- United States

- /

- Machinery

- /

- NYSE:SPXC

SPX Technologies (SPXC): Assessing Valuation as Shares Extend Their Steady 2024 Climb

Reviewed by Kshitija Bhandaru

SPX Technologies (SPXC) stock has been climbing steadily over the past month, gaining around 1% and building on a strong year so far. This trend has caught the attention of investors who are wondering what is fueling the move.

See our latest analysis for SPX Technologies.

SPX Technologies’ share price has posted a solid uptick over 2024, continuing a strong run that reflects growing confidence from investors following healthy earnings growth and a track record of resilience. The stock’s momentum is building, with its one-year total shareholder return outpacing many peers and suggesting ongoing optimism about future prospects.

If you’re curious what other opportunities are capturing investor attention, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares reaching new highs and robust fundamentals supporting the rally, the big question for investors now is whether SPX Technologies remains undervalued, or if all that future growth is already reflected in the share price.

Most Popular Narrative: 5.9% Undervalued

SPX Technologies’ last close price was $189.83, which sits below the consensus narrative's fair value target of $201.64. This perspective creates a compelling backdrop for the assumptions driving current market optimism.

Expansion in data center cooling solutions, highlighted by the new OlympusV Max launch, which addresses the rapidly growing demand for energy-efficient, large-scale data center infrastructure, positions SPX to meaningfully expand its addressable market and top-line growth as hyperscale projects accelerate into 2026. This supports both revenue and margin improvement due to product differentiation and high-engineering requirements.

Which bold forecasts are fueling this premium view? The narrative is pinned on accelerating sales, surging margins, and record profit projections, all tied to strategic moves in high-demand markets. Discover the crucial numbers and see if this ambitious growth story holds up under scrutiny.

Result: Fair Value of $201.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in project-driven growth or challenges with acquisition integration could quickly undermine these optimistic forecasts and the current valuation narrative.

Find out about the key risks to this SPX Technologies narrative.

Another View: Is the Premium Justified?

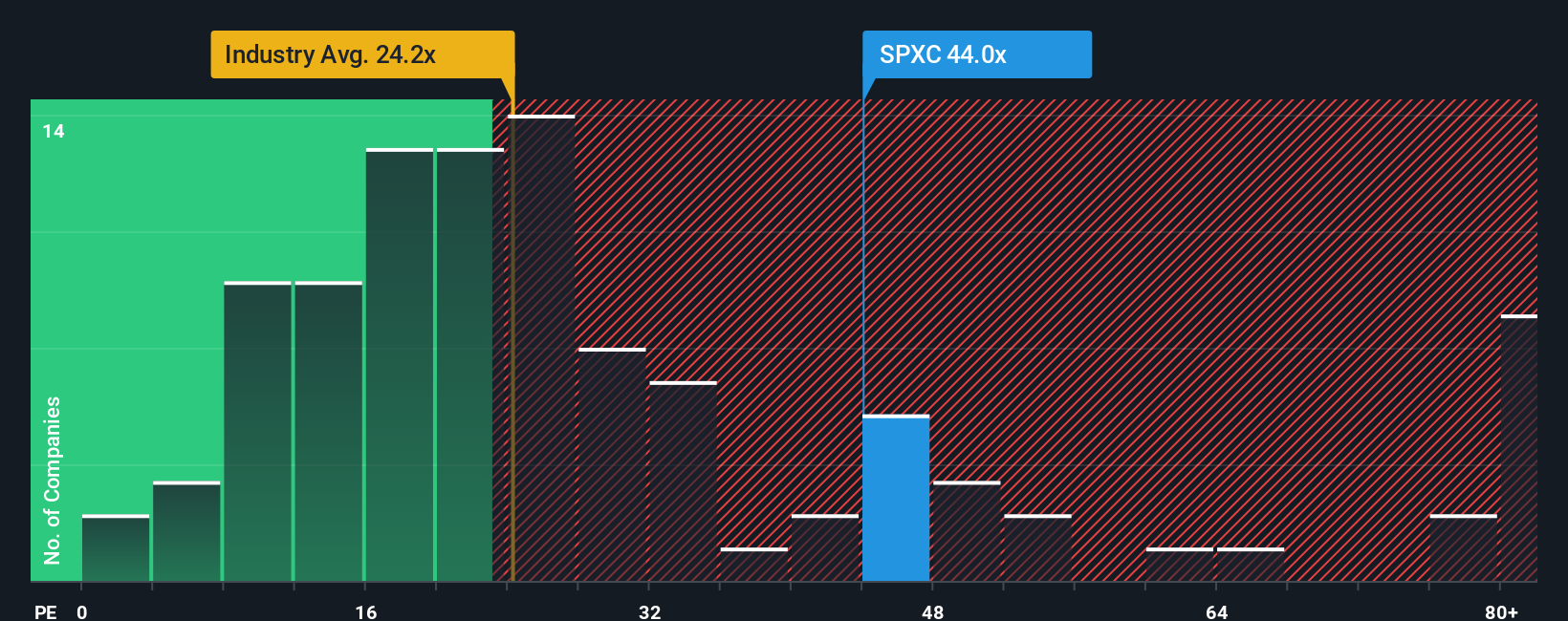

A look at price-to-earnings ratios paints a different picture. SPX Technologies trades at 44.3x earnings, which is much higher than the Machinery industry average of 24.5x, its peers at 31.9x, and the market’s fair ratio of 30.6x. This gap raises questions about valuation risk if profit growth stalls. Is the current optimism already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SPX Technologies Narrative

If you want to challenge the consensus or prefer hands-on analysis, you can build your own investment case using our tools in just a few minutes. Do it your way

A great starting point for your SPX Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines while others chase the next big winner. Act now and unlock fresh ideas that match your goals and investing style using our exclusive screeners.

- Capture high-yield potential by checking out these 19 dividend stocks with yields > 3%, which features consistently strong payouts and above-average yields for compounding growth.

- Spot game-changing companies in artificial intelligence and transform your portfolio with these 24 AI penny stocks, which are at the forefront of this breakthrough trend.

- Jump on solid opportunities overlooked by the market by examining these 885 undervalued stocks based on cash flows, as these could offer better value and upside than the mainstream picks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPXC

SPX Technologies

Engages in the supply of infrastructure equipment serving the heating, ventilation, and cooling (HVAC); and detection and measurement markets worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives