Black & Decker continues to emphasize innovation in its Tools & Outdoor division, with brands like DEWALT and Cub Cadet showcasing new battery-powered handheld tools and next-generation mowers at Equip Expo 2025. This focus addresses the push for higher-margin, technology-driven products, which supports the company’s efforts to offset broader industry headwinds. In contrast, investors should be aware that persistent end-market weakness and...

Read the full narrative on Stanley Black & Decker (it's free!)

Stanley Black & Decker's outlook anticipates $16.8 billion in revenue and $1.3 billion in earnings by 2028. This implies 3.5% annual revenue growth and an increase in earnings of about $822 million from the current $478.3 million.

Uncover how Stanley Black & Decker's forecasts yield a $87.82 fair value, a 24% upside to its current price.

Exploring Other Perspectives

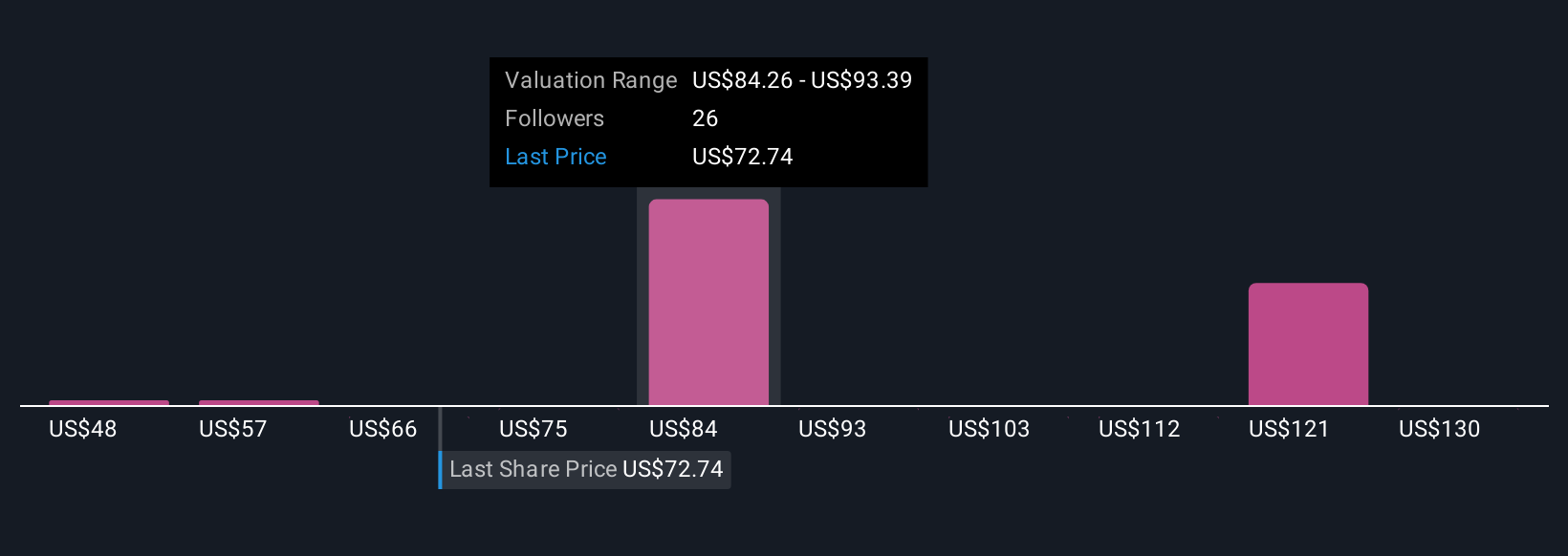

Nine fair value estimates from the Simply Wall St Community span a wide range, from US$47.77 to US$139 per share. Keep in mind that many see limited pricing power as a key risk, shaping divergent outlooks on future performance.

Explore 9 other fair value estimates on Stanley Black & Decker - why the stock might be worth 33% less than the current price!

Build Your Own Stanley Black & Decker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stanley Black & Decker research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Stanley Black & Decker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stanley Black & Decker's overall financial health at a glance.

No Opportunity In Stanley Black & Decker?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SWK

Stanley Black & Decker

Provides hand tools, power tools, outdoor products, and related accessories in the United States, Canada, Other Americas, Europe, and Asia.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives