- United States

- /

- Electrical

- /

- NYSE:ST

Sensata Technologies (ST): Exploring Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Sensata Technologies Holding (ST) has caught the attention of investors following recent moves in its share price. With the stock showing gradual gains over the past month, some are taking a closer look at its performance and fundamental outlook.

See our latest analysis for Sensata Technologies Holding.

While Sensata Technologies Holding’s share price has climbed nearly 17% year-to-date, it is still down over the past year, with a 1-year total shareholder return of -10.5%. The recent uptick in the share price suggests investors are warming back up to Sensata, possibly signaling renewed confidence after a tough stretch. Momentum appears to be slowly building again, which could indicate a more constructive period ahead.

If this rebound has you curious about what else is gathering steam, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With solid recent gains and analyst targets well above current levels, the question for investors is whether Sensata is trading at a discount to its true value or if future growth is already reflected in the price.

Most Popular Narrative: 16.6% Undervalued

Compared to its last close at $31.82, the narrative consensus sees Sensata Technologies Holding as significantly below its estimated fair value, setting up a compelling story about where the shares could go from here.

Ongoing strategic focus on applications for electrified powertrains (including electrical protection and tire pressure monitoring systems) across global automotive and NEV markets increases content-per-vehicle, expanding Sensata's addressable market and supporting topline and earnings growth as electrification accelerates worldwide.

Curious about the ambitious path to this valuation? The narrative banks on accelerated momentum from bold growth initiatives, along with a future profit margin you might not expect. Want to know which game-changing projections are fueling analyst conviction? Uncover the details that form the backbone of this fair value.

Result: Fair Value of $38.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or aggressive price competition in China could challenge Sensata's rebound and put pressure on margins and growth expectations.

Find out about the key risks to this Sensata Technologies Holding narrative.

Another View: What Do Price Ratios Suggest?

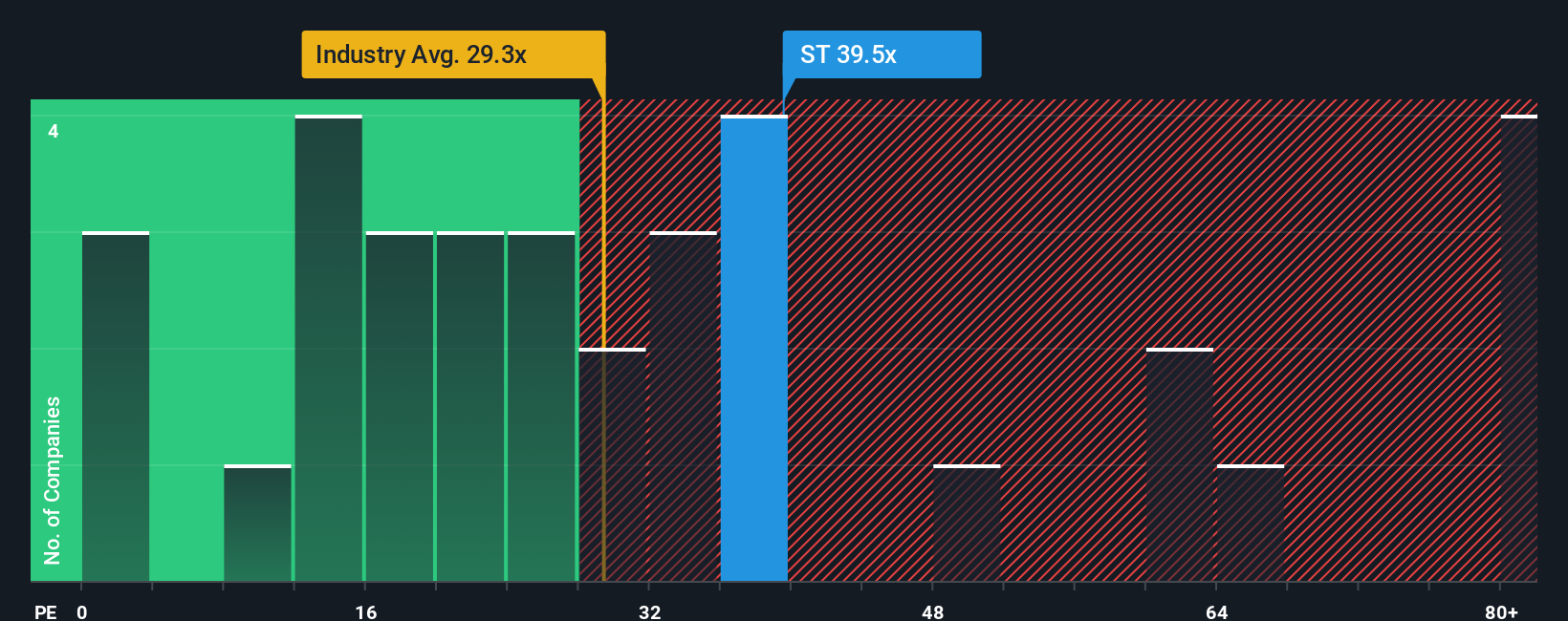

Looking from a different angle, Sensata’s current price-to-earnings ratio stands at 41.6x, which is notably higher than its peer average of 31x and the industry average of 30.5x. The fair ratio, which represents where the market could move towards, is 36.8x. This gap raises real questions about valuation risk, even though the stock seems undervalued by other measures. Could this be a signal for caution or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sensata Technologies Holding Narrative

If you want to form your own perspective on Sensata, you can dive into the data and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your Sensata Technologies Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take the next step and explore fresh opportunities. Don’t settle for one angle when you can find what the market might be overlooking. Use these powerful tools to enhance your investing:

- Discover income potential from reliable payers by scanning these 20 dividend stocks with yields > 3% offering attractive yields above 3%.

- Explore the forefront of technology with these 24 AI penny stocks propelling artificial intelligence and shaping future industries.

- Identify hidden value with these 871 undervalued stocks based on cash flows that analysts believe are trading well below their long-term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ST

Sensata Technologies Holding

Develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives