Sensata Technologies Holding plc (NYSE:ST) will pay a dividend of $0.12 on the 27th of November. This means the annual payment will be 1.4% of the current stock price, which is lower than the industry average.

See our latest analysis for Sensata Technologies Holding

Sensata Technologies Holding's Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Sensata Technologies Holding's Could Struggle to Maintain Dividend Payments In The Future

Sensata Technologies Holding's Future Dividends May Potentially Be At Risk

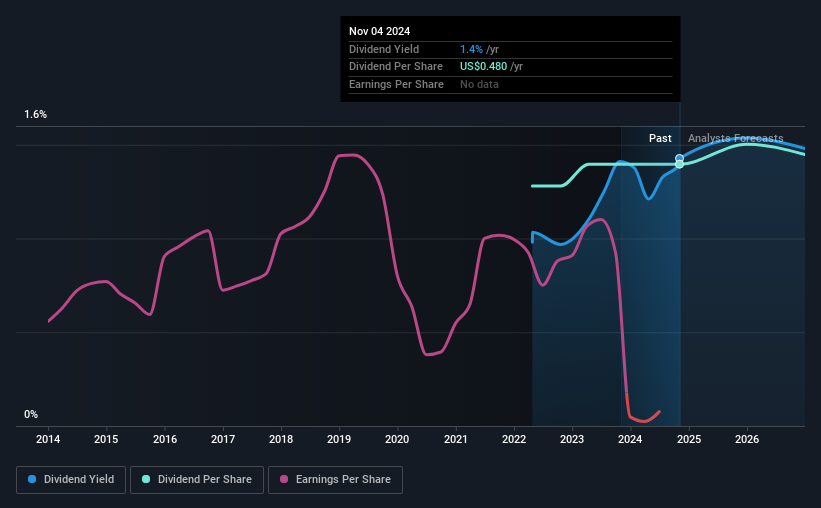

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Sensata Technologies Holding is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS is forecast to expand by 167.4%. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

Sensata Technologies Holding Is Still Building Its Track Record

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2021, the dividend has gone from $0.44 total annually to $0.48. This implies that the company grew its distributions at a yearly rate of about 2.9% over that duration. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Unfortunately things aren't as good as they seem. Sensata Technologies Holding's earnings per share has shrunk at 16% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Sensata Technologies Holding's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Sensata Technologies Holding's payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 1 warning sign for Sensata Technologies Holding that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ST

Sensata Technologies Holding

Develops, manufactures, and sells sensors and sensor-rich solutions, electrical protection components and systems, and other products used in mission-critical systems and applications in the United States and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.