- United States

- /

- Building

- /

- NYSE:SSD

Does Simpson Manufacturing (NYSE:SSD) Have The Makings Of A Multi-Bagger?

What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Simpson Manufacturing's (NYSE:SSD) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Simpson Manufacturing is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = US$194m ÷ (US$1.2b - US$163m) (Based on the trailing twelve months to March 2020).

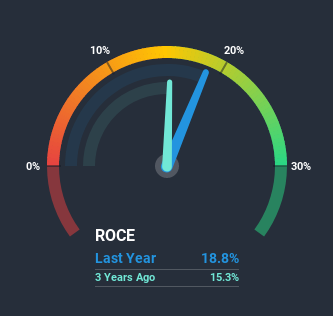

So, Simpson Manufacturing has an ROCE of 19%. On its own, that's a standard return, however it's much better than the 14% generated by the Building industry.

Check out our latest analysis for Simpson Manufacturing

In the above chart we have a measured Simpson Manufacturing's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Simpson Manufacturing.

How Are Returns Trending?

Simpson Manufacturing's ROCE growth is quite impressive. More specifically, while the company has kept capital employed relatively flat over the last five years, the ROCE has climbed 65% in that same time. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

The Key Takeaway

To bring it all together, Simpson Manufacturing has done well to increase the returns it's generating from its capital employed. And a remarkable 173% total return over the last five years tells us that investors are expecting more good things to come in the future. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you'd like to know more about Simpson Manufacturing, we've spotted 2 warning signs, and 1 of them is concerning.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Simpson Manufacturing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:SSD

Simpson Manufacturing

Through its subsidiaries, designs, engineers, manufactures, and sells structural solutions for wood, concrete, and steel connections in North America, Europe, and the Asia Pacific.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives