- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

Supply Chain and Governance Strains Might Change the Case for Investing in Spirit AeroSystems (SPR)

Reviewed by Sasha Jovanovic

- In recent days, Spirit AeroSystems Holdings asked key customers Boeing and Airbus to help absorb rising inflationary costs while Boeing warned of lower 737 deliveries due to a supplier issue. An investigation was also launched into possible fiduciary duty breaches by Spirit AeroSystems’ leadership, raising questions around operational and governance stability.

- This convergence of supply chain and governance pressures creates a complex challenge for Spirit AeroSystems as it navigates ongoing industry partnerships and internal oversight.

- With delivery disruptions and governance concerns in focus, we'll explore how these events shape Spirit AeroSystems’ current investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Spirit AeroSystems Holdings' Investment Narrative?

To invest in Spirit AeroSystems Holdings, you need belief in a turnaround story with persistent challenges. The company’s value often reflects its status as a major supplier in the global aviation industry, its deep-rooted relationships with Boeing and Airbus, and the assumption that operational disruptions and profitability pressures can be overcome. The recent request for inflation support from its largest customers and Boeing’s warning of fewer 737 deliveries sharply raise the stakes. These events put short-term catalysts like accelerated aircraft delivery and margin recovery into question, as supply chain hiccups may delay operational improvement while governance investigations could unsettle boardrooms right as the Boeing merger moves to completion. If these uncertainties escalate, previously anticipated progress in earnings recovery and financial stability may be at risk, and market sentiment could quickly shift.

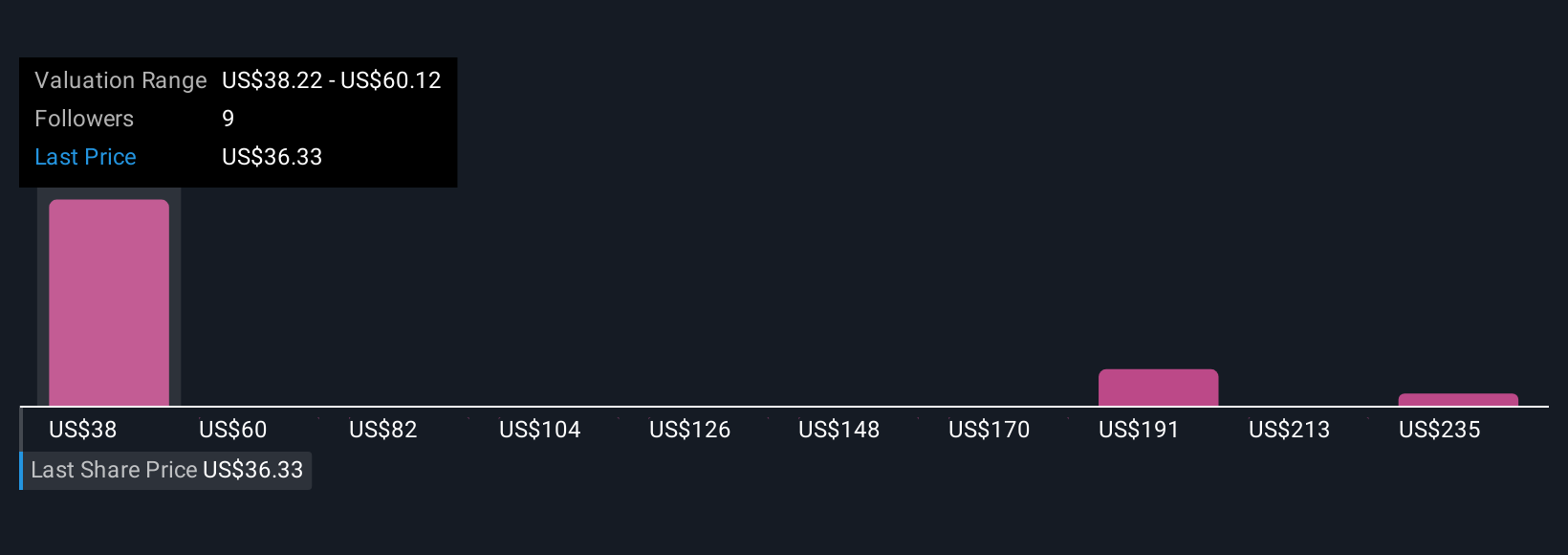

Unexpected delivery setbacks may now matter more than ever for Spirit investors. Despite retreating, Spirit AeroSystems Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Spirit AeroSystems Holdings - why the stock might be worth just $38.22!

Build Your Own Spirit AeroSystems Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spirit AeroSystems Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Spirit AeroSystems Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spirit AeroSystems Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives